BASIC 'plunderers' go happy

In the four years between 2009 and 2013, Tk 4,500 crore was swindled out of BASIC, once a healthy public bank. But what followed was more shocking than the country's biggest loan scam itself.

It was a glaring example of how the protectors of a bank turned predators. Multiple investigations found that Sheikh Abdul Hye Bacchu, chairman of the bank at the time, literally plundered the bank with the help of other board of directors.

In 2015, the Anti-Corruption Commission filed 56 cases in connection with the scam, but ironically neither Bacchu nor any of the board members were named as accused. The state appeared too weak to put high profile offenders in the dock.

But as many as five bank officials, a couple of whom only followed orders and had little to do with the decisions, were hauled off to jail.

| “We have to cover our faces in shame.” The HC said last week about ACC's failure to complete the probes |

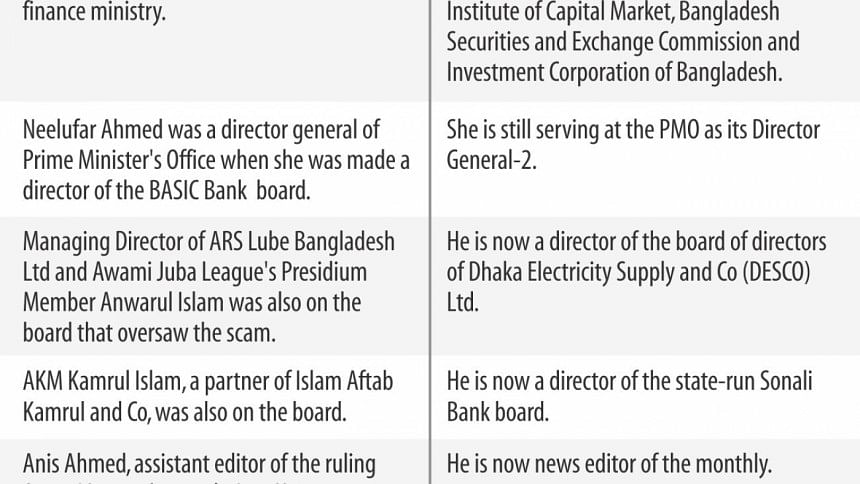

Even as the bank sank, the Bacchu gang prevailed. When the scam was underway with hundreds of crores of depositors' money being sucked out the bank, he bought 11 deep-sea fishing trawlers with Tk 150 crore. In the meantime, most of his mates, the board of directors, have been promoted and they now hold higher positions in different ministries and other government bodies.

The ACC had arrested at least 14 people, including eight businessmen, one surveyor and five high-ups of the bank. All but the bank officials managed to secure bail from the High Court.

Disappointed at the sluggish probe and ACC's failure to catch the big fish, the HC during a hearing last week said, “We have to cover our faces in shame.”

“We have to grant the accused bail due to the long delay in completing probe,” said Justice M Enayetur Rahim, the presiding judge of the HC bench now dealing with a number of bail petitions in the loan scam cases.

Earlier in July last year, the HC ordered the ACC to look into the alleged involvement of Bacchu and other directors in the scam.

In line with the directive, Bacchu has since been quizzed five times. The Commission also questioned all the directors of the then board.

However, the ACC seems to have found nothing to charge them although multiple investigation reports suggest otherwise.

A BASIC Bank official held the Bacchu-led board fully responsible for the scam.

Of the Tk 4,500 crore swindled out of the bank, more than 95 percent was sanctioned by the board. In each case, the loan amount was more than Tk 1.5 crore, a sum the management cannot approve without the board's approval, he said.

“The management had to place those before the board for approval,” the official told The Daily Star.

Several investigations by the central bank also unearthed the board's direct involvement in the scandal which subsequently took a heavy toll on the bank's financial health, he added, requesting anonymity.

One such probe report, sent to the ACC in 2014, detailed how borrowers embezzled money from the state lender through fake companies and suspicious accounts.

The 47-page report, which includes a list of borrowers, gives almost a minute-detail account of how the loans were approved and then withdrawn in clear violations of the rules.

The report said BASIC Bank's board and its credit committee at the headquarters ignored the negative observations from the bank's branches on a number of loan proposals, and approved those without following due diligence.

“We're examining the documents. The directors will be quizzed again,” said an ACC investigator.

Talking to The Daily Star, ACC Director Syed Iqbal Hossain spoke of the challenges of quizzing the directors, most of whom hold top positions in government offices.

For example, when the investigators wanted to quiz Shuvashish, a former member of the board and now the commerce secretary, he sought time on several occasions. He was later quizzed in his ministry office, said the ACC director.

However, the HC is clearly irked at the delay in completing the probe and has little interest to buy such excuses.

“From your [ACC officials] indifference and long delay in completing the probes it seems that you have connivance with the accused,” the court said last week.

On that day, the HC granted bail to former deputy managing director of the bank Fazlus Sobhan. He however remains in jail as he faces charges in other cases related to the scam.

The Daily Star could not reach Bacchu for his comment.

He was last quizzed by the ACC on May 30. On that day, he declined to comment on the matter when journalists asked him about his alleged involvement.

This newspaper also could not reach Shuvashish by phone. On Wednesday, his personal assistant said he was outside the country. Last night, his phone was found switched off.

Contacted, personal assistants to Syam Sunder Sikder, Neelufar Ahmed and Quamrun Naher, all of whom were on the bank board, said they were in a meeting and was unavailable for comment.

Former managing director of the bank Kazi Fakhrul Islam has been in hiding since his dismissal along with nine senior bank officials in May 2014.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments