Basic Bank Scams: HC summons investigators

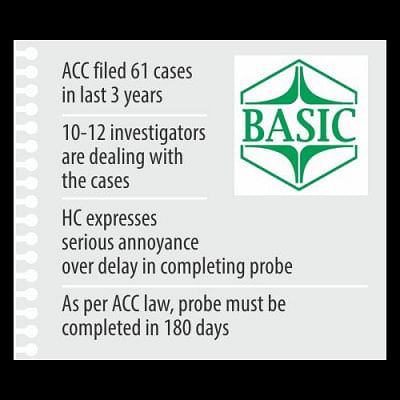

The High Court yesterday summoned all the investigation officers of the 61 corruption cases filed over the BASIC Bank loan scams, seeking explanations for the delay in completing investigations and information about their latest status.

“Ten to twelve investigation officers are conducting probes in the 61 cases filed by the Anti-Corruption Commission between 2015 and last year,” Pranab Kumar Bhattacharya, public relations officer of the commission, told this newspaper.

He could not give the exact number of IOs in the cases.

Yesterday, the HC ordered the ACC to ensure that the IOs appear before it by 10:30am on May 30 with all relevant documents.

The bench of Justice M Enayetur Rahim and Justice Shahidul Karim passed the order while hearing 15 petitions filed by Fazlur Sobhan, former deputy managing director of BASIC Bank, seeking bail in 15 cases.

During the proceedings, the judges found that the investigations of the cases were not completed in due time.

According to the ACC law, the probe of any corruption case has to be completed by an investigator in 180 days from the date of receiving the commission's order for probe, ACC lawyer Khurshid Alam Khan told this correspondent.

Sobhan, who is now in prison, has been accused in 48 cases. He got bail in most of those.

The HC bench yesterday expressed great annoyance over the long delay in completing the investigation of the cases against Sobhan, saying they had earlier made several observations and issued directives for completing investigations of the cases, but probe reports were not submitted.

Justice Enayetur Rahim, the presiding judge of the bench, asked the ACC lawyers why the commission is keeping the accused detained when it is unable to complete investigations and submit charge sheets in the cases.

ACC lawyer Syed Mamun Mahbub told the HC that the investigations of the cases are going on in full swing and probe reports will be submitted to the trial courts concerned very soon.

The IOs of the commission are very sincere in probing the cases, he said, adding that the ACC sometimes faces serious limitations due to socio-economic and political situation of the country.

The HC judges then issued the summons.

Mamun told The Daily Star that he already conveyed the HC order to the commission.

On November 8 last year, the same HC bench severely rebuked the ACC for foot dragging and showing weaknesses in investigating cases over the BASIC Bank loan scams.

The commission lacks neutrality, transparency and competence in dealing with the cases, the bench had said, adding that the ACC is applying the “pick and choose” policy as "it keeps detaining and releasing people" in connection with the cases, observed the court.

The bench made the remark while hearing three bail petitions filed by Md Selim, former general manager of Internal Credit Division of BASIC Bank.

In the pleas, Selim sought bail in three cases filed in 2015 for misappropriation of money and irregularities in allocating bank loans.

That day, Justice Enayetur told ACC lawyer Khurshid that the commission was yet to arrest "any of the beneficiaries of the loan scams".

The commission has kept the investigation of the cases pending for more than two years and therefore, the culprits have been given the scope to get away, the judge said, adding that "the offences relating to the scam are very clear and not like those of clueless murders".

"Thousands of crores of taka have disappeared. Does the commission have no responsibility over the matter? The ACC should have directed the IO to arrest all the accused."

In reply, Khurshid said a total of 48 cases have been filed in connection with the scams and charge sheets in five cases are awaiting the commission's approval.

The ACC would finish the investigation in those cases soon, he said.

The HC bench later granted bail to Selim in the three cases.

According to a Bangladesh Bank enquiry, around Tk 4,500 crore was siphoned out of BASIC Bank between 2009 and 2013 when Abdul Hye Bacchu chaired the bank's board.

Kazi Faqurul Islam, the then managing director of the bank, was removed from his post on May 25, 2014 over his alleged involvement in the financial scams.

Bacchu resigned as chairman on July 5 that year amid growing allegations that he misappropriated funds by approving shady loans of several thousand crores of taka.

On July 14 the same year, the BB sent a report on the BASIC Bank scam to the ACC, detailing how money was embezzled from that bank through fake companies and dubious accounts.

After primary investigation, the ACC filed around two dozen cases in September 2015 against more than 20 officials of the bank and two dozen borrowing firms.

The financial scams resulted in huge amount of defaulted loans and eroded the capital base of the bank in the last several years.

According to the BB data, defaulted loans in the bank increased to Tk 7,390 crore as of June last year from Tk 706 crore in December 2012.

Capital shortfall in the bank stood at Tk 2,210 crore at end of June last year, indicating that the financial health of the organisation deteriorated significantly.

Finance Minister AMA Muhith on several times in parliament expressed anger as he could not take steps against all involved in the scams in BASIC Bank and state-run Sonali Bank.

On February 24, 2016, he told parliament that 27 bank officials, 56 organisations and eight surveyor firms were involved in the BASIC Bank loan scams.

He also said external audit firms appointed by the BB and BASIC Bank detected involvement of Bacchu in granting irregular loans.

The BB found that Bacchu illegally influenced all the activities of the bank, leaving the once-sound institution in a grave state.

In September 2015, the anti-graft watchdog filed 18 cases against a number of bankers and borrowers linked with the scams.

But Bacchu, who is believed to be at the centre of the swindle, was not accused in any of the cases.

On July 26 last year, the HC directed the ACC to probe the alleged involvement of Bacchu and board members of the bank in the incident.

Bacchu has already skipped ACC quizzing thrice.

Saying he was suffering from illness, he avoided appearing before the commission on May 15 this year, and sought two months' time.

The ACC granted him 15 days, and warned that if he doesn't appear before it on May 30, legal action will be taken against him.

Earlier on May 7, Bacchu skipped ACC grilling and sought two months' time on the same ground.

He had also avoided appearing before the ACC on December 17 last year on health grounds, with a prayer for a month's time. The commission gave him a couple of weeks.

The ACC had earlier questioned Bacchu on four occasions -- the first was on December 4 last year.

He asked for a month's time on December 17 last year but the commission refused.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments