Telcos invested $1 billion for 4G

Mobile phone operators have invested around $1 billion for starting fourth generation (4G) mobile service in the country so far, Association of Mobile Telecom Operators of Bangladesh (AMTOB) said today.

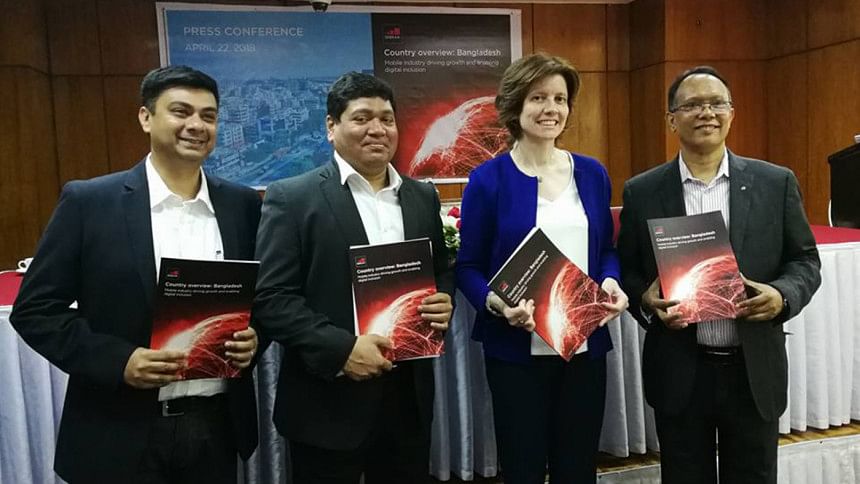

Spectrum price is so high in the country which ultimately affecting the quality of service, TIM Nurul Kabir, secretary general of AMTOB, said at a press conference on three reports on Bangladeshi mobile market released by GSMA, mobile operators' global organisation, at the Pan Pacific Sonargaon Hotel in Dhaka.

All four operators awarded 4G licence on February 19 and top three of them launched the service on that day, though the state-run operators yet to launch their service.

Kabir said that 4G enabled handset is a big challenge in the country as currently there are less than 15% handsets having 4G though the total smartphone share is about 30 percent.

"We asked the authority to cut tax from 4G enabled mobile handsets importing at least next few years to make the 4G a success in the country," Kabir added.

The GSMA on its report said that Tk 51 directly goes to national exchequer out of Tk 100 spent by a mobile user and therefore, an operator is left with less money to develop its network and run business smoothly.

Emanuela Lecchi, head of GSMA Asia Pacific, said that Bangladesh is one of the lowest mobile spending countries in the world but spectrum price is one of the highest and that is why mobile service quality is not much higher.

"When operators earning per customer in a month is less than $3 then how can one achieve the purpose of digital Bangladesh?" said Lecchi.

In their reports GSMA said Bangladesh, along with Pakistan, has the lowest level of mobile internet penetration in the Asia Pacific region.

Only 21% of the population of both Bangladesh and Pakistan have mobile internet connection -- the lowest among regional peers, according to their report.

In 2017, one in five Bangladeshis subscribed to mobile internet services despite 3G networks covering in excess of 90% of the population.

Even countries like Nepal and Myanmar, both of which have lower GDP per capita than Bangladesh, have higher mobile internet penetration: 28% and 35% respectively.

The majority of subscribers in Bangladesh primarily use their phones for basic voice and SMS services, the report said.

As a result of this low level of engagement, the country also generates one of the lowest subscriber average revenue per user (ARPU) levels in the world at $2.9. This is considerably below the averages for Asia Pacific and the world of $10.4 and $14.6 respectively, limiting the ability of operators to engender the required transition to mobile broadband technologies, the report said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments