Bank Asia launches 4th Subordinated Bond

Bank Asia PLC has launched its 4th Subordinated Bond - a high-yield, floating-rate bond designed to strengthen the Bank's Tier-II capital and elevate its Capital to Risk-Weighted Asset Ratio (CRAR) in compliance with Bangladesh Bank's regulatory framework.

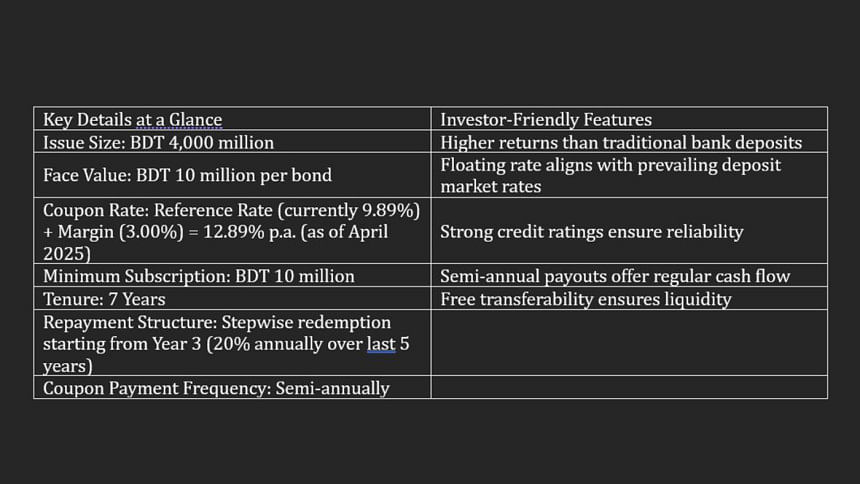

Arranged by City Bank Capital Resources Limited (CBCRL), this unsecured, non-convertible, fully redeemable bond is tailored for institutional investors and high-net-worth individuals, offering an attractive coupon rate of 12.89% p.a. as of April 2025 — a significantly higher return compared to traditional fixed deposit options.

At a time when the average bank Fixed Deposit Receipt (FDR) rates hover around 8–10%, the Bank Asia Subordinated Bond offers an attractive rate of 12.89%, backed by a solid AA1 long-term issuer rating from Credit Rating Agency of Bangladesh (CRAB) and an AAB bond rating from Emerging Credit Rating Ltd. (ECRL). This presents a rare combination of high yield with strong creditworthiness.

With a 7-year tenure and semi-annual coupon payments, the bond is structured for predictable income while the floating rate mechanism ensures protection against interest rate volatility — a feature especially attractive in a fluctuating macroeconomic environment.

The bond proceeds will be used to bolster Bank Asia's Tier-II capital base, allowing the bank to enhance its capacity for sustainable growth, ensure regulatory compliance, and continue supporting Bangladesh's economic development through responsible lending.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments