Slowdown in investment: a headache for Muhith

The outgoing fiscal year is defined by growing confidence and optimism in the country's ability to achieve higher economic growth.

The government's increasing investment in giant infrastructure projects has helped Bangladesh achieve 7.05 percent growth.

Yet, there are many concerns in the economy, with the slowdown in private investment being the paramount of all, brought on by inadequate gas, electricity and land.

Declining remittances could hurt the economy further.

The inflow of foreign direct investment is also a matter of worry. Even though the country offers the most liberal investment opportunities in South Asia, the FDI in Bangladesh is less than in India, Myanmar and Pakistan.

The government's capacity to implement the budget and public-private partnership (PPP) projects also raises questions as no significant progress was seen on this front.

Reforms or privatisation of state-owned enterprises, including troubled banks, is another big challenge for the government.

In this backdrop, Finance Minister AMA Muhith is set to place the budget for fiscal 2016-17 in parliament today.

He has already disclosed many of the budget figures including the total outlay, which would be about Tk 340,000 crore, up about 30 percent year-on-year. The figure is also 17.4 percent of the gross domestic product.

Inadequate gas, electricity and land are big impediments to private investment, said Wahiduddin Mahmud, a renowned economist.

The finance minister himself several days ago said it would take two years to address the gas crisis, meaning businessmen who want to set up new factories will have to wait for that long to get gas supply to their units.

Zaid Bakht, another economist, said the upcoming budget has to have the alchemy to boost private investment, which has been declining or stagnant for the past few years or so.

“We succeeded in attaining higher GDP growth by increasing public investment. If we want to transcend that, private investment has to be boosted up, and for that, an improved business climate is needed.

Bakht, who is also the chairman of Agrani Bank, suggested the government improve the investment climate by ensuring quality public expenditure.

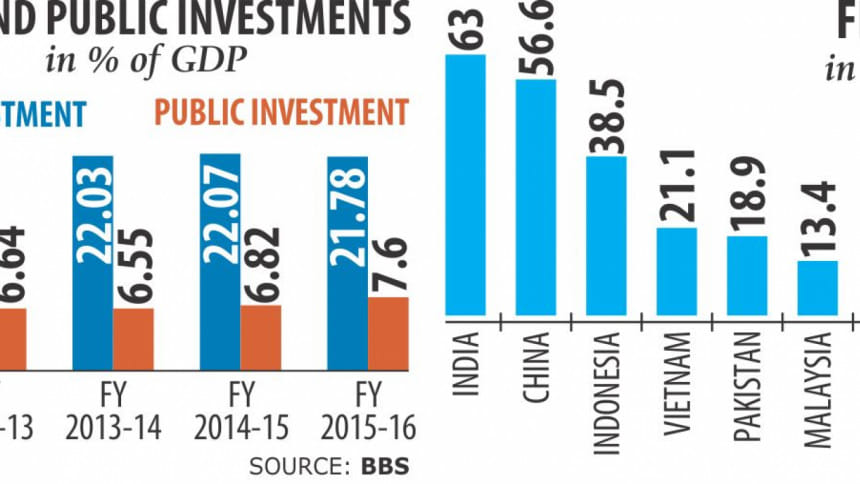

Overall investment stood at 29.38 percent of GDP in fiscal 2015-16, with private sector accounting for 21.78 percent, according to Bangladesh Bureau of Statistics. Five years ago, the private sector's contribution stood at 22.5 percent.

On the other hand, public sector investment rose to 7.6 percent in the outgoing year from 5.76 percent five years ago.

The turnaround of this static state of private investment will be a key challenge for the government, according to analysts.

“Public sector investment is rising, but it cannot substitute private investment,” said Mustafa K Mujeri, executive director of the Institute for Inclusive Finance for Development.

He said the government has been trying to boost private investment, but it seems the measures are not enough to inject confidence among businesses.

Binding constraints such as gas, electricity and land crisis have to be resolved to boost investment.

“But the good thing is private sector credit growth has started picking up in recent months,” said Mujeri, also a former director general of the Bangladesh Institute of Development Studies.

Private sector credit grew 15.16 percent year-on-year in March, according to data from Bangladesh Bank. The July-March credit growth is still low at 10.76 percent compared to the BB's annual target of 15 percent.

FDI inflows remain below 1 percent of GDP. Bangladesh received $1.6 billion last year, but the country needs about $5.4 billion a year to fulfil its dream of getting the middle-income status by 2021.

In contrast, Myanmar in the 12 months to March received $9.4 billion in FDI, up from the previous year's $8 billion. Pakistan received FDI amounting to $2.68 billion in 2015.

Foreign remittance, which is one of the major lifelines to the Bangladesh economy, is declining in recent months, much to the concern of the government and the millions of beneficiaries.

Remittance slipped 2.39 percent in the first ten months of the fiscal year, and in the month of April it plummeted 7.71 percent, triggering worries that the trend will only get worse.

The last but not the least concern is the government's poor budget implementation capacity.

Analysts said the size of the budget has been rising incrementally, but implementation capacity and the quality of spending have not improved in proportion.

“In reality, the size of our budget is not big, but it gets bigger when we see the implementation capacity,” Mujeri said.

It is also evident in the finance ministry's data.

Of the Tk 185,191 crore allocation for non-development or revenue budget, the government has been able to spend only 30.7 percent of the sum, with interest payment accounting for over 25 percent.

But it is heartening to see the government prioritise its development works by laying out a roadmap for 10 mega-projects and allocating about Tk 18,700 crore in the upcoming budget for them, he said.

“But the move will not work if there is no improvement in budget implementation capacity.”

In 2010, the government issued the policy and strategy for PPP to facilitate the development of vital public infrastructure and service.

Since then, there has not been much movement on this front, and this is down to a lack of capacity of government agencies and officials. “PPP is a tough subject and Bangladesh lacks the capacity,” Mahmud said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments