It was like a militant attack, an earthquake

He was the one who first pushed for digitisation of the central bank and banking sector of the country.

It was under his leadership that Bangladesh Bank (BB) took forward the government's digital campaign in the financial sector.

And ironically, it was a digital theft that cost him his job about four months before his scheduled retirement.

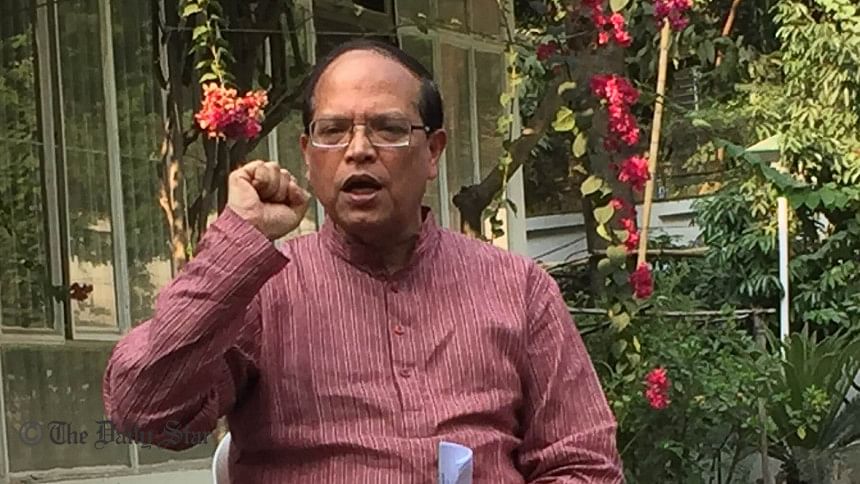

Atiur Rahman yesterday quit as the BB governor after cyber-thieves stole $101 million of the central bank's account with the Federal Reserve Bank of New York early February.

"It was like a militant attack. It was like an earthquake. I did not come to realise immediately what direction it came from or who perpetrated it," he told The Daily Star in an interview hours before his resignation.

"When I was informed about the incident, I got very puzzled. I had already been reeling from the ATM scam."

Fraudsters last month stole over Tk 1 crore, according to the investigators, from ATM booths of several banks using cloned cards.

Atiur said he was afraid that the two incidents might throw the country's economy into a major crisis.

"So, I took advice and opinions from the experts, and hired experts from abroad very quickly. I did so to beef up security of the [foreign exchange payment] system and prevent any further damage."

In his attempt to find out the source of the cyber attack and how it was pulled off, Atiur said he took the intelligence agencies, the Rapid Action Battalion, the Financial Intelligence Unit (FIU) and the World Bank officials on aboard.

"On the first day, I filed an FIR with the FIU. I worked as per their advice."

He said he also spoke to the central bank governor of the Philippines, where part of the stolen money was laundered through casinos. The rest of the money ended up in Sri Lanka.

"As it was a confidential matter, things like these had to be done in secret ... It took some time."

Atiur, who was a development studies professor at Dhaka University before he was appointed the BB governor in May 2009, drew ire from Finance Minister AMA Muhith for not informing him about the theft. Muhith claimed to have learnt of it from media reports, that too more than a month after the incident.

In his defence, Atiur said, "I have tried my best to set up a firewall because attacks like this can happen any time, like an earthquake.

"When the situation came under my control to some extent, I informally informed the higher authorities about the case. Then I wrote a letter to the honourable finance minister informing him about the issue."

Had the news been broken immediately after, he might not have been able to bring back part of the money because the hackers would have become more cautious, claimed the 10th governor of the central bank.

Part of the stolen money that ended up in Sri Lanka has been recovered.

"But by the grace of the Almighty, we have got back a significant portion. We have news from the Philippines that we will get back the whole amount [laundered there]," Atiur said.

"I took the time for the sake of the country, for bringing back the money and for averting any further major crisis," Atiur said.

Questions were raised over his March 10-14 visit to New Delhi to attend an event at a time when mysteries over the cyber theft were unfolding.

Asked about this, he said, "It was an inter-governmental meeting organised by the IMF [International Monetary Fund] and the finance ministry of India. Finance Minister AMA Muhith too was scheduled to attend the meeting but he could not go there on health grounds."

"I went to India with permission from the prime minister and the finance minister."

On the sidelines of the IMF meeting, he held talks on how the money could be recovered, said Atiur.

He especially thanked the finance minister and the central bank governor of Sri Lanka for helping Bangladesh recover $20 million of the stolen money.

Until the cyber heist, Atiur had been basking in the glory of maintaining a strong macroeconomic scenario in Bangladesh for a long time despite turbulence in the world markets.

During his stint as the BB governor, the size of the economy doubled, the foreign currency reserves quadrupled, inflation came down, and the interest rates declined.

"Bangladesh is now one of the two fastest growing economies in the world," he said.

The BB is the first institution that introduced e-tendering and e-commerce, and made all payment systems online in Bangladesh.

He said he also tried to bring the underprivileged under the banking system.

"I have always worked in the best interest of the country," said an emotional Atiur.

"The $28 billion [reserves] is like a child to me. I have piled this up inch by inch."

When he took over as governor in 2009, the reserves stood at less than $6.5 billion.

He said his job did not allow him to spend much time with his family. "I did not take leave even for a single day in the last seven years."

Atiur thanked Prime Minister Sheikh Hasina for her cooperation and guidance during his tenure. "She was on my side during every crisis."

He said he now plans to go back to teaching.

"I will be beside the poor and the farmers. I will protect the sons of the soil," he said while wiping his tears.

As per software security firm Kaspersky Lab, Bangladesh, among all the countries, is most vulnerable to malware attacks and other cyber crimes.

When his attention was drawn to this, Atiur said he had taken some measures to ensure the cyber security of the country. "More remains to be done. Cyber security should be given the highest level of attention, like we have done in case of disaster management."

He thanked the private banks, which he said were under his full control.

These banks, he said, have come up with new and innovative products for companies, small and medium enterprises, and women entrepreneurs.

"I am proud of them. I hope these banks will continue with this new trend of banking," he told reporters at a farewell press briefing at his Gulshan residence later in the day.

The state-run banks have problems, Atiur said. "I have tried to bring discipline by appointing observers to these banks. I hope the government will take care of these banks."

He also expressed gratitude to the finance minister for his support over the past seven years.

Atiur went on to thank the officials and employees of the BB and all other banks for making the inclusive financing and the mobile financial services a success.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments