Fish revolution

With a 25-fold growth in farmed fish market over the last three decades, Bangladesh has been experiencing a quiet revolution in aquaculture.

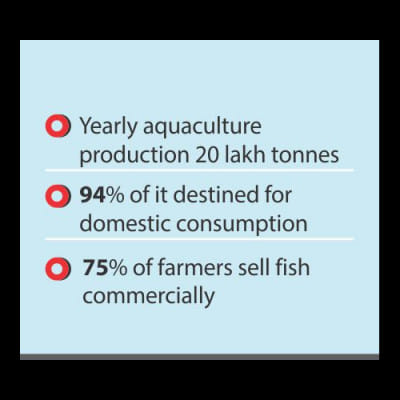

The country grows nearly 20 lakh tonnes of farmed fish a year, and an overwhelming 75 percent of the farmers sell fish to wholesalers.

In the mid-80s, 60 percent (75,000 tonnes) of the farmed fish output of 1.24 lakh tonnes was traded in markets. Now, more than 90 percent of aquaculture production of 20 lakh tonnes is sold commercially.

An international study on Bangladesh's growth in fish culture came up with the data, debunking the traditional view that the country's fish farming is mainly subsistence-oriented.

Carried out by researchers from the International Food Policy Research Institute (IFPRI) and Michigan State University in the US, the study was published recently in Aquaculture, an international journal.

It says 42 percent of the marketed farmed fish is consumed in urban areas, and that share is growing fast.

The Washington-based global think tank, IFPRI, notes, "The fish value chain in Bangladesh is growing and transforming very rapidly, in all segments. The quiet revolution in the fish value chain is a domestic market revolution: 94% of aquaculture production is destined for domestic consumption."

With an annual production of nearly 20 lakh tonnes of cultured fish, Bangladesh is the world's fifth largest producer of inland aquaculture after China, Indonesia, India and Vietnam, the UN Food and Agriculture Organisation (FAO) stated in its report titled “State of World Fisheries and Aquaculture 2016”.

Ricardo Hernandez, IFPRI research coordinator and lead author of the study, said “Aquaculture has become an important driver of Bangladesh economy and the industry now employs as many persons as the garment sector, another growing success story in the country.”

Just over a decade ago, rural farmers usually sold their fish to local traders, but now they are selling two-thirds of their product to large wholesalers based in towns and cities, he said.

The study points out that volumes and actors in the fisheries tripled in Bangladesh in the last 10 years.

Statistics of Bangladesh's Department of Fisheries (DoF) also reflect the fast change in the dynamics of the country's fish production.

Within the last 10-12 years, the contribution of farmed fish to net fish output has grown from 43 percent to 56 percent, meaning that cultured fish (farmed in inland closed water) now overtakes the volume of captured fish (grown in natural free-flowing open water).

DoF figures show that the country's annual fish production stands at 37 lakh tonnes, and nearly 56 percent of that comes from farmed fish, 28 percent from captured fish and the rest from marine fisheries.

Hernandez said, “What really surprised me about these findings was the extent of the growth in many sectors, not just in production but also in many off-farm segments, such as rural and urban traders, input dealers and feed mills.

“The rapid increase in mainly small and medium actors has produced a more competitive environment that has pushed the adoption of new technologies, which has increased productivity. This has greatly benefited poor and low-income consumers.”

This rapid growth has been driven by increased demand; improvements in technology, communications and infrastructure; and investments by millions of farm households and small and medium enterprises, he added.

The study says, "Very little change was brought about by NGO or government action, although the government did play an important role in the early stages with infrastructure investment (such as investment in fish seed production, electricity and roads), a pro-business outlook, and a laissez-faire approach to land use and crop choice."

The researchers observed that Bangladesh saw proliferation of feed mills, hatcheries, farmers and traders as well as increase in the use of hired labour and investment in agricultural equipment.

Hernandez said, “Both rural and urban poor households have been able to improve their diets by consuming more protein and micronutrients from a source other than rice.”

According to the DoF, fisheries contribute 3.69 percent of Bangladesh's GDP and over 23 percent of agricultural GDP. With an average fish intake of 53 gram per person a day, fish now account for 60 percent of protein supply for the entire population.

Besides, one crore 78 lakh people are fully or partially employed in the fisheries sector.

Aquaculture saw a robust growth of 8.2 percent, much higher compared to the average growth rate of all fisheries (5.4 percent) in the last one decade.

The IFPRI-led study noted that there has been rapid capital deepening in the form of investments by hundreds of thousands of actors in the fish value chain; apparent in a great jump in feed use, investment in equipment and pond construction, and investments in mills, hatcheries and vehicles.

These investments have been made by, and provided opportunities for, a multitude of smallholder farmers and small and medium enterprises throughout the chain, it observed.

It also made mention of the diversification and specialisation beyond carps in production of commercial species such as tilapia and pangasius catfish, which have raised yields.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments