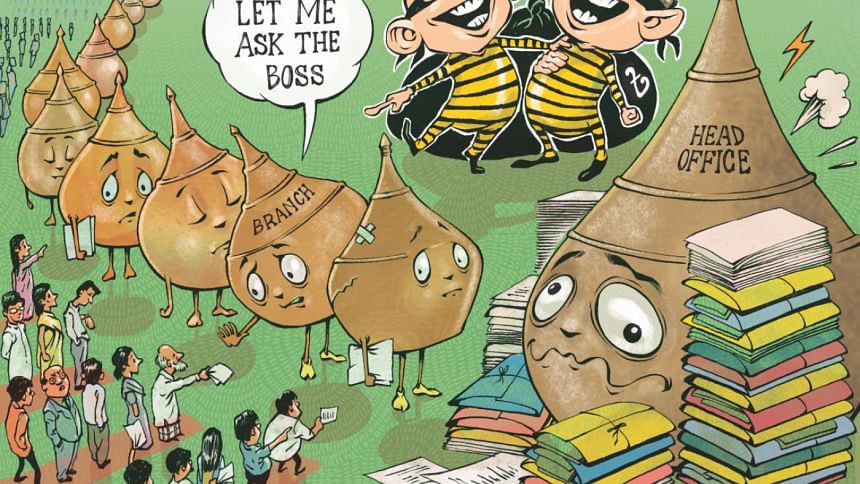

Centralised Decision-Making: Bank services slow down

Faruk Hussain was waiting for about an hour at the branch office of a private bank in the capital's Karwan Bazar to encash his boss' savings scheme.

It was a simple task.

His boss, a secretary at an important ministry, had opened a savings scheme that would double in amount in five years. The secretary signed all the papers.

It should not have taken more than 15 minutes to complete the task. Yet the minute hand of the clock ticked 60 times and Faruk was still waiting.

Faruk then prodded the branch manager, wanting to know how much longer he would have to wait.

“Please take another cup of tea. I am calling the head office right away to get updates,” said the manager as he picked up the phone.

“Please madam, can you hurry things up a bit more because the client is a secretary. We have to take special care of the big clients ... you know,” the manager pleaded over the phone.

This is not an isolated incident, rather a general picture of how client service has slowed down at some banks, which have switched over to centralised decision-making in the last several years, taking back power from their branches.

But why did the banks walk in the backward direction? The answer lies in the huge non-performing loans and scams that have plagued the banks in the last one decade.

The banks have found that in many cases, the branches breached the rules to provide loans to clients, overlooked credit worthiness of clients and even hid information.

The solution they have come up with is to bring the entire decision-making process under the fold of the head office -- even as simple as that of opening a bank account.

This may have cut some risks in credit but it comes at the cost of slow client service as was experienced by Faruk.

“Mr Faruk had to wait for long as all decisions are now made at the head office. And the head office has to deal with thousands of such requests every day which delays service,” explained the branch manager of the bank concerned.

Opening of an account takes longer now. Earlier, it was hardly a 30-minute job to open a savings account, but now it takes two to three days.

If it is a fixed deposit account, a client will have to come twice to the bank to collect a savings instrument which would earlier take about 30 minutes to complete, according to a number of customers.

But that is the price everybody pays for the loan scams.

Most of the big loan scams such as Hallmark, Bismillah, BASIC Bank, Crescent and AnonTex were revealed at different bank branches.

The experience led a number of banks to shift their banking operation to the centralised model from the decentralised one to have better control over decision-making and loan disbursement.

At present, Prime Bank, BRAC Bank, Eastern Bank Limited, and The City Bank are operating based on the centralised model.

Another private bank, Bank Asia, started the process of moving to the centralised model a few years back.

The main difference between the centralised and the decentralised models lies in the decision-making process.

In the centralised system, a branch manager does not have the authority to decide on selection of borrowers or approval of loan. And all the branches only provide service to clients and collect deposits.

All the decisions regarding opening of accounts and letters of credit, selection of borrowers and loan approval will come from the head office.

Under the decentralised system, every branch has a separate credit division, risk management division, customer service division and its own vault. Branch managers have the authority to select clients and disburse loans.

Prime Bank, which has been feeling the pinch of Bismillah Group loan scam for six years since 2013, shifted to full-fledged centralised system last year from the decentralised one.

The bank initiated the process of transformation in 2015 after the scam was revealed at its Dilkusha branch.

The decision by one of the country's largest private banks led several other banks to follow its footstep.

Talking to this newspaper, Rahel Ahmed, managing director of Prime Bank, said the bank shifted to the centralised model to mitigate risks of loan scams.

In support of the move, he said a branch manager has to deal with lots of issues, including business operation, loan recovery, monitoring, client service, manpower and management, and this huge burden of responsibilities creates scope for errors.

The bank will benefit financially in the long run because the size of its branches will be reduced under the new model, mentioned the official.

During the period of transformation from 2015 to 2018, Prime Bank opened only two new branches, taking the total number of its branches across the country to 146, he said.

Contacted, Md Arfan Ali, managing director of Bank Asia, said the risk of loan scam is very high in the centralised system due to poor book keeping at bank branches.

Besides, branch managers sometimes use their authority to approve loans, keeping the head office in the dark.

Asked about concern over slowdown of customer service under the centralised model, Arfan said the new system will allow branches to provide better service than earlier because their focus will be only on providing services to clients.

In late 1980's, banks in the country slowly decentralised their operation in line with the practices of the multinational banks, according to a study by Bangladesh Institute of Bank Management last year.

But some of these banks moved to reinstate the previous centralised system in the last 10 years due to abuse of power and malpractices, especially in case of lending decisions, by officials at the branch level, shows the survey titled “Centralised and Decentralised Banking System”.

The main objective of this transformation was to reduce corruption, embezzlement, fraud and malpractices by branch officials and check their inappropriate use of authority.

Cost cutting is another factor that led the banks to go back to the centralised system, the study found.

Most of the bankers, covered by the survey, are of the opinion that that less manpower is required in the centralised system, and it is cost effective.

However, the level of customer satisfaction is high in the decentralised system because it saves customers' time. Business expansion is easier and speedy in this system because of quick decision-making, according to the study.

Loan recovery and amount of bad loans are almost equal in both systems, it adds.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments