Stockmarket poised for a stellar year

The capital market will remain moderately bullish this year thanks to the stable economic growth and low interest rates.

The forecasts were made by the majority of the respondents in a recent survey on the Bangladesh capital market conducted by LankaBangla Securities. The findings of the survey were released yesterday.

The survey, which is the fifth of its kind, was carried out between January 4 and January 15 this year. A total of 107 people from various sectors -- including academicians, fund managers, foreign investors, chief executives, traders and students -- responded to the survey styled 'Bangladesh Capital Market Sentiment Survey 2017'.

The majority, or 41.1 percent, of the participants said the capital market's performance last year was moderate, mainly due to declining interest rates and improved investor confidence.

Some 71 percent of the respondents felt that the introduction of internet trading has boosted transaction volume in the stockmarket.

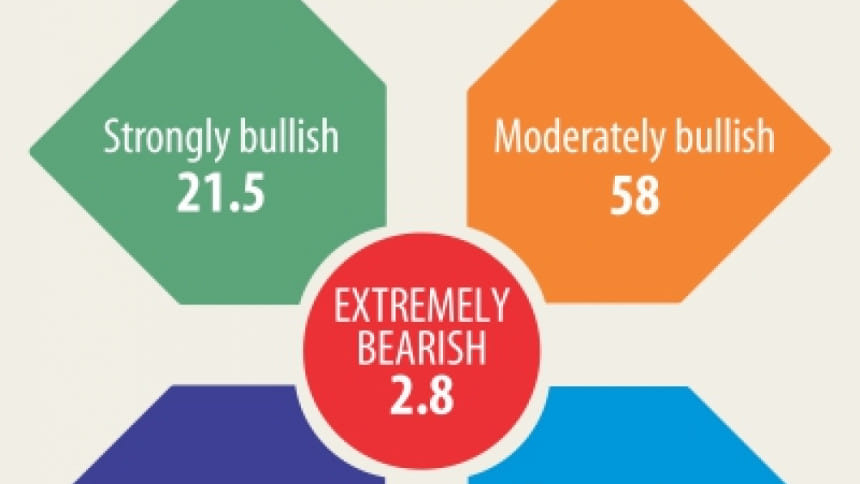

Almost 87 percent of the respondents believed the capital market will perform better this year than the last. About 58 percent of the respondents felt that the market may become moderately bullish in 2017.

The reflection has already been seen in the market with the Dhaka bourse's key index and turnover hitting record highs this month.

DSEX, the benchmark index of Dhaka Stock Exchange, crossed the 5,700-point mark for the first time this month, while turnover scaled a six-year high of Tk 2,100 crore.

The index, however, closed at 5,421 points yesterday, while the turnover came down to Tk 1,075 crore, which is still within the expectations of the survey respondents.

The majority -- 43 percent -- expected the average daily turnover to remain over Tk 1,000 crore this year; 57 percent thought the index will close 2017 above the 5,500-point mark.

However, weak regulatory framework will be the biggest risk to the capital market this year, according to 31.8 percent of the respondents.

Lack of investor confidence, political stability and intervention through frequent policy changes by regulators were also identified as risks to the capital market, according to the survey.

Over 52 percent of the respondents are expecting the pharmaceutical stocks to be the best performers this year, followed by fuel and power, cement, bank and textile shares.

Some 44 percent thought the market was “too immature to absorb derivatives”, while 65 percent felt the demutualisation of the stock exchanges has made the market “more transparent and vibrant”.

But 43.5 percent of the respondents called for improved transparency of financial reporting and other corporate disclosures, which they felt is most needed to improve investor trust and market integrity this year.

The majority, or 46.7 percent, also felt that market fraud and manipulation will be the most critical ethical issue for the capital market in 2017.

However, 85 percent said financial projection through equity research publication will improve decision making in the market.

In addition to a lack of corporate governance in listed firms, fear and trust issues and political instability are responsible for the lacklustre foreign investment in the capital market, according to the survey.

On the macroeconomic front, the survey recorded a mixed opinion, with the majority saying that economic growth will remain between 6.7 percent and 7 percent this fiscal year.

Local infrastructure bottleneck will pose the biggest risk to Bangladesh economy this year.

The respondents think inflation will rise this fiscal year, the taka will appreciate against the dollar and borrowing will be even cheaper this year.

More than half of the respondents felt that Brexit and the new US administration will have a negative impact on the Bangladesh economy.

They also think that the Padma bridge project will not be completed within the stipulated time and that there is a need for improvement with regards to the food safety scenario.

The majority of the participants felt that there will be a positive impact of the fall in global crude oil prices on the Bangladesh economy, though the domestic oil prices are still very high compared to the international prices.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments