New VAT system won't hurt people

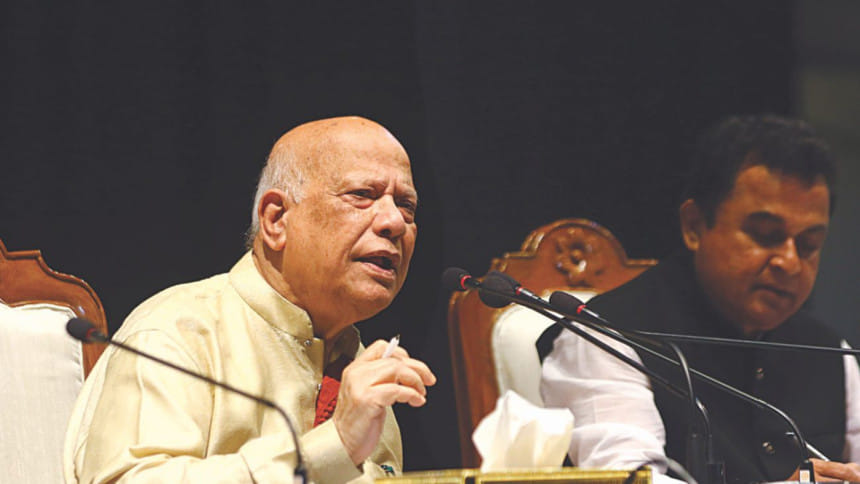

“This is my best budget…I see no weakness in it. Everything is bright.”

Ama Muhith

Finance Minister

The new VAT system will not cause prices of goods to rise as a host of concessions and exemptions have been given in the new budget, Finance Minister AMA Muhith said yesterday.

“Many have got exemptions and will not pay VAT [Value Added Tax]. Small and medium-sized businesses have got concessions,” he told reporters at a post-budget media briefing in the capital's Osmani Memorial Auditorium.

At the briefing, Planning Minister AHM Mustafa Kamal said 536 items are exempted from tax under the existing VAT Act, while the new law extends the exemption to 1,043 items.

“Prices of the goods will not go up. The economy will not come under pressure,” he said.

In the proposed budget for fiscal 2017-18, a business entity with yearly turnover of less than Tk 36 lakh has been exempted from turnover tax. But if its yearly turnover is between Tk 36 lakh and Tk 1.5 crore, it has to pay 4 percent turnover tax.

Industries Minister Amir Hossain Amu said there is no shortage of supply of essential commodities.

He further said a section of unscrupulous traders is hiking prices of goods without any reason. “Businesspeople have a tendency to increase prices of essentials during the Ramadan. We need to enact laws to prevent them from raising prices of items without any valid reason.”

On the new VAT law, Amu said whenever a new system is introduced, there would be criticism. “It would be okay after a few days.”

The proposed budget has drawn criticism from businesses, economists and political parties.

Muhith, however, said, “This is my best budget… I see no weakness in it. Everything is bright.”

The budget is ambitious but implementable, he said.

“Every budget is ambitious. Have you ever seen a budget smaller in size than those in previous years?”

He said the country is now going through a different level of development. “We have moved from one plateau to plateau. Now, we are moving towards another plateau.”

Muhith said he didn't give any scope for legalising undisclosed money in the last two fiscal years, and undisclosed incomes were legalised as per the existing rules.

About irregularity in the banking sector, he said irregularity takes place in banks in every country. “We are trying to check it.”

Muhith said that no “looting” was taking place in the private sector. “There are problems in one or two banks. The banks concerned and Bangladesh Bank are looking into it.”

In the proposed budget, excise tax has been raised to Tk 800 from the existing Tk 500 on each bank account having a balance between Tk 1 lakh and Tk 10 lakh at any time of a year.

“It is very difficult to define the rich. People with deposits of Tk 1 lakh or more are affluent enough. They have the ability to bear the additional burden of the increased excise duty.”

He said the size of the budget increased to Tk 400,266 crore from Tk 99,962 crore in 2008-09 with enhancement of the government's implementation capacity.

“How could any questions be raised about the implementation capacity? Rather, it should be praised.”

The government has been putting emphasis on private sector investment since it came to power in 2009, he said, adding that the private sector makes up 80 percent of the economy.

“We know that the country's development will not be possible without private sector investment.”

Muhith said a lot of foreign aid is stuck in the pipeline. “This money has to be used… We have taken steps to enhance utilisation of foreign aid.”

On job creation, he said one percentage point increase in GDP growth results in creation of three lakh jobs.

Referring to gas price, he clarified that he had not said gas price would be increased anytime soon.

The government plans to start importing liquefied natural gas (LNG) from the next year. Once imported LNG is added to the pipeline, gas prices would have to be adjusted to the prices on the international market, said Muhith.

“When this happens, we will need to raise the gas price.”

Muhith said the government would review the interest rate on savings certificates in next two months to narrow the interest rate gap between the savings instruments and the bank's deposit rates.

If the interest rate gap remains very high, this would distort the market, he pointed out, adding that the government plans to review the deposit rate of savings certificates every month.

Muhith said the government is taking steps to bring down costs of sending remittance.

Agriculture Minister Matia Chowdhury said rice prices went up recently as an impact of sudden floods in the haor areas.

“The prices will come down very quickly as we have taken steps to import rice under government-to-government arrangements.”

The relief work, particularly related to food, would continue in the haor areas until the next harvest time, she added.

The planning minister said the investment-to-GDP ratio has gone up to over 30 percent. “It is important because if we don't have over 30 percent investment-to-GDP ratio, we will not be able to attain more than 7 percent GDP growth.”

He hoped the finance minister, in consultation with the prime minister, would review some of the issues in the proposed budget.

Bangladesh Bank Governor Fazle Kabir said state banks have been recapitalised because they provide various services to the customers such as channelling payments for government projects, social safety net allowances and utility bill payments without charging any commission.

“We are trying to improve the asset quality of state banks. Once their asset quality improves, they won't need recapitalisation.”

MA Mannan, state minister for finance, and Md Nojibur Rahman, chairman of the National Board of Revenue, also spoke.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments