Deposits jump 20pc in a year

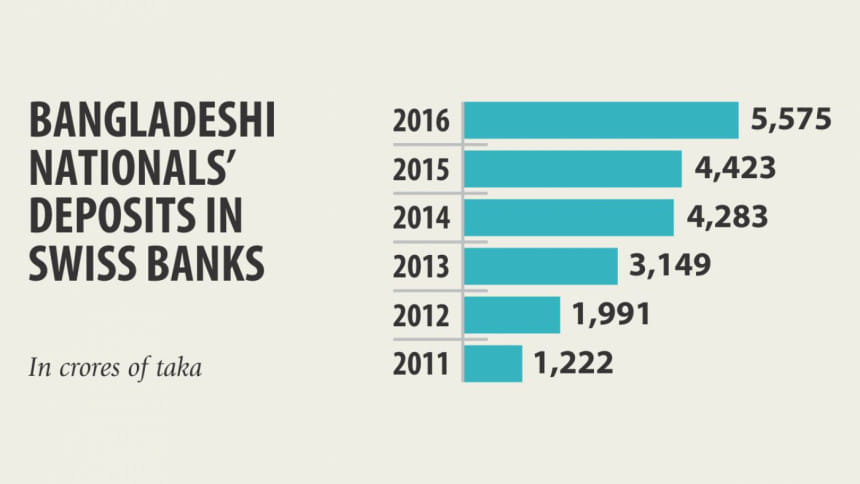

Bangladeshi nationals' deposits in Swiss banks rose 20.18 percent year-on-year in 2016 to 661.96 million Swiss francs or Tk 5,575 crore.

The Swiss National Bank (SNB) came up with the data in its annual report titled “Banks in Switzerland 2016”.

The amount was Tk 4,423 crore in 2015 and Tk 4,283 crore in 2014, show the data by the Swiss central bank.

The deposits went up in case of Bangladesh despite an ongoing global clampdown on the famed secrecy wall of Swiss banking system.

The report, however, does not shed light on the alleged black money held by Bangladeshis.

On the other hand, Indian nationals' deposits in Swiss banks dropped to 664 million francs last year from 1.2 billion francs in the pervious year.

In November 2016, India became one of a select group of countries to get benefits from an annual automatic exchange of banking information with Switzerland. This would ensure that financial information on bank accounts held by Indian citizens in Switzerland and vice-versa would be shared annually.

Pakistani nationals' deposits in Swiss banks also fell to 1.386 billion francs last year from 1.477 billion francs in the previous year.

Seeking anonymity, a Bangladesh Bank official said the Bangladeshi nationals' deposits in Swiss banks don't mean that the money flew there only from Bangladesh or those were illegally earned or laundered.

Bangladeshis living abroad also put their money in Swiss banks, noted the banker.

“Bangladesh will be able to bring back any money only if it can prove that the money was siphoned out of the country,” added the official.

Speaking at the Jatiya Sangsad on June 6, Finance Minister AMA Muhith said it was true that money was being laundered, but it was not possible to stop the outflow of money completely.

“What we can do is lessen the opportunity for siphoning off money. That means taking measures to stop generation of black money.”

The government is taking steps in this regard, which would be visible next month, the minister said.

Over the last several decades, Switzerland has provided wealthy families around the globe with a convenient and safe place to stash their money.

The country's political neutrality, stability and tradition of bank secrecy have kept their fortunes beyond the reach of national governments and even the most determined tax collectors.

Offshore accounts are not illegal, but many people use them to hide cash from the tax authorities, say experts.

Swiss banks have come under global pressure in recent times, as a number of countries, including India, are stepping up efforts to crack down on black money. A Europe-led clampdown has also been launched on tax evasion and corruption.

Experts, however, say data from the Global Financial Integrity (GFI), a Washington-based research organisation, gives a comprehensive picture about money laundered out of a country.

Bangladesh lost between $6 billion and $9 billion to illegal money outflows in 2014, according to a GFI report.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments