Govt asked to act now to boost private investment

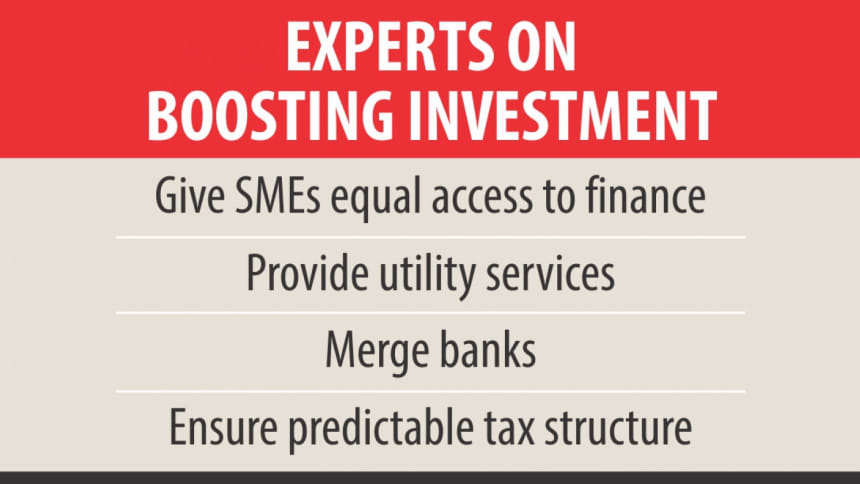

Experts yesterday called on the government to take steps to dispel the uncertainty among investors, fix infrastructure bottlenecks and provide services to boost private investment stagnant since 2013.

“It is comparatively tough for a new investor to invest in the country,” said Khondaker Golam Moazzem, additional research director of the Centre for Policy Dialogue, during The Daily Star organised roundtable “Looking at ways to boost private investment” at The Daily Star Centre.

“It is true for a new domestic investor and a new foreign investor. So, we have to keep in mind this new area while fixing investment incentives in future.”

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh (PRI), said if the government really wanted to achieve the 7.2 percent growth target of gross domestic product (GDP), it would have to increase the investment-to-GDP ratio by at least 2 percentage points for the private sector, as it has to compensate for the loss incurred last year.

MA Mannan, state minister for finance and planning, said foreign investors would not come to Bangladesh if local investment was not vibrant.

He also said the government had to invest for developing infrastructures such as ports, energy supplies, deep-sea port and railways as the private sector would not go into these areas.

Private investment rate has continued to stagnate and has remained largely unchanged as a share of the GDP since fiscal year 2012-13, according to the World Bank.

Private investment rate is estimated to have declined to 21.78 percent in fiscal year 2015-16 from 22.07 percent of the GDP in fiscal year 2014-15. Private investment and growth remain constrained by disabling regulations, infrastructure deficiencies, financial sector weaknesses and political uncertainties, said the World Bank in April.

Ahsan of the PRI said a significant part of the desired private investment growth would come from foreign direct investment (FDI).

The former economist of the International Monetary Fund said the FDI went up this year but the economy also widened. As a result, the FDI was still below 1 percent in relation to the GDP.

Ahsan said the private sector was facing problems in getting utility services from the public sector. “… But the government will have to be proactive in giving certain things to private enterprises.”

The economist said Bangladesh should go aggressive in borrowing capitally cheap funds from abroad, as the country's foreign debt to the GDP ratio came down to 13 percent in the 2015 fiscal year and would go down to below 12 percent in the outgoing fiscal year.

“It is very low for a country like us. The capital is so cheap outside of Bangladesh but we are not using it as well as concessional capital,” he said.

Due to stalled regulatory reforms, Bangladesh was 174th, among 189 nations, in the World Bank's 2016 ranking of the ease of doing business.

Ahsan questioned: “What have we done [in the area]? Why aren't we working systematically on the constraints which are well-identified?”

Binayak Sen, research director of the Bangladesh Institute of Development Studies, said one of the sources of private investment is the long-term borrowing from the financial system. But that long-term borrowing from the financial system is very inequitably distributed.

He said the bulk of the private investment, especially organised private investment, was happening in the larger segment.

“Inequality in the distribution of private investible assets is itself a stumbling block to accelerating private investment.

“We hear about the issue of the excess liquidity in the banking system and that private investors are not sufficiently stimulated to invest in the country. Because of investment uncertainty, capital flight takes place.”

But medium and small investors don't have the luxury of capital flight and are sitting idle, he said. “The problem is that they don't have equal access to the financial system. That is perhaps one of the structural reasons that private investment is not sufficiently getting momentum. This is an issue of financial inequality and an issue that has to be squarely brought into discussion.”

Binayak said the country could easily raise the private investment-to-GDP ratio to 26 percent from 24 percent if the government could slightly bring in equity in the distribution assets.

Biru Paksha Paul, chief economist of the Bangladesh Bank, said the country was turning into a savings society as savings rate had exceeded the investment rate. Too much savings discourages investment.

He also said markets should control the interest rates on savings certificates.

He also said without a low interest rate regime, apart from other regulatory issues, one can't stimulate the stock market.

Moazzem of the CPD said the 7-plus percent GDP growth was the result of investment in the service sector rather than contribution from manufacturing sector.

“As a result, you will not see investment but there will be growth there. We will have to switch to a scenario where a lot of investment will take place and jobs will be created,” he said, adding that new private investment in the manufacturing sector was of utmost importance.

The economist said the ineffectiveness in investment was also growing. “India is getting better economic growth compared to ours although they are investing comparatively less than Bangladesh. We are investing a lot but are not getting expected returns.”

He said banks could tie up with NGOs to lend money among grassroots SMEs, as microfinance organisations have established models of giving loans bypassing various documentations demanded by formal financial organisations.

Moazzem said predictability was needed for industries. “It is very difficult for industries to go for long-term investment planning,” he said, suggesting framing tax policies in a way that allows businesses to predict tax regimes for three to five years.

Rupali Chowdhury, president of the Foreign Investors' Chamber of Commerce & Industry, said the existing investment was suffering due to power and energy crisis, inadequate infrastructure and lack of trust between the government bodies and the business people.

“We know how difficult it is to get power and gas connections. So, running an industry and the cost of doing business is very high,” she said.

Whenever businesses demand something from the government or its agencies, including the National Board of Revenue, it is not only to maximise profits, but also to survive in the market and to provide employment for people, she said.

“There is a huge amount of distrust between the government bodies and the business people. This mindset has to be changed,” said Rupali, who has been serving Berger Paints Bangladesh as managing director since 2008.

She said frequent change in tax structures also hampers the businesses. “The tax structure should remain stable for a few years so that we can plan ahead and do the business accordingly,” she added.

She also said getting approvals in different stages for investment was a big problem. “Starting from the Board of Investment to environmental licence, it takes a long time -- 8 to 10 months -- to get the clearances. In other countries, it's only two and a half months.”

Abdus Salam Murshedy, president of the Exporters Association of Bangladesh, said there was problem in getting industrial land. Besides, the factories can't start production until they get gas connection.

“Had there been investment and demand for money, would the bank's interest rate come down to below single digit? Still, investors are not borrowing. The reason is lack of confidence.”

Political uncertainly is not the only reason behind stagnant private investment, Murshedy said.

He said only one-third of the industries, who had set up factories in the last few years, had received energy connections.

Sardar M Amin, vice-president of the Real Estate & Housing Association of Bangladesh, said sales had dropped by 80 percent across the country and new projects have been cut by 90 percent since the 2013 violence with up to 90 percent jobs in about 1,200 REHAB members and 1,500 in other developers lost.

“But the government has not come up with support,” he said, adding that the increase in advance income tax and the 15 percent value added tax had increased the cost of doing business.

Humayun Rashid, acting president of the Dhaka Chamber of Commerce and Industry, said his company Energypac Ltd's factories outside Dhaka had to pay the same amount for electricity that industries inside Dhaka pay.

“This is discrimination,” he said.

Humayun Kabir, chief executive of Beximco Group's jute and ceramics divisions, lambasted the government for increasing tax at source for all export industries irrespective of them making a profit or losing money.

“All these industries have to pay the same tax [1.5 percent]. Is it fair?” said Kabir. But the major change in the proposal is that this tax at source would be counted as final settlement and minimum tax without considering a company's profits or losses.

Also, this tax measure would discourage diversification of the export basket, he said.

Kabir, also a certified accountant, criticised the government for imposing surcharge on wealth tax, which he said would discourage capital formation and private investment as well.

“Effective tax rate for a corporate house stands at over 70 percent in Bangladesh. Tax structure becomes anti-investment,” he said.

Mohammed Shoheler Rahman Chowdhury, manager of the Bangladesh Economic Zones Authority, said 100 economic zones would be set up in the next 15 years to attract local and foreign investment as well as to create jobs.

“We want to be a part of the global value chain especially by entering the East Asian value chain first,” he said.

Anis A Khan, chairman of the Association of Bankers, Bangladesh, called for merger and acquisitions of banks in order to solidify their foundation, as the capital base of most banks was weak.

“If they can merge they will be able to do businesses, give large loans and help private investment,” said the managing director of Mutual Trust Bank.

Luthful Bari, director for operations of Meghna Group that manufactures bicycles, said export of bicycle had been growing at 15 percent over the last several years.

“Now 80 percent parts of a bicycle are produced locally. Bangladesh can be a hub of bicycles,” he said.

He said Bangladesh could be a hub of bicycle exports, if the government extends facilities, such as reducing corporate tax to 10 percent from 35.

Mahfuz Anam, editor of The Daily Star, and Brig Gen Shahedul Anam Khan (retd), associate editor of the newspaper, also spoke on the occasion.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments