Audit Objections 2013-18: CAG detects Tk 11,710cr anomalies

Financial anomalies involving Tk 11,710 crore have been detected in 16 ministries between the fiscal years 2013-18 during audits by the Office of Comptroller and Auditor General.

The constitutional body raised 434 objections in 34 audit reports in the five fiscal years.

The anomalies ranged from breaching laws and policies, disregarding government instructions and public procurement rules 2008, weak internal control, irregularities, corruption, administrative and technical weakness, and laxity in realising government revenue and depositing them to the national coffer.

Mohammad Muslim Chowdhury, comptroller and auditor general, submitted a compilation of the audit reports to the president recently, an official of the Office of Comptroller and Auditor General (OCAG) said.

The ministries under question are finance, LGRD, housing and public works, law, justice and parliamentary affairs, youth and sports, industries, civil aviation and tourism, health and family welfare, education, religious affairs, foreign affairs, power and energy, fisheries and livestock, textiles and jute, water resources, road transport and bridges, and railways.

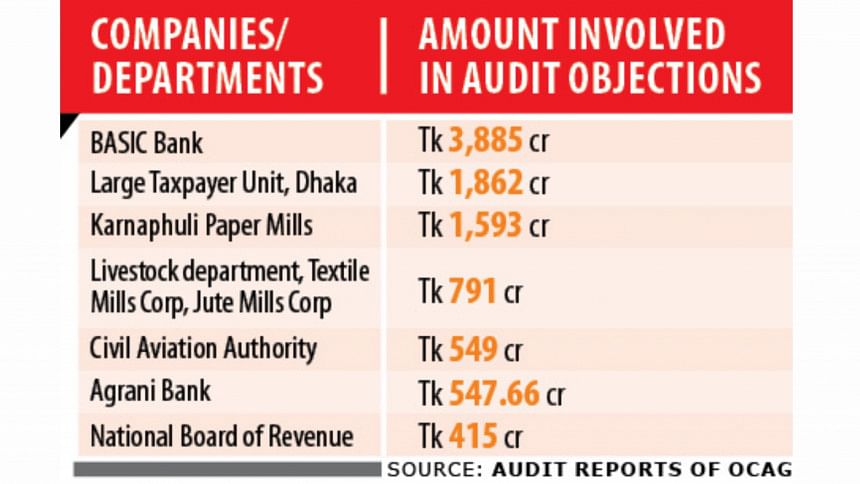

Of the amount, audit objections against BASIC Bank alone involved Tk 3,885 crore, according to the OCAG report.

The types of irregularities found include releasing loans without verifying documents, granting credit without securing sufficient guarantee and flaws in supporting collateral in case of classified loans, providing loans to non-existent companies on the basis of documents, and extending loans against properties that had already been mortgaged with other banks.

In the four years between 2009 and 2013, Tk 4,500 crore was swindled out of BASIC Bank, according to a central bank inspection.

Seven more objections were also raised against the bank, involving Tk 73 lakh. These dealt with appointments ignoring recruitment policy, promotions without displaying outstanding performance, hiring people without curriculum vitae or application or applicants having fake certificates, reappointing officials who were earlier sacked, and employing officials who were sacked for misappropriation of funds, corruption and forgery.

The OCAG also raised 29 objections involving Tk 1,001 crore against the Large Taxpayer Unit’s (LTU) Dhaka office for 2014-15. The LTU is a unit of the National Board of Revenue.

The objections include fixing less income tax by showing less revenue mobilisation than actually realised; determining reduced total income by deducting unapproved expenditure; fixing reduced total income without adding unapproved expenses with income; and determining reduced total income without adding claimed expenditure that was beyond the ceiling and unapproved expenses with income.

The same LTU faced 16 more objections involving Tk 861.93 crore for fiscal year 2012-13.

State-run Agrani Bank faced audit objections related to Tk 547.66 crore for the fiscal 2013 and the preceding year.

The irregularities stem from turning housing loans, project loans and demand loans into risky debt; failure in recovering loan fully despite extending demand loan and the loan against trust receipts; uncertainty over realising misappropriated loans; and failure in realising loans from the clients despite extending rescheduling facility.

Sonali Bank, the largest state-run bank, faced 15 audit objections involving Tk 477.15 crore for the fiscal 2014-15.

These include extending rescheduling facility despite the clients breaching conditions, providing loan renewal facilities and credit beyond approved ceiling time and again, extending back-to-back letters of credit facility through fake amendments, writing off a huge amount of interest, and failure in recouping loans despite granting loan waiver.

Back-to-back letters of credit are actually made up of two distinct LCs, one issued by the buyer’s bank to the intermediary and the other issued by the intermediary’s bank to the seller. The arrangement ensures payment in favour of the seller.

The same bank faced 18 more audit objections involving Tk 421.38 crore for fiscal 2012-13.

There were also audit objections against the income tax department of the Internal Resources Division involving Tk 415 crore between 2012 and 2014.

Karnaphuli Paper Mills Ltd, under Bangladesh Chemical Industries Corporation (BCIC), faced audit objections of Tk 1,593 crore for the fiscal years 2010-11 and 2012-13.

The OCAG raised 13 objections against the Civil Aviation Authority of Bangladesh involving Tk 549 crore for 2013-14. The irregularities include unpaid overflying charge, arrears in landing charge and dues owing to embarkation fee of various airlines and utilities, and unpaid boarding bridge charge.

Audit objections also emerged against various customs, excise and VAT commissionerates involving Tk 306 crore for 2012-13.

Janata, Rupali, Bangladesh Krishi Bank, and Rajshahi Krishi Unnayan Bank (RAKUB) faced 11 audit objections involving Tk 206 crore in 2013-14, stemming from uncertainty over realising bad loans from closed factories and lack of supervision which led to loans turning bad, among other reasons.

A number of audit objections involving Tk 791 crore were raised against the companies under the Department of Livestock Services, Bangladesh Textile Mills Corporation (BTMC) and Bangladesh Jute Mills for 2013-14.

Besides, there are audit objections involving Tk 66.77 crore against Rajdhani Unnayan Kartripakkha, Tk 63.92 crore against Bangladesh Water Development Board, Tk 105 crore against 10 companies under the civil aviation and tourism, textiles and jute, food, health and family affairs and industries ministries, and Tk 63.66 crore against the health engineering department.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments