Brac Bank on a roll

Brac Bank is a private commercial lender, but it put the unbanked population and sustainable banking at the heart of its activities from the word go instead of making hefty profits because of its deep conviction that if it can serve the society and clients well, profits will automatically pour in.

The bank has proven right. Today, Brac Bank is one of the most profitable lenders in Bangladesh.

"Our objective is different from others. We have had a strong development focus since the inception and we want to add value to our clients and society," said Brac Bank Managing Director Selim RF Hussain in an interview with The Daily Star recently.

When the bank was set up in 2001, the lender emphasised SME loans although extending finances to the segment was not a popular proposition at the time. Conventional banks had their maximum focus on corporate banking as they saw SME loans were very risky and were not commercially viable.

"But disbursing Tk 100 crore among 10,000 SME clients instead of one big borrower has a great impact on the society and economy," said Hussain, who has recently been elected as the president of the Association of Bankers, Bangladesh, the platform of the chief executives in the banking industry.

Micro, small, and medium-sized enterprises (MSMEs) are critical to economic growth, covering 99.97 per cent of all enterprises. They absorb around 86 per cent of the labour force.

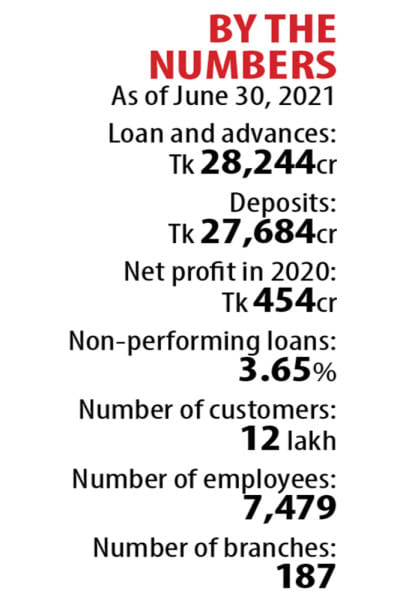

Keeping this in mind, the bank has disbursed 53 per cent of its outstanding loans to the tune of Tk 28,244 crore in the SME sector.

The ratio of SME loans was 39 per cent when Hussain joined Brac Bank in November 2015 as its managing director after leading IDLC Finance, one of the top non-bank financial institutions, in the same position.

He says disbursing loans among small enterprises is expensive as funds have to be distributed to a lot of borrowers. For this reason, the fund is termed as intensive supervisory credit.

The bank's cost-income ratio in the SME segment is nearly 85-90 per cent. This means the returns from the SME loans is low.

"Still, we are trying to expand the volume of SME loans as this is our mandate," Hussain said.

The cost-income ratio of the SME business surged to 170 per cent just after the central bank capped the lending rate at 9 per cent in April 2020.

Brac Bank had lent at 16 per cent before the cap. But as the rate declined to the single-digit overnight, it brought in a large amount of losses for the bank.

"But, we have turned around by improving different processes, including upgradation of technology and rolling out of new products."

The bank registered a net profit of Tk 284 crore in the first half of 2021.

Hussain praises SME entrepreneurs as resilient and compliant. The bank faced only 3 per cent default loans in the SME segment.

Brac Bank disbursed 17 per cent loans in the retail sector and 30 per cent in the corporate segment.

Under the retail banking, the bank's credit card has received tremendous popularity, becoming one of the top players in the card business.

The outstanding loans in the credit card segment stand at Tk 850 crore, of which less than 4 per cent have turned sour.

The overall ratio of default loans at Brac Bank stood at 3.5 per cent as of September last year, way lower than the average NPL ratio of 8.12 per cent in the industry.

In keeping with the changing times, the bank has intensified efforts to make its digital banking vibrant.

Around 22 per cent of its total transactions were settled through online platforms in January 2020. Currently, the ratio is 57 per cent.

"This means we have progressed a lot in the digital segment in the last two years," said the top executive.

The pandemic has also helped accelerate the digital banking programme, because it has changed customers' behaviour on how they communicate, work, study, carry out financial transactions, and get entertained.

However, implementing digital tools across the board within the next couple of years will not be possible as Bangladesh is a cash-based economy.

So, there is a strong requirement to ensure coordination between digital and physical banking in order to provide financial services to people from all walks of life, he said.

In 2021, the bank rolled out a banking application named "Astha" (confidence), which has drawn attention from clients. The app is helping clients carry out banking efficiently from the convenience of their home.

"Brac Bank will invest to upgrade its online platform in a consistent manner as a cashless society will be established in Bangladesh in the future."

The bank has also won the confidence of both local and foreign investors.

The rate of foreign shareholding in Brac Bank is around 38 per cent, whereas no other bank in the country has more than 5 per cent of external shareholding.

Hussain heaps praises on the board that has never intervened in the running of the day-to-day operations of Brac Bank.

Among the local lenders, Brac Bank has secured top-notch credit rating from S&P and Moody's, the two leading credit rating agencies in the world.

Recently, Hussain has got extension to continue in the same position for about five years. And he has set his sights on increasing the bank's market shares in all segments of businesses – SME, retail and corporate.

"Technology along with skilled human resources will help achieve the goals," he said.

Hussain says the economy greatly benefited in 2020 from the rolling out of the lending cap as it reinvigorated the private sector credit. But phasing out of the cap should be reconsidered.

The International Monetary Fund has also urged the government to do away with the lending ceiling gradually.

"The interest rate cap can be revisited initially for the SME and retail sectors," Hussain added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments