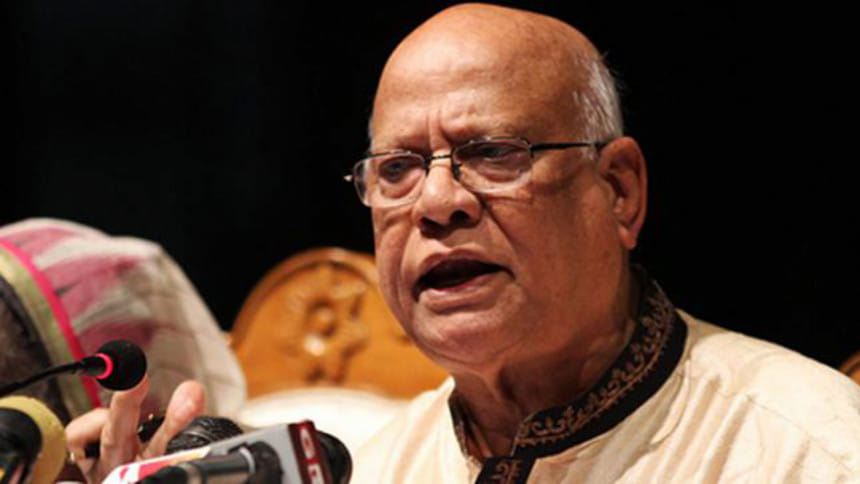

7 banks facing capital deficit of Tk 9,417.42 crore: Muhith

Four state-run and three private banks are facing capital deficit of Tk 9417.42 crore as of September, 2017, Finance Minister Abul Maal Abdul Muhith told parliament today.

“Yes, the state-run and private banks are now facing capital deficit. Out of total 57 banks operating in banking sectors, four state-run banks are facing capital deficit of Tk 7626.23 crore while three private banks are facing capital deficit of Tk 1791.20 crore as of September 30, 2017,” Muhith replied in response to independent MP Md Abdul Matin’s query.

The lawmaker wanted to know whether any state or privately run banks are facing capital or provision crisis. The MP also wanted to know the government’s measures to address the crisis.

In a scripted answer, Muhith informed the House that the capital deficit at the state-run Sonali Bank stood Tk. 3140.41, Tk 689.90 crore at Rupali Bank, Tk 1272.93 crore at Janata Bank and Tk 2522.99 crore at BASIC Bank.

Of the three privately-run banks, Bangladesh Commerce Bank Ltd suffers capital crisis of Tk 231.31 crore, The Farmers’ Bank Ltd Tk 74.76 crore and ICB Islamic Bank Ltd Tk 1485.13 crore, Muhith said.

About the government’s various measures to address the capital crisis in seven banks, Muhith told the House that the government has already provided Tk 10,272 crore as recapitalising to those banks in between 2005-06 fiscal to 2016-17 fiscal.

Muhith also said agreement and Memorandum of Understanding have been signed with the concerned banks aimed at closely monitoring those banks.

Under the agreement different target including progress of financial condition and quality of loan were set for those banks, Muhith added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments