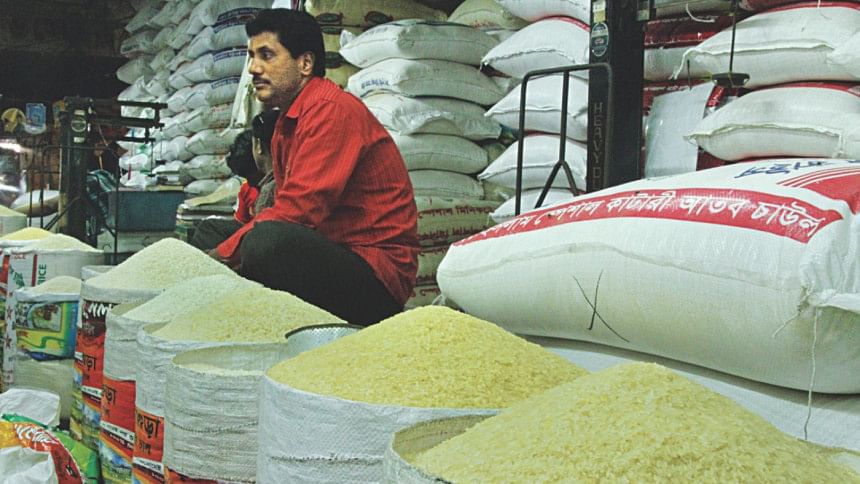

Rice import from India: some realities

In 2017, a large quantity of rice was imported from India and mainly from the bordering state of West Bengal. Exact figures of imported rice from India are not known yet and, most probably, it will not be known and, as always, approximate figures are the basis for following the trend in Indo-Bangladesh trade in rice. One is left with this impression based on the experience of rice imports from India during 1998 floods.

In 1998, government figures showed 4.2 million tonnes of rice were imported from India. Of this amount, 2.2 million tonnes were imported to make up for the shortage created by floods and 2 million tonnes to cover the usual annual deficit in domestic rice production. At that time, the only land port of entry of Indian rice into Bangladesh was Benapole. Bangladesh's customs authority at this checkpoint provided figures of Indian rice imports that don't match official government statistics. When the Indian central bank (as sole authority of opening letter of credit) was approached to verify which estimates were correct, it provided a different figure. It shows uncontrolled border trade played a significant role in entry of Indian rice into Bangladesh. It is likely this scenario may also play out in current situation.

Last year when price of coarse rice was rising rapidly, I had the opportunity to observe the coarse rice auction systems in Bardhaman district of West Bengal auction place and the price at auction was Rs 20-21 per kg subject to availability of rice in the auction place. Sometimes the price rose to Rs 22-23 during short supply. The price of rice in the local market of West Bengal at that time was Rs 28-30/kg. Price of one kg was equivalent to Bangladeshi Tk 26-27. In the local market of Bangladesh rice price during the same period was Tk 42-43. I was told that upon reaching Benapole border rice price increases to Rs 26-27 per kg, which is equivalent to Tk 34-35. Price of one kg rice within Bangladesh until it reaches local market increased Tk 9-10 taka. The issue is here whether there is any scope to reduce the cost of transportation and handling of the merchandise during transit so as lower the retail price of imported rice in local markets.

India's total rice production in 2016-2017 (October/September) was 107-107.5 million tonnes against the demand of 99 million tonnes. It means India has a maximum exportable surplus of 8.5 million tonnes of rice, of which 4.5 million tonnes are Basmati rice. In other words, only 4 million tonnes of conventional rice is available for export. As India maintains close friendly relations with other countries to further its geo-strategic interests, Bangladesh should be mindful of a stark reality that India cannot be taken as granted as the sole source of importing rice. Additionally, India has its some own internal problems in different states in handling rice issues.

For example, the central government of India requested West Bengal state government to provide it with some quantity of rice for supply in other rice-deficit states of India. For its part, the West Bengal government has its mid-day meal programmes and supply of rice to the people living below the poverty line. The West Bengal state government's programme of subsidising rice to poor people is larger in scope than the central government's programme.

However, the state government has been facing some problems to run these two programmes. The system of procurement in West Bengal is as follows: farmers sell their paddy to the millers and millers sell milled rice to the government. However, this year, due to higher price in local market, farmers are not giving the paddy to the millers. The system is that millers should buy rice only from real farmers (government provides identity card to the real farmers) and not from individuals other than farmers. Farmers are not happy with this approach because very often millers do not buy farmers' rice saying quality is not good, moisture contents are high and lack of money to the millers and delays in cashing miller cheques received from the government by selling milled rice to the government as government has no money in their account. In these circumstances, farmers incur losses in labour and transportation costs for bringing paddy to the millers. Media reports say in some places, to avoid this situation, a group of farmers sell their rice to the middlemen and certify that he/she is authorised by farmers to sell their rice to the millers. This system also did not work due to dishonesty of the middlemen.

Because of above situations both social safety net programmes of the state government are under threat and government has very little options to overcome this situation. However, one of the options may be to reduce export of rice to Bangladesh in future.

Other points to take into account for long run rice import from India is that the MSP (minimum support price) of rice has been increased 1.5 times of the cost of production and will be effective since October 2018. It has been announced in the recent budget of 2018-2019. It may cause rice price hike in India.

Another point is that rice is grown in India mainly in monsoon period and is considered as rainfed crop and the major winter crop of India is wheat and not rice. In view of that production and productivity performance of rice depends mainly on rainfall distribution in the country. In India only 40 percent of rice areas are irrigated. The third point is that the geo-political landscape has been changing very rapidly in this region. It may stand as one of the weighty factors of receiving rice from any country including India.

Considering the above situation, Bangladesh should not entirely rely on rice import from India and try to open up new opportunity for importing rice. We have to remember that Bangladesh's efforts to import rice from Vietnam, Cambodia, Myanmar and Thailand in 2017 were less successful. It says policies in this regard should be more straightforward and transparent and country capacity to negotiate import deals will also play a crucial role.

The writer is the former senior technical officer of the Food and Agriculture Organisation of the United Nations. He can be reached at [email protected].

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments