Banks may face bigger crisis

The government decision to slash the cash reserve ratio and allow state-run enterprises to keep half their funds with private banks may lead to a bigger crisis in the already under-pressure banking sector, said a think-tank yesterday.

The banking sector is now characterised by weak regulation and monitoring and no visible punishment for irregularities under political patronage, said the South Asian Network on Economic Modeling (SANEM), a Dhaka-based research organisation.

“Also, the lack of independence of the Bangladesh Bank intensified the problem.”

The organisation made the remarks in its April quarterly review of Bangladesh economy unveiled at a programme at the Westin hotel in the capital. Prof Selim Raihan, executive director of SANEM, made a presentation on the review.

It estimated that the current level of inefficiency in the banking sector was leading to a loss in GDP by about 1 percent annually, equivalent to about Tk 10,000 crore in 2016-17.

On Tuesday, the BB lowered the cash reserve ratio by one percentage point to 5.5 percent to help cash-strapped banks ride out the current liquidity crunch.

And on Monday it cleared the way for keeping 50 percent of the government funds with private banks, up from 25 percent.

Both the decisions drew flak from experts.

The crisis in the banking sector is a culmination of prolonged structural problems, said the review.

There are exceedingly high non-performing loans, now amounting to more than Tk 80,000 crore. There have been frequent scams in the sector.

“We are not sure whether there are some [scams] more to come. This has created a lack of depositors' confidence in the banking sector,” it said.

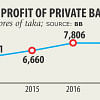

In recent times, the review said, excessive lending by some private banks has pushed up the advance-deposit ratio more than 90 percent for these banks.

“Such excessive lending happened in the context of a sluggish private sector investment growth. There is a concern that a large part of this lending is misused.”

Also, cutting down interest rates on national savings certificates is not a valid proposition, said the research organisation.

It further said that to meet the development challenges, the country needs to drastically improve its performance in terms of revenue mobilisation through increased tax generation effort.

In the context of expenditure, both implementation rate and the quality of spending have to be increased substantially, it said.

The organisation said Bangladesh has a poor record in terms of foreign direct investment, a high concentration of exports, weak competitiveness, and poor physical and social infrastructures.

The country needs to attract a large volume of FDI, noticeably diversify the export baskets, enhance competitiveness, and significantly improve physical and social infrastructures, it said.

“Improvement in the quality of economic and political institutions and quality service delivery by the public institutions are very crucial in sustaining the development process.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments