Bullish Stockmarket: It's time to be cautious

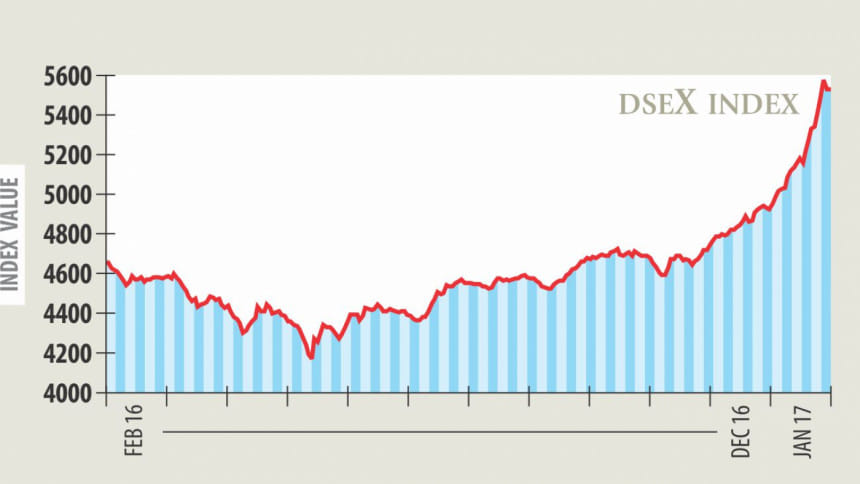

The stockmarket is getting back its rhythm missing for almost six years since the inevitable crash in early 2011, which left thousands of investors penniless. And the latest bullish run continuing for months has evoked the fear of bubble waiting to burst.

The premier bourse's key index reached 5,500-point mark with the turnover crossing Tk 2,000 crore for the first time in more than six years. The index jumped around 9 percent last year.

The escalation of turnover and index -- the two most important indicators of the market -- in general suggests that the investors' confidence in the market is coming back. But fears run deep among investors, as the stockmarket witnessed debacles twice -- first in 1996 and then in early 2011.

However, it is now being forecast by many, including government high-ups, that the market, which passed a decent year in 2016, will go from strength to strength this year, given the promising market fundamentals and increasing participation of investors.

On different occasions, the finance minister and the chairman of the regulator said the stockmarket will perform better in the coming days.

Their comments indicate that the government is giving importance to the market.

Faruq Ahmad Siddiqi, former chairman of Bangladesh Securities and Exchange Commission, said the index and the turnover have been gradually increasing over the last two-three months. It's a good sign for the market, which was suffering for more than five years since the price debacle.

“It seems that the investors' confidence is growing. It is quite normal, and still there is no sign of abnormality,” he told The Daily Star.

The overall market PE (price-earnings) ratio, which is around 18, showed that the market can perform better from this stage.

The PE ratio is an important indicator to better understand what happens in the market after a large gain or decline. It is also one of the best gauges to know how expensive or cheap the overall stockmarket is at a certain moment.

But Siddiqi was worried about the sharp rise in the market over the last two or three weeks without correction or profit taking.

He also pointed out that the tendency of many investors to bet on weak fundamental shares for quick profit would also be an area of concern.

Dhaka Stock Exchange, however, assured yesterday that the market is behaving quite normally.

“There is nothing to be worried,” Rakibur Rahman, a director of the premier bourse, said at a press briefing on the current market situation.

As an upward trend was continuing in the market for the last few weeks, investors were switching from one stock to another, generating the record turnover, he said, replying to a query.

The index is increasing, as the market movers such as banking, fuel and power stocks caught the investors' attention. “The share prices are lucrative for investment,” said Rakibur, also managing director of Midway Securities, a stockbroker.

He also called for expediting the process of offloading of shares by government, which has stakes in many state-owned and multinational companies.

DSE Managing Director KAM Majedur Rahman said it is not right to judge the market volatility or abnormality by measuring the index or turnover. “We have to see whether the share prices become overvalued.”

The interest rate is declining, while foreign investors are injecting funds into the market. “These are also the reasons behind the rising trend,” he said.

“Our focus should be on how we can contribute to the economy through the capital market,” added Majedur.

The market, however, closed almost flat yesterday, with the DSEX, the benchmark index of the DSE, increasing by only 0.56 points to finish at 5,534. The turnover stood at Tk 1,408 crore, down from 1,989 crore the previous day.

Losers, however, beat gainers as 205 declined and 93 advanced, while 30 finished unchanged.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments