Goal high on hopes

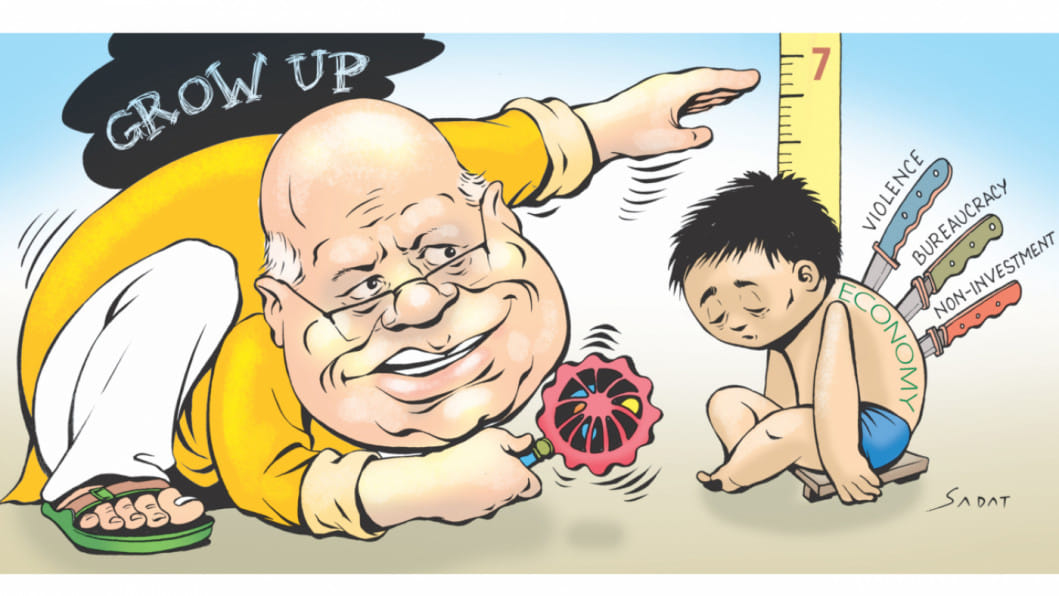

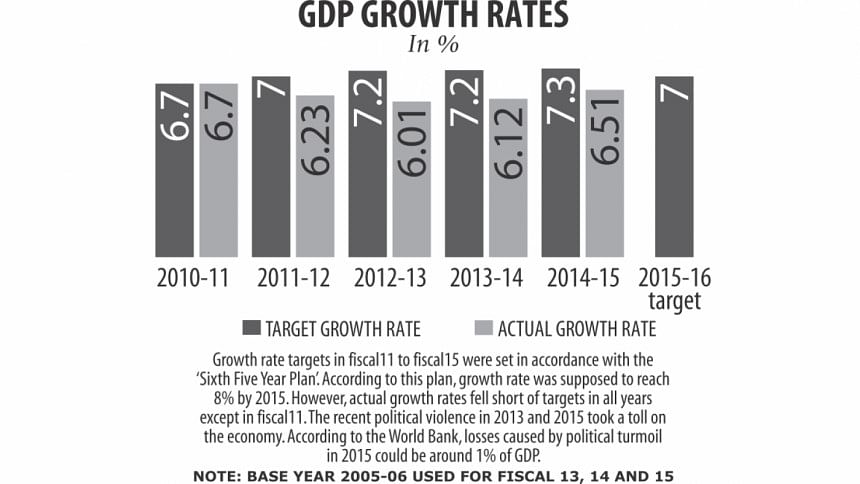

For Finance Minister AMA Muhith, it was a moment of reality check, strategizing and some shifting of blame for failure when he proposed the budget for the next fiscal year yesterday. But he fell way short in actually proposing or visualising what big things he wants to do to achieve his growth target of 7 percent next year.

He was candid and truthful when he said his plans did not gather "expected momentum" during this year and private investment was not forthcoming. But then he put political uncertainties as a scapegoat of non-achievement of targets for this year and also for possible shortcomings next year too as he mentions "making further progress hinges on favourable political environment".

In his proposed budget he did not show us how he was going to solve some of the nagging problems like easing land acquisition process, diversifying exports, goading the lethargic bureaucracy into action or increasing the inflow of foreign assistance in projects to get the elusive 7 percent growth.

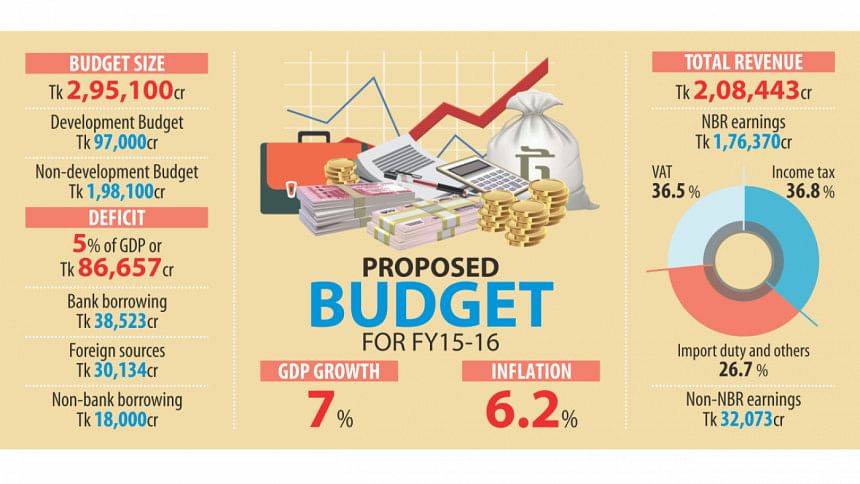

His budget is stuck in the usual quagmire of big expenditure and big revenue earning. Much of the spending will be on the increase in government sector salary -- from this year's Tk 29,350 crore to Tk 45,153 crore -- and interest payment -- a sign that the government's internal borrowing is soaring rapidly (26 percent this year) as foreign funds dry up.

With a glut of big projects already in place, many of which are dragging, he actually had little new projects to showcase for next year.

His ambitious revenue target -- 27 percent higher than this year's revised figure -- will be challenging to achieve although the wisely proposed three-fold increase in advance income tax on garment exports will rake in huge money.

Muhith's tough call will be to ensure a 40 percent higher foreign funding for projects by removing the bottlenecks in the pipeline. He himself is doubtful as he states "if we can increase disbursement from the huge pipeline". That "if" sticks out like a sore thumb.

And if that does not happen, the economy will be caught in further domestic borrowing with incidence of interest rate payment going up. Or in the alternative scenario, expenditure will be cut to make up for a likely shortfall in revenue collection.

The net impact of this will be again to be caught up in the 6 percent growth cycle.

The finance minister has prepared his recipe of growth on accelerating aggregate demand through improvement in energy, roads and economic zones. Pay rise, he hopes, will generate consumer spending.

But his budget book shows no new road plans other than the ongoing Dhaka-Chittagong and Dhaka-Mymensingh ones. His energy chapter contains no major announcement on infrastructure while the ongoing ones are slow-going. Economic zones will take years to materialise.

Muhith knows that an increase in private investment holds the key to higher growth but he has yet to find an answer about how that will happen in the face of a sluggish bureaucracy, dearth of good governance, a crippled Board of Investment, and above all the great political uncertainty that he has ranted about a lot. The factors he himself listed as impediments to private investment -- delay in getting utility services, institutional complications, high interest rates or land scarcity -- remain unresolved.

Good governance prospect does not look bright. He promises little on public administration, police force and judiciary. And strengthening the local government, a crucial ingredient for development, remains full of empty talks. On top of that he now mulls devolution of power, another far-fetched idea.

Muhith instills no new hopes on roads, gas supply, and traffic jam in Dhaka city that hurts the economy so bad. There is no remedy for a wilting agriculture or the flagging manpower export.

In short, Muhith in his budget wants good growth with a clear idea of what needs to be done, only that the specific actions are missing once again.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments