AB Bank board restructured

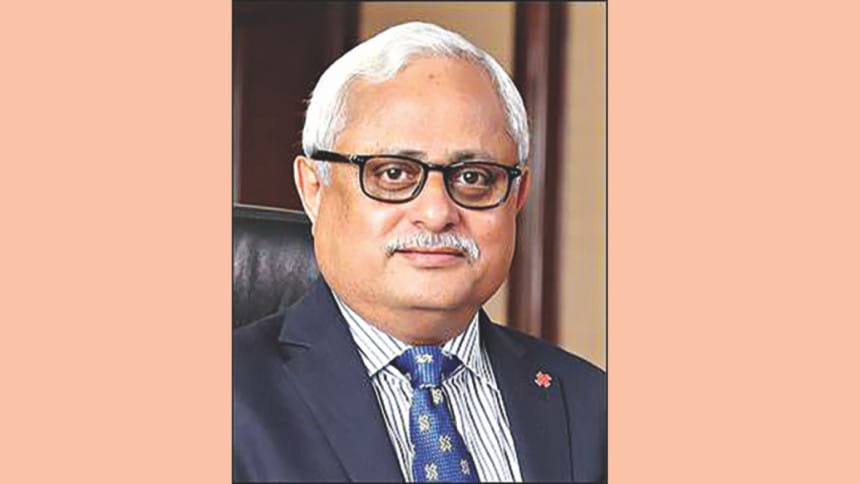

AB Bank Chairman M Wahidul Haque, along with its vice chairman and a director, resigned from the bank's board of directors yesterday amid allegations of money laundering by the bank.

Wahidul, Vice Chairman Salim Ahmed and Director Faheemul Huq tendered their resignations to the board which approved those at the bank's annual general meeting (AGM) in the city's Le Meridien hotel.

Wahidul was absent from the AGM which was deferred by around four months. However, Salim and Faheemul were present.

The development comes at a time when the bank faces criticism over its alleged laundering of around Tk 165 crore ($20 million) to the United Arab Emirates through two shady organisations in the name of investment.

A Bangladesh Bank inspection team, which recently unearthed the scam, recommended Wahidul's removal from the bank's board.

Seeking anonymity, a BB official told The Daily Star yesterday that the central bank verbally asked Wahidul to resign from the board as early as possible due to his alleged involvement in the money laundering.

Mahadev Sarker, company secretary of AB Bank, told this correspondent that the bank is yet to elect a new chairman and vice chairman.

The board will make the decisions at its next meeting, he said.

Former foreign minister and BNP leader M Morshed Khan and his son Faisal Morshed Khan attended the AGM as the bank's sponsor shareholders.

According to AB Bank sources, Morshed and his family reportedly own around 25 percent shares in the bank.

Morshed nominated Wahidul as a director of the bank on December 12, 2007. Wahidul became the bank's chairman in July 2008 and held the post till yesterday.

“Wahidul was a representative of my company and I nominated him. But in recent times, the board and the management failed to comply with the rules and regulations properly.

“None of the shareholders stood by Wahidul at the annual general meeting,” he told this newspaper over the phone.

Morshed alleged that in the past, the bank recruited qualified and skilled people through proper tests, but the existing management has been hiring people in breach of the rules.

There will be no corruption at the bank if the management carries out internal audit from time to time, he added.

THREE NEW DIRECTORS

Sajir Ahmed, Mushtaq Ahmed Chowdhury and Shirin Sheikh Mainuddin were appointed as board members at yesterday's AGM.

Mushtaq and Shirin were nominated by Morshed, and Sajir by his father Salim, who quit as the bank's vice chairman.

Mushtaq, a leader of the Awami League, is chairman of Cox's Bazar Zila Parishad.

The AB Bank board had decided to hold the AGM on August 17 at the Bashundhara Convention Centre. It later rescheduled the AGM for December 21 and chose Kurmitola Golf Club as the venue. But finally it held the meeting at Le Meridien hotel.

ALLEGATIONS OF MONEY LAUNDERING

According to a BB probe report, the AB Bank board in December 2013 approved investment of Tk 165 crore in Singapore-based firm Pinnacle Global Fund Pte Ltd (PGF) through the bank's Offshore Banking Unit (OBU).

In February 2014, the OBU laundered the money to an account at the UAE-based Abu Dhabi Commercial Bank.

The account belonged to Cheng Bao General Trading LLC which acted as a Special Purpose Vehicle (SPV) or a mediator for the PGF. Cheng Bao immediately withdrew the money and closed the account.

Wahidul, two ex-managing directors M Fazlur Rahman and Shamim Ahmed Chaudhury, and its former head of financial institutions and treasury Abu Hena Mustafa Kamal were directly involved in laundering the money, says the BB report.

The central bank on October 13 wrote to the AB Bank, asking it to suspend Abu Hena, ex-treasury head, from his job at the bank in line with the service rules.

The BB also instructed it to immediately classify the laundered money as bad loans, and stop borrowing, investing and lending through the OBU.

This was the second instance of money laundering by the AB Bank in the last two years.

The BB last year detected that the bank laundered around Tk 340 crore ($40.25 million) to Singapore and the UAE through its OBU.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments