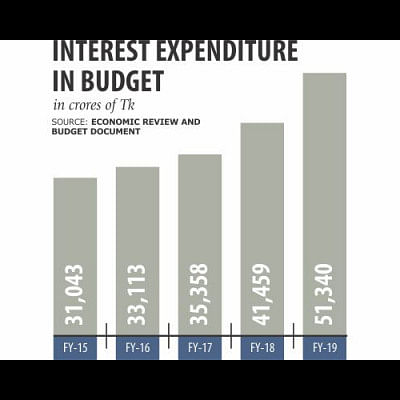

Interest burden getting heavier

Interest payments get the fourth highest allocation, which is also higher than the combined allocation for health, social security and welfare in the proposed budget for 2018-19.

For the upcoming fiscal year, Finance Minister AMA Muhith has earmarked Tk 51,340 crore for interest payments, which is 35 percent higher than the outgoing year's revised allocation of Tk 37,920 crore.

Probably, the 85-year-old minister has forgotten the proverb "Cut your coat according to your cloth" and decided to spend more, anyhow, no matter if it is by borrowing from savings tools that cost up to 11.5 percent interest.

Of the total interest payments, Tk 48,377 crore will be paid for domestic borrowing and a meagre Tk 2,963 crore for foreign loans, which come with a maximum of 2 percent interest.

"The government could spend more for social welfare if it can reduce expenditure on interest payments," said AB Mirza Azizul Islam, a senior economist and a former finance adviser to a caretaker government.

He said the government has failed to reduce the interest rate on saving instruments due to political environment and pressure from powerful quarters.

For instance, the government set a target to borrow Tk 30,150 crore from savings tools in the outgoing fiscal year, but the target was achieved in six months.

Later the target has been reset at Tk 44,000 crore and the government borrowed Tk 40,063 crore in the first 10 months of the outgoing fiscal year.

However, the government has cut the borrowing target from savings instruments for the coming year -- Tk 26,197 crore.

"The government should strictly stick to its target. Otherwise, fiscal management would be in trouble," the former finance adviser said.

The rate of interest on savings certificates is about 12 percent whereas deposits in the banking sector offer 6 to 7 percent interest.

After the Farmers Bank's scam and its failure to return depositors' money, people are now tilting towards the savings certificates, which yield more and ensure security to them.

On Monday, at a pre-budget talk, Finance Minister AMA Muhith said the rate of interest on savings instruments will be adjusted with the other rates in the market.

The borrowing target from the banking sector is set at Tk 42,029 crore in the proposed budget which is 49 percent higher than Tk 28,203 crore set for the outgoing year.

The government did not borrow a single penny from the banking system in the first 10 months of the outgoing year; rather, it repaid Tk 25,705 crore.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments