China's waste import ban upends global recycling industry

For years China was the world's top destination for recyclable trash, but a ban on certain imports has left nations scrambling to find new dumping grounds for growing piles of garbage.

The decision was announced in July and came into force on January 1, giving companies from Europe to the United States barely six months to look for other options, and forcing some to store rubbish in parking lots.

In China, some recycling companies have had to lay off staff or shut down due to the lost business.

The ban bars imports of 24 categories of solid waste, including certain types of plastics, paper and textiles.

"Large amounts of dirty... or even hazardous wastes are mixed in the solid waste that can be used as raw materials. This polluted China's environment seriously," the environment ministry explained in a notice to the World Trade Organization.

In 2015 alone, the Asian giant bought 49.6 million tonnes of rubbish, according to the latest government figures.

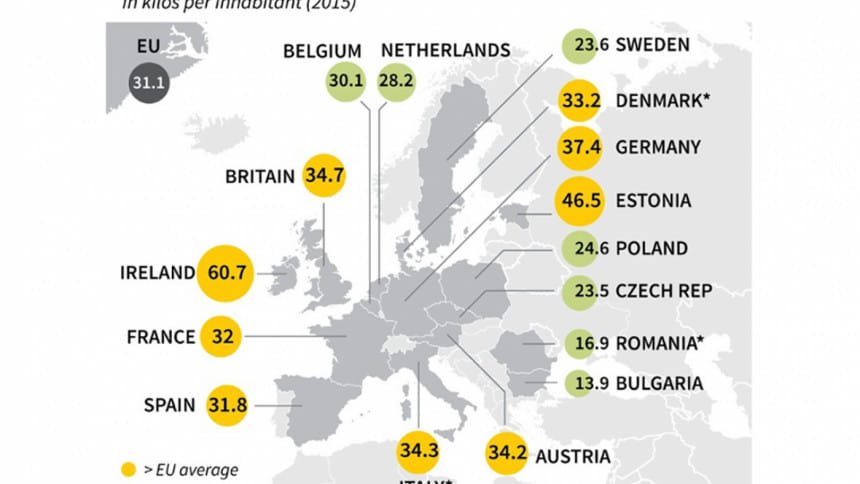

The European Union exports half of its collected and sorted plastics, 85 percent of which goes to China. Ireland alone exported 95 percent of its plastic waste to China in 2016.

That same year, the US shipped more than 16 million tonnes of scrap commodities to China worth more than $5.2 billion.

Filling China's enormous shoes

The ban has been like an "earthquake" for countries dependent on China, said Arnaud Brunet, head of the Bureau of International Recycling.

"It has put our industry under stress since China is simply the largest market in the world" for recycled materials, he told AFP, noting that he expected exports of certain materials to tank by 40 percent or more.

The decrease will be partly due to a fall in the threshold of impurities China is willing to accept per tonne of waste -- higher standards that most countries currently cannot meet.

Some are now looking at emerging markets elsewhere such as India, Pakistan or southeast Asia, but it could be more expensive than shipping waste to China.

Sending recyclables to China is cheaper because they are placed on ships that would "otherwise be empty" when they return to the Asian country after delivering consumer goods in Europe, said Simon Ellin, chief executive of the Britain-based Recycling Association.

Brunet also warned that many alternate countries may not yet be up to the task of filling China's enormous shoes, since "processing capacity doesn't develop overnight."

The ban risks causing a "catastrophic" environmental problem as backlogs of recyclable waste are instead incinerated or dumped in landfills with other refuse.

In the US, collectors of recyclables are already reporting "significant stockpiles" of materials, said Adina Renee Adler, senior director of international relations at the Institute of Scrap Recycling Industries (ISRI).

"Some municipalities have announced that they will either not take certain materials or direct them to landfills," she said.

Brandon Wright, a spokesman for the US National Waste and Recycling Association, told AFP that some facilities were storing inventory outside or in parking lots.

'Hard to do business'

The ban has also created challenges for Chinese companies dependent on foreign waste.

"It will be very hard to do business," said Zhang Jinglian, owner of the Huizhou Qinchun plastic recycling company in southern Guangdong province.

More than half their plastics were imported, and as prices for such raw materials go up, production will be reduced by at least a third, he said. He had already let go a dozen employees.

But at the same time, the ban could jolt China into improving its own patchy recycling systems, allowing it to reuse more local materials, said Greenpeace plastics expert Liu Hua.

"In China at the moment, there isn't a complete, legal and regulated recycling system in place," he said, with even big cities like Beijing reliant on illegal scavengers.

"When there aren't resources coming from abroad, there's a greater likelihood of us improving our own internal recycling."

In Europe, the ban could also have the positive effect of prompting countries to focus on developing domestic recycling industries, said Jean-Marc Boursier, president of the European Federation of Waste Management and Environmental Services.

"The Chinese decision forces us to ask ourselves whether we wouldn't be interested in making processing plants in Europe so as to export products rather than waste," he said.

On Tuesday, the EU unveiled plans to phase out single-use plastics such as coffee cups and make all plastic packaging recyclable by 2030.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments