Contrasting price rise

It sounds funny but true. Prices of some food items essential for survival have risen in real terms more than that of tobacco, which kills people.

For this contrasting price increase, anti-tobacco campaigners blame the faulty tax structure for tobacco and also strong lobbies for low tax.

Between 2001 and 2013, price of a pack of cigarette saw an average rise of 140 percent. During the same period, prices of hen eggs and milk rose between 150 and 200 percent, according to an analysis by the Campaign for Tobacco-Free Kids (CTFK).

“As a result, people have better affordability to buy tobacco. This in turn led to a rise in tobacco cultivation and consumption,” said ABM Zubair, executive director of PROGGA, an anti-tobacco campaigner.

In 2014, farmers cultivated tobacco in 108,000 hectares of land, up from 49,000 hectares in 2010, agriculture department data shows.

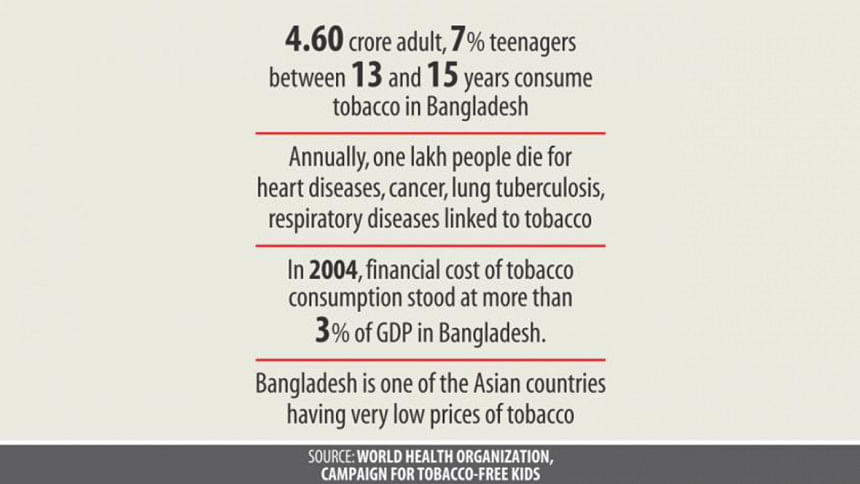

On the other hand, the number of tobacco consumers, which was 37 percent of adult population in 2004, went up to 43 percent in 2009, according to the Global Adult Tobacco Survey 2009.

Currently, 3.5 million people die globally every year from tobacco-related diseases. By 2025, it will rise to 10 million, said the World Health Organisation in a report last year.

A majority of these deaths will occur in the Third World countries and Eastern Europe, as the West sees a drop in tobacco consumption.

Bangladesh is one of the developing countries having high prevalence of tobacco use. It has a commitment to make the country tobacco-free by 2040.

Realities are different, however.

The CTFK's comparative analysis of price rises of three items -- eggs, milk and an average brand cigarette 'Cegare' -- early this year found that the cigarette packet that cost Tk 10 in 2001-02 went up to Tk 24 in 2012-13, an 140 percent increase.

On the other hand, the price of four pieces of hen eggs that was less than Tk 12 in 2001-02 went up to Tk 37, a rise of over 200 percent. During the same period, price of milk rose by some 150 percent.

Price of fine rice rose from Tk 24 a kg in 2001-02 to Tk 42 in 2012-13, which is a 75 percent increase.

In another analysis, the CTFK found the price of 5,000 tobacco sticks (bidi) in 2008-09 was 1.82 percent of per capita GDP, which went down to 1.34 percent in 2013-14.

“Apparently, we see a rise in tobacco taxes and prices in the budget, but it is not commensurate with people's income rise and also inflation,” said Shariful Alam, lead consultant of the CTFK in Bangladesh.

Ideally, tobacco price should be much higher than that of daily essentials to discourage tobacco consumption, but just the opposite is happening in Bangladesh, he told The Daily Star.

Dr Syed Mahfuzul Huq, national professional official of the WHO in Bangladesh, said price increase through taxation has been globally proved as the most effective tool to reduce tobacco use.

However, Bangladesh has no taxation policy to achieve the goal of making the country tobacco-free by 2040, he said.

ABM Zubair of PROGGA said a strong lobby from tobacco industry was a major factor behind low taxation, but complicated tax structure for tobacco is also to blame.

There are four price slabs for four types of tobacco products -- low, medium, high and premium. For each slab, there are different prices and taxes.

“Such a price and tax structure creates scopes for tobacco companies to dodge taxes. They can present medium category tobacco product as low category and pay low taxes,” Zubair added.

He suggested that the NBR simplify the tax structure and impose 70 percent of excise tax equally on all tobacco products.

By increasing tax from 32 percent in 1993 to 52 percent in 2009 on retail price of tobacco, South Africa managed to cut tobacco consumption by 50 percent and increase revenue by 9 percent, he said.

Contacted, National Board of Revenue Chairman Nojibur Rahman said the government was aware of the harmful effects of tobacco and there would be a “realistic declaration” in this regard in the upcoming budget.

“The tax structure [for tobacco] will be rigorous,” he told this correspondent, without elaborating.

Mahfuzul Huq of the WHO said enforcement of Bangladesh's tobacco control law was weak, another reason why tobacco cultivation and consumption is rising.

The WHO suggests stopping illegal trade of tobacco, using children in sales and arranging alternative economic activities for those who are presently engaged in tobacco cultivation and manufacturing.

“Bangladesh needs a roadmap to implement these interventions,” he said.

Prof Abdul Malik, founder of the National Heart Foundation, said besides increasing tobacco price, massive awareness and stringent law enforcement were important factors in developed countries for low tobacco consumption.

“People, mainly women in our country, consume gul-zarda [non-smoke tobacco]. They don't know its consequences. We need to work on this,” he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments