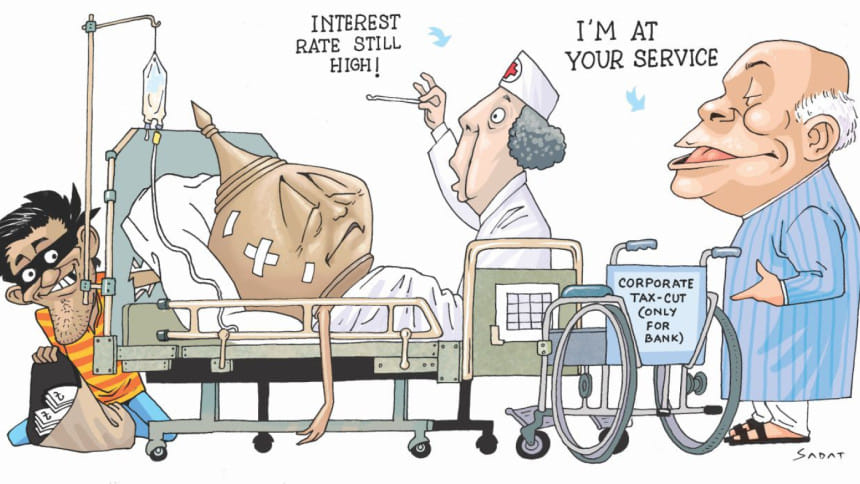

Bowing to banks

The government is continuing to treat banks with kid gloves instead of going tough on them for the rampant financial irregularities and continued poor judgement.

The latest in the line of mercies came yesterday in the form of a slash in corporate tax for banks and financial institutions by 2.5 percent in the incoming year.

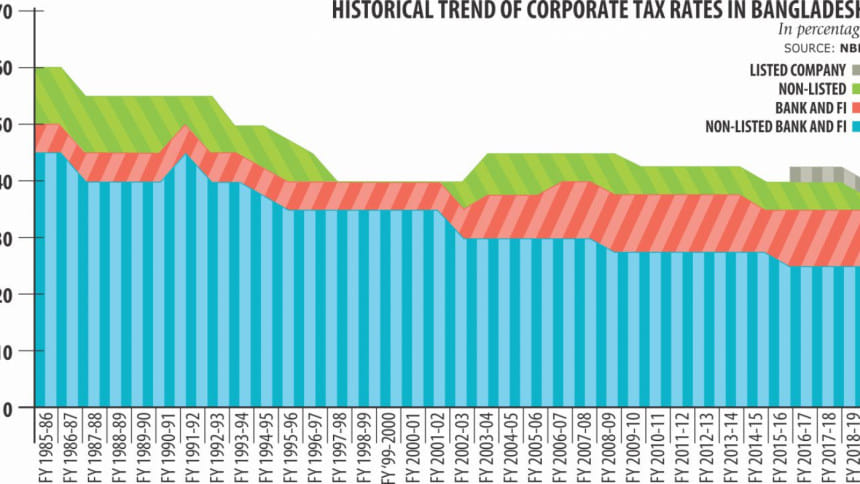

In fiscal 2018-19, the corporate tax rate for non-publicly traded banks, insurance and financial institutions would be 40 percent and for publicly traded ones 37.5 percent.

The move will cost the government about Tk 1,000 crore in lost revenues, said a high official in the National Board of Revenue.

The corporate tax rates for the other sectors have been kept unchanged by Finance Minister AMA Muhith.

The reason for the special treatment for the financial sector is that its corporate tax rates are higher than the other sectors, Muhith said in his budget speech yesterday.

"We will lose a certain amount of tax revenue from such rationalisation of corporate tax rate but this will give a positive signal to our investors," he added.

The economic rationale underlying the corporate income tax rate cut for banks while leaving all other rates unchanged is not at all clear, said Zahid Hussain, lead economist of the World Bank's Dhaka office.

The whole idea behind corporate tax cuts is to make the investment climate in Bangladesh globally competitive, but this latest round of cut will not move the needle.

The rate of corporate tax in Bangladesh is higher than the Asian average of 21 percent and the global average of 24 percent, according to KPMG, a global network of professional firms providing audit, tax and advisory services.

Bangladesh's tax rates for companies are also higher than that of Vietnam, Thailand, Malaysia, China, Indonesia, Sri Lanka and Pakistan. Vietnam and Thailand charge 20 percent tax for companies. It is 24 percent in Malaysia and 25 percent in Indonesia.

A rate cut to a sector that is already saturated and looks unlikely to attract foreign direct investment seems ill thought-out.

Reduction in corporate tax rate will not matter for banks, which are mired in excessive non-performing loans. "They will hardly be making profits after provisioning for loan losses," Hussain added.

Debapriya Bhattacharya, a distinguished fellow of the Centre for Policy Dialogue, echoed the same.

"We don't see any logical economic and administrative reason for the cut because this benefit will not affect the interest rate."

It will only increase the profit for owners; no depositor or borrower will benefit from the tax cut.

"When there is chaos in the banking sector, there is no logic to granting the tax cut benefit at all. This is completely immoral and useless," he added.

Some unethical facilities have already been extended to banks earlier this year, said Khondkar Ibrahim Khaled, a former deputy governor of the central bank.

"And now comes this. It will set a very bad precedent."

The corporate tax rate cut will neither make banks lower the interest rate on lending nor will fresh investment flow into the sector. "Only the bank owners will be happy," Khaled added.

In the past two and a half months, using the excuse of solving the liquidity crisis that the banks found themselves in then, Muhith took four major steps whose true beneficiaries were just the bank owners.

The Bangladesh Bank slashed the repo rate by 75 basis points to 6 percent, making funds cheaper for banks. Repo is a short-term fund that the central bank gives to banks in case of cash shortfall.

It also slashed the cash reserve ratio by one percentage point to 5.5 percent and pushed back the deadline for banks to lower their loans-deposit ceiling to March 31 next year from June 30.

Economists had said then that the moves will make funds cheaper for banks. And the excess money supply will increase default loans further as many banks frequently breach the rules and regulations while sanctioning loans.

The finance ministry also issued a notice clearing the way for private banks to keep 50 percent of the government funds.

Previously, private banks could hold 20 percent of the funds for annual development programme and 25 percent from the revenue budget.

At the time, Muhith had said the steps would bring down the interest rate to single digit in one month. The banks' lending rate is yet to come down.

The reduction of corporate tax for banks should have been on the condition of bringing down the lending rate to single digit, said AB Mirza Azizul Islam, a former advisor to a caretaker government.

Instead of pocketing the extra cash that the corporate tax cut would bring, the bank owners should reinvest the sums for the banks' betterment, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

In another puzzling move, the finance minister completely overlooked the toxic situation prevailing in the country's banking sector.

His deafening silence has surprised many. "I am surprised to see he has not mentioned anything on the ongoing crisis in the banking sector," Islam said.

In recent years, the banking sector has been struggling to survive from the rising default loans, capital shortfall and financial scams that mainly emerged from a lack of corporate governance, corruption with loan disbursement and growing influence of directors of private banks into the affairs of the bank.

In addition to the long-lasting problems, some banks are now facing liquidity crisis, which has fuelled interest rates on loans by 2 to 4 percentage points.

Furthermore, the intrinsically faulty state banks continued to be indulged: the finance minister has stuck to recapitalising the banks with hard-earned taxpayers' money.

"It will be the same as this year's budget," Muhith told journalists at his secretariat office during an informal talk on the budget on Tuesday.

About Tk 2,000 crore has been earmarked for state bank's recapitalisation in fiscal 2017-18's budget.

In his budget speech yesterday, Muhith said customers' confidence on the scam-hit Farmers Bank has been restored after it management and board were reconstituted.

But the central bank data showed the problem-ridden bank is yet to pay back many depositors' money and many of them lodged complaints with the regulator.

Salehuddin Ahmed, a former governor of the central bank, said it is not possible to implement the budget properly if the banking sector fails to operate effectively.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments