World Bank sees headwinds ahead for Bangladesh

The World Bank yesterday praised the progress Bangladesh achieved in recent years but apprehends a struggle ahead for the low tax revenue and banking sector’s poor condition.

“While Bangladesh is poised to maintain its current level of growth in the medium term, key structural reforms are needed to sustain productivity growth,” said the Washington-based multilateral lender in its review of Bangladesh’s performance under the country partnership framework (CPF).

The WB prepares a CPF for five years for member countries. It prepared one for Bangladesh in fiscal 2015-16 in which it set some targets in sectors such as energy, transport, social protection, education, job creation, health, and climate and environment management.

The country has made remarkable progress in improving the wellbeing of its citizens.

The national poverty rate fell from 48.9 to 24.3 per cent between 2000 and 2016, while the extreme poverty rate declined from 34.3 to 12.9 per cent.

Rural poverty fell substantially, driven by gains in non-agricultural income. Progress is also seen in non-monetary indicators of wellbeing. The average life expectancy increased to 72.5 years.

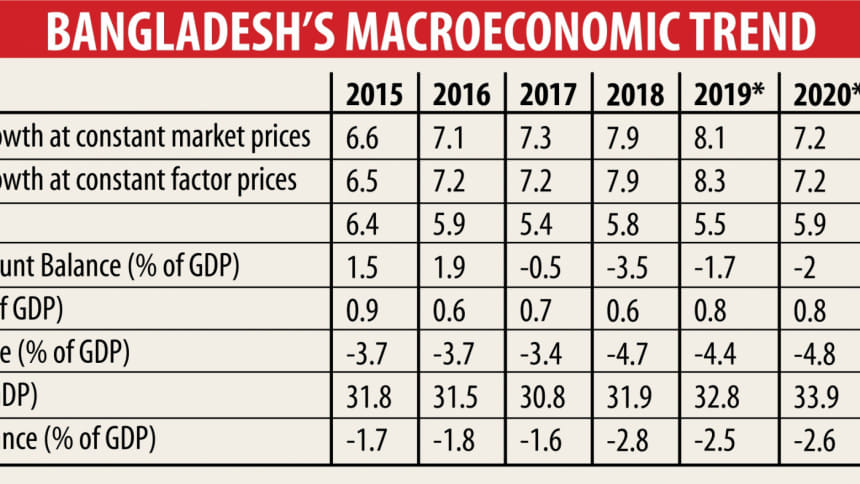

Economic growth has been robust, exceeding 7 per cent since 2016, well above the 3.9 to 4.7 percent average for developing countries in recent years, according to the WB.

Exports and remittance have been buoyant. Agriculture had bumper harvests. Propelled by a solid economic performance, gross national income per capita increased from $1,188 in fiscal 2014-15 to $1,944 in fiscal 2018-19.

Overall inflation has ranged between 5.4 and 6.4 per cent since 2015 and declined in 2019 as decelerating food prices offset a rise in non-food inflation.

The expansion of monetary aggregates has been limited as private sector credit growth slowed and banking liquidity has been impacted by the central bank’s recent sell-off of dollars to defend the taka.

“With easing of loan classification standards and reopening of classified loan rescheduling facility on easier terms, vulnerabilities in the banking system and capital markets persists.”

Accelerating exports and slowing imports have narrowed the current account deficit. The country’s budget deficit increased since fiscal 2017-18 but remained below the target of 5 per cent of GDP in fiscal year 2018-19.

However, according to the finance ministry’s existing data, the budget deficit crossed the target of 5 per cent of GDP last fiscal year.

“Low tax revenue collection continues to be a major challenge as policy and administrative reforms have stalled and, in some cases, been reversed.”

Public debt is expected to increase slightly to 32.8 per cent of GDP. The risk of both external and total public debt distress remains low.

Domestic demand growth is strong. Private investment is set to gain momentum given the reduced risk of political uncertainty following the 2018 elections and expected reforms to lower the cost of doing business.

Tariff escalation by the US against China may provide a boost to exports in the short run if Bangladesh can capture some of the trade diversion.

However, the recession in European and US export markets and appreciation of Bangladesh’s real exchange rate would adversely impact export demand and remittance.

The elevated global economic risk calls for accelerated structural reforms to increase potential output and build fiscal and external buffers.

An immediate challenge is to address banking sector vulnerabilities, revenue shortfalls and appreciation of the real effective exchange rate.

At the same time, there is a need to prepare for tighter external financing conditions in the near to medium term.

Given that garment occupies 84 per cent of total export Bangladesh’s export base is narrow, posing a structural economic weakness.

Diversification of export base is critical to buffer impacts from both external and internal shocks, and to sustain relatively high growth and accelerate job creation.

Overall volume of foreign direct investment (FDI) is still limited, with Bangladesh trailing competitors such as Vietnam, where FDI averaged 6 per cent of GDP in the last five years compared to 0.7 percent in Bangladesh.

Additionally, reforms are necessary to improve infrastructure, improve access to credit, address the high interest rates, boost human capital, and make business regulation less onerous and more predictable.

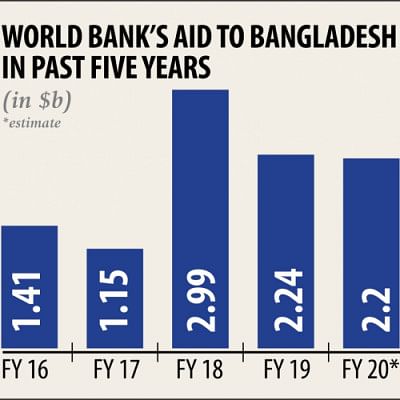

The WB Group has already given Bangladesh $10.06 billion under the CPF for five years from fiscal 2015-16. It will provide $2.2 billion in the current fiscal year.

Earlier, the WB gave Bangladesh $8.38 billion from fiscal 2010-11 to 2014-15 under the CPF.

The International Finance Corporation (IFC), a sister concern of the WB, already provided Bangladesh with $1.8 billion in the last four years. The amount was $783 million from fiscal 2010-11 to 2014-15.

The WB’s another concern, Multilateral Investment Guarantee Agency, gave the country $474 million in the last four years.

Under the CPF, the lender will provide $12.26 billion from fiscals 2015-16 to 2019-20.

The WBG now proposes extending the tenure of the partnership framework for one more year to June 2021 to align with the government’s eighth Five-Year Plan.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments