Where should I invest my money?

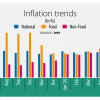

Amid persistently higher inflation in Bangladesh for more than a year, the low- and middle-income groups are struggling to meet their daily expenses.

Still, the few that have managed to scrounge up some savings are desperately trying to invest their hard-earned money in a proper way. Unfortunately, investment opportunities are not widely known, and, at the same time, many people don't know the methods they can use to invest their savings or how to get started.

The most popular forms of investment in Bangladesh involve the stock market, national savings certificates (NSCs), land, gold, and deposits in banks and non-bank financial institutions (NBFIs). However, keeping deposits in accounts and purchasing government treasury bills and bonds have become the most attractive investment options in recent months due to higher yields.

In the past, NSCs used to offer higher returns, but nowadays banks are offering higher yields due to the contractionary monetary policy adopted by the central bank to rein in high inflation, which has been above 9 percent since March last year and stood at 9.67 percent in February this year.

The tight liquidity situation in the banking industry has made deposits costlier for banks, forcing them to raise the rates to attract funds.

Keeping deposits in banks

Parking deposits in a commercial bank account or an account with an NBFI has become the most attractive proposition since the withdrawal of the interest rate cap on loans and deposit products last year. In June last year, the banking regulator ended the 9 percent interest rate ceiling and introduced a new interest rate formula.

In December, the central bank removed the deposit rate cap, which was imposed in August 2021. As the policy rate was hiked by the central bank to combat the unprecedented spell of inflation, it pushed up the deposit rate further.

Most banks are now offering over 9 percent interest on term deposits. Even a few months ago, that was less than 5 percent. The interest rate on deposits is increasing keeping pace with the lending rate. In January, the weighted average interest rate on deposit products at banks stood at 7.62 percent, up from 7.42 percent in December, as per central bank data.

For example, the rate offered by AB Bank stood at 8.19 percent in January. It was 8.96 percent for NRB Commercial Bank and 8.17 percent for Dhaka Bank.

Bankers say they are raising the lending rate as funds have become costlier due to the contractionary monetary policy.

"People are now returning to banks to deposit their money due to the growing interest rate on deposit products," said Anis A Khan, a former chairman of the Association of Bankers Bangladesh, the platform of the chief executives of banks.

Khan, also a former managing director of Mutual Trust Bank, added that the currency outside the banking system had been decreasing due to the rising deposit rates.

Government treasury bills and bonds

Of late, government treasury bills and bonds, popularly known as T-bills and T-bonds, have become a lucrative tool for investors and savers, driven by a record spike in yields. The yield of all genres of treasury bills has gone past a record 11 percent, far higher than the interest rates offered on bank deposits.

This is because the government's domestic borrowing from financial institutions and individuals climbed after the central bank stopped lending money to the government. The yield of the 91-day bills currently stands at 11.35 percent, the 182-day bills at 11.40 percent and the 364-day bills at 11.60 percent. This was up from 6.95 percent, 7.25 percent, and 8.30 percent respectively in June last year.

"Individual investment in treasury bills and bonds is growing thanks to the interest rate hike," said Emranul Huq, managing director of Dhaka Bank. "The rate is higher than the deposit rate at banks."

He explained that both individuals and corporate depositors can receive more than 11 percent interest in just 91 days by investing in government securities.

"Since investors are leaning towards T-bills and T-bonds, it will be tough to mobilise deposits for banks," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank. "Some depositors are even withdrawing funds from banks and investing them in treasury bills since the interest rate of the latter is more than two percentage points higher than the former."

Who can invest in treasury bills?

Anyone in Bangladesh can easily put money in treasury bills because of the initiatives adopted by the central bank. At present, treasury bills that mature in 91 days, 182 days and 364 days are up for grabs for residents, which refer to individuals and institutions such as banks, NBFIs and insurance companies.

T-bills are issued through price-based multiple price auctions. Retail investors can buy them from the local offices of the central bank, commercial banks and brokerage houses. The minimum investment ceiling has been set at Tk 1 lakh but there is no maximum limit.

As the instruments are issued and backed by the government, the investment in the tools is considered risk-free because Bangladesh has never defaulted on its debts. The principal amount and profit, or interest, are paid out upon maturity.

Investment in stock market

Buying stocks is a popular form of investment worldwide. For example, more than 60 percent of adults in the United States invested in the stock market in 2023. It stands at about 1 percent in Bangladesh.

By buying a stock and holding it for a certain period, you qualify for both stock and cash dividends at the end of the financial year. Dividends are the profits a company shares with its owners or stockholders after paying off all other stakeholders.

People with a valid passport or national identification card and a bank account can invest any amount in stocks. All they need is a BO (Beneficiary Owner's) account in a brokerage house.

The stock market of Bangladesh is an important component of the country's economy but the market has been plagued by various problems, including low liquidity, weak governance, lack of investors' confidence and poor market infrastructure.

Purchasing savings certificates

Investment in savings certificates is a lucrative instrument for savers because of higher interest rates. Until the fiscal year of 2021-22, NSCs were the primary source of domestic financing for the government, so the investment tool received huge traction. NSC issuance has remained negative in the first seven months of the current financial year because of less competitive interest rates and tighter controls over NSC issuance, according to a World Bank report.

There are four categories of savings certificates with varying interest rates, with the highest rate standing at 11.76 percent. However, only retired government officials, the officials of semi-government, autonomous, semi-autonomous organisations and the family members of the deceased employees of these firms are eligible to invest in the tool that provides the best yield.

Currently, savers are encasing their investment more than the new investment is made. In July-February of 2023-24, the net sales of NSCs stood at negative Tk 8,891 crore. It was negative Tk 3,509 crore in the same period of the last fiscal year.

Land purchase

There are numerous options to invest. However, investment in real estate is lucrative to many investors in Bangladesh since such investment is secure. As Bangladesh is a densely populated country, real estate is the top most necessity and its value is on the rise since farmland is depleting while urbanisation is expanding.

Industry insiders say property values tend to stay steady, so real estate would be a good hedge against inflation. As Bangladesh is developing and witnessing fast economic development, real estate will continue to be a very lucrative investment option.

What to know to avoid traps

Gathering accurate information and proper knowledge about investment tools are important to avoid risks. The investors will have to assess their options and determine the risk tolerance, time horizon and other factors.

Faruk Moinuddin, a former managing director of Trust Bank, said savers must have knowledge of the financial indicators of banks and financial institutions before investing.

"If savers understand accounting, they can study the annual reports of banks, look at their bad loan ratio, capital adequacy, and loss and profit balance before parking their money. If the savers do not understand accounting, they should seek suggestions from professionals."

It would not be a wise decision to deposit money only due to higher interest rates, he said, adding that in most cases, weak banks and financial institutions offer the highest interest rates in their industry.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments