BB's intervention fails to stabilise exchange rate

The foreign exchange market has been going through volatility because of the widening demand-supply gap of US dollars amid high import expenditure and low export earnings.

The average bills for collection (BC) selling rate, used for import payments, were Tk 83.90 per dollar yesterday, which was Tk 83.80 at the beginning of October.

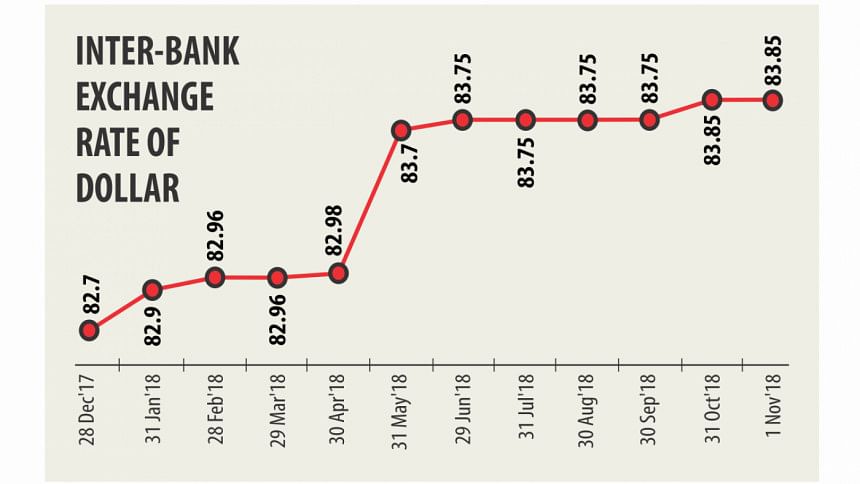

The rising demand for dollar compelled the Bangladesh Bank to devalue the local currency gradually throughout last month, from Tk 83.78 to Tk 83.85 per dollar.

Moreover, the central bank has sold around $435 million in the market in the past four months since July to meet the growing demand.

The interbank exchange rate increased by almost Tk 3 in the last one year from Tk 80.90 in October 2017.

The scarcity of greenbacks prompted private banks to sell the dollar to importers at a rate of up to Tk 85 last month, which was beyond their own declaration rate, in violation of Bangladesh Bank's rule.

The breach was identified during an investigation conducted by the central bank in the first week of October.

Last week, the central bank issued a show-cause notice on nine private banks for selling the dollar to importers at Tk 84 to Tk 85 against their declared rate of Tk 83.85 per dollar.

The banks are Trust, City, NCC, Dutch-Bangla, BASIC, Mutual Trust, Exim, Dhaka and Prime banks.

The banks, in their explanations, regretted for charging the higher rate, said a senior executive of the BB.

In this perspective, the central bank decided to warn the nine banks and ask them to keep the exchange rate within the limit, he said.

Banks can set the BC rate at the interbank exchange rate plus Tk 0.05 to Tk 0.10, according to the central bank's instruction.

The ceiling for the BC rate is not a rule but a practice, which aims at maintaining discipline in the foreign exchange market, said the BB executive.

The recent volatility in the exchange violated the discipline, he added.

The rising dollar price raised concerns among the central bank as it will create inflationary pressure, he said.

Md Arfan Ali, managing director of Bank Asia, said the rising exchange rate will put pressure on inflation as the price of imported goods will increase.

The devaluation of the local currency will also put pressure on the liquidity market as the settlement of letters of credit will require more money, he said.

The exchange rate is likely to go up further in the coming days due to rising import and various international factors, he hinted.

The trade deficit widened to $ 2.1 billion in the July-August period of the current fiscal year from $ 1.76 billion in the same period last year.

The current account deficit, however, narrowed to $60 million in the first two months of 2018-19 from $369 million in the same period last fiscal year thanks to good inflow of remittance.

Remittance earnings increased 31.56 percent to $1.12 billion in September this year compared to $856.87 million in the same month last year.

The credit goes to a rise in the dollar price as private banks offered up to Tk 85 per dollar in recent months, said a senior executive of a private bank.

The country's import expenditure registered a 5.66 percent growth in July-August against export growth of 2 percent, according to central bank data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments