BAD LOANS TWICE AS LARGE

The actual size of bad loans is more than double the officially recognised figure, according to a recent report of the International Monetary Fund -- a damning evidence of the fragile state of Bangladesh’s banking sector.

“While reported default loans do not seem exorbitant, the true situation of problem assets seems much more serious,” said the Washington-based multilateral lender in its Financial Sector Stability Review on Bangladesh.

The report was prepared at the request of the government. A specialised mission of the IMF’s Monetary and Capital Markets department visited Bangladesh twice in the last six months for a diagnostic review of Bangladesh’s banking sector and came up with 43 suggestions for reforms.

The 69-page report was handed over to the finance ministry and the Bangladesh Bank earlier this month, said a central bank official with knowledge of the matter.

Finance Minister AHM Mustafa Kamal will sit with the IMF on the sidelines of the multilateral lender’s annual meetings, due to be held in Washington from October 14 to 20, to discuss the contents of the report and decide on the next plan of action.

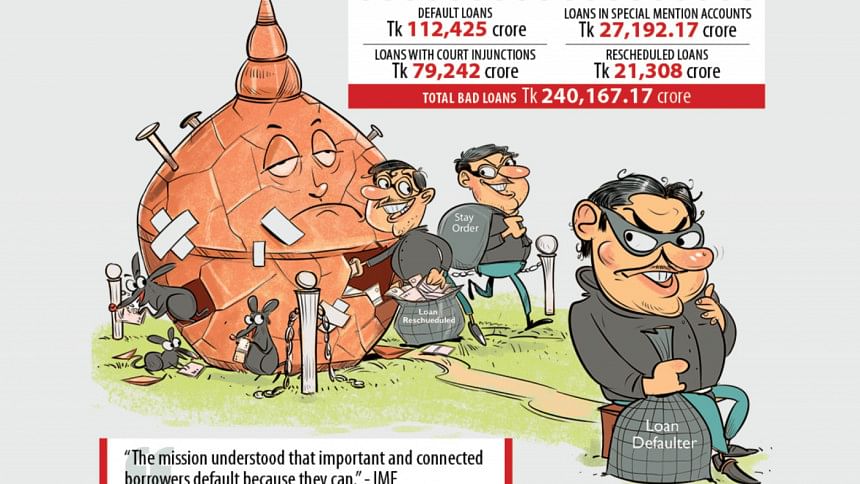

At the end of June, the banking sector’s total defaulted loans stood at Tk 112,425 crore, which is 11.69 percent of the total outstanding loans, according to BB data.

But not all sources of problem assets are captured by the central bank’s definition of defaulted loans, the report said.

Some 675 large borrowers reported as defaulters by the Credit Information Bureau have obtained stay order from the High Court, as a result of which their defaulted loans no longer appear in the CIB database and banks can report them as non-classified.

There are Tk 79,242-crore such loans as of January 10, according to BB.

Those loans should be counted as problem assets as well as those in the Special Mention accounts, which is the precursor to classified category.

A large number of the Special Mention loans are rescheduled or restructured many times and in so doing mask the problem loans, it said.

As of June, loans amounting to Tk 27,192.17 crore are held in Special Mention accounts, according to BB data.

Then the central bank’s granting of no-objection certificates to banks to reschedule defaulted loans on a case-by-case basis means those are often categorised back as regular loans.

In the first six months of this year, loans of Tk 21,308 crore were rescheduled.

Subsequently, the computation of problem assets should also include stay orders, Special Mention loans, and the rescheduled loans, the report said.

Accordingly, the total amount of problem assets in Bangladesh’s banking sector as of June stands at Tk 240,167.17 crore, which is more than double the reported amount of defaulted loans.

And the IMF mission, which visited Bangladesh twice in the last six months for assessment, felt a large number of defaults were by choice and not due to any unexpected financial hardship.

“There seems to be a deep-seated pattern of non-payment of loans by certain segments of the population.”

Technical discussions with the authorities have led the mission to believe that certain well-connected and rich businessmen have understood clearly that “there is no palette to enforce repayment of their loans”, the report said.

“The mission understood that important and connected borrowers default because they can.”

Those borrowers entertain expectations, based on experience, that being late in meeting their commitments will put pressure on the lenders and allow them to renegotiate their obligations downward.

The general thrust of the current search for solutions to defaulted loans seems aimed at providing relief to delinquent borrowers, it said, while citing the rescheduling facilities extended to 11 large borrowers last month for the second time to further its point.

Back in 2015, the 11 businesses had committed to meet a number of conditions under a special package to get their loans amounting to Tk 15,180 crore restructured.

One of the conditions was that they would be marked as defaulters if they failed to pay two consecutive instalments. If that happened, the benefit would be cancelled and they would be barred from any loan rescheduling benefit in future.

But four years later the central bank walked back on the stance.

The move rewarded non-compliance with commitments and also undermined credit discipline throughout the economy, the IMF mission said.

“The BB had originally planned to allow banks to pursue these defaulters under the Bankruptcy Act of 1997, which indeed would have created a powerful deterrent and demonstrated that defaulting would have serious consequences.”

Subsequently, the IMF mission called for new and creative solutions to the defaulted loan issue, which can hold back the economy from reaching the next stage of growth.

“They should foster incentives for the delinquent borrowers to service their obligations rather than the opposite as is currently the case.”

The solutions should also be in line with the country’s strong macroeconomic performance and designed in such a way that a fair share of the wealth that the corporate sector is accumulating reaches the financial sector to enable it to further support growth while at the same time strengthening credit discipline, the mission said.

One option worth exploring could be a publicly supported mechanism to allow debt to equity swaps, unilaterally imposed on delinquent corporate borrowers and complemented by a facility for the banks to dispose of the equity holdings so acquired.

“Whatever the solution selected, delinquent borrowers in particular when they are rich and connected should not be provided with any relief, but on the contrary subjected to increasingly elevated rates, so that their liabilities toward the lenders rise at an accelerating pace with time.”

The IMF report also called for bringing down the single party exposure limit for banks to 25 percent of Tier 1 capital -- which is the primary funding source of banks and consists of shareholders’ equity and retained earnings -- from 35 percent of the total capital at present.

“Currently, default by only three large borrowers could render a bank insolvent.”

And the risks are actually higher due to the current exemptions from the limit for interbank and energy sector exposures and the preferential treatment of export financing -- all of which should be eliminated, it added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments