Budget aims to please all

With the national elections only months away, Finance Minister AMA Muhith places the budget tomorrow for a record 10th consecutive time, aiming to please people from all segments of society.

The size of the budget to be placed in parliament at 12:30pm will be Tk 464,500 crore, 16 percent bigger than the current one.

The government will make some allocations for people-oriented programmes in the next budget, keeping in mind the parliamentary polls slated for December this year.

Muhith, however, does not like the term "election-time budget".

"It's a useless comment. Before placing the budget, every government remains careful about its electorates. Every budget is placed to make all satisfied," he told reporters on Monday.

To meet the expenditures, he will set an ambitious revenue target without any additional tax measures.

"The good news is there is a limited increase in tax rates. That's the happiest thing for people... that's all," Muhith said.

According to finance ministry officials, there will be no increase in income tax rates so that taxpayers don't feel the pinch in the months before the polls. In fact, some tax rates are likely to be reduced.

In the next fiscal year, the government is likely to set revenue target of Tk 339,200 crore.

Of the amount, the National Board of Revenue will collect Tk 296,201 crore, which is around 32 percent higher than the revised collection target in this fiscal year.

This means around 90 percent of the total revenue will be collected by the NBR. But it's unclear how the ambitious revenue target will be achieved as the NBR's revenue growth rate was 18 percent in the first 10 months of FY 2017-18.

Muhith thinks revenue collection will increase as the process of collecting tax has become easier and the revenue administration is more efficient now. Besides, harassment of taxpayers has been reduced significantly.

In terms of income tax, people don't need to worry as there will be no increase in tax rates, said finance ministry officials.

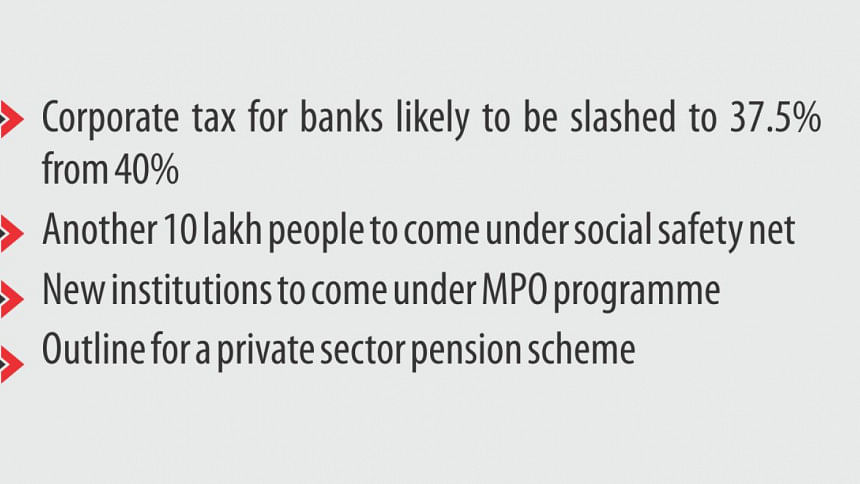

Corporate tax rates, on the other hand, will be slashed.

The corporate tax rate for banks is likely to be reduced to 37.5 percent from 40 percent.

NBR officials say this will encourage banks to bring down their lending rates, and eventually have a positive impact on private investment.

In case of Value Added Tax (VAT) on goods and services, there will be five slabs, instead of existing nine, but the VAT rates will not be increased, said the officials.

On the expenditure side, a number of projects and programmes will be taken up, eying the national elections.

Take social safety net for example.

The government plans to bring more people under the programme in the next budget without raising the allowance per person in most of the schemes.

The number of beneficiaries, who get allowances and food under the programme, will go up by around 10 lakh to 96 lakh in fiscal 2018-19.

In this fiscal year, the government allocated Tk 54,206 crore for the programme, which accounts for 13.54 percent of the total outlay. The amount will cross Tk 65,000 crore in the next budget, said the officials.

At a recent meeting on social safety net, a minister demanded that the number of beneficiaries be increased as the national election is approaching.

Another major focus of the next budget will be on speeding up implementation of nine mega infrastructure projects, including Rooppur Nuclear Power Plant, Padma Bridge, Padma Rail Link and Metro Rail.

For the projects, Tk 32,555 crore has been set aside, which is around 19 percent of the development budget.

Besides, some other mega projects such as Dhaka Underground Metro Rail, circular railway and the second Padma Bridge have been included in the Annual Development Programme (ADP).

The next budget may bring smiles to several thousand teachers of private secondary educational institutions working without any pay, as the government is likely to allocate Tk 500 crore to bring around 1,000 institutions under the Monthly Pay Order (MPO) scheme.

In December last year and January this year, teachers and employees of non-government educational institutions took to the streets, demanding resumption of the MPO scheme that remains suspended for seven years.

A Tk 7,595-crore infrastructure project is also in the pipeline under which 300 lawmakers will get allocations for constructing buildings for 2,000 MPO-listed madrasas in their constituencies. The institutions will be selected by the MPs.

Under another big project, the lawmakers will get allocations of Tk 10,649 crore to construct and extend 10 school buildings in each constituency.

In the upcoming budget, Muhith will give an outline for the universal pension system to be introduced primarily in the private sector.

Under the scheme, private sector employees will make a voluntary contribution to the pension fund. If an employee resigns from an organisation and joins another, his contribution will be transferred.

To materialise the idea, several subsidiary institutions will be established. Those include pension enrolment office, pension trust, central record-keeping agency, trustee bank, pension fund managers and annuity service providers.

In the next fiscal year, the government will also provide housing loans to around 14 lakh government employees at low interest rates.

Loans between Tk 75 lakh and Tk 20 lakh will be disbursed in three categories depending on location of the property.

The interest rate will be 10 percent, of which 5 percent must be paid by the loan applicants and the rest will come from government subsidy. The tenure for repaying the loans will be 20 years.

The government will also implement a Tk 60-crore special project to publicise its development work through screening of films, rallies and various programmes across the country.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments