No tax hike for next five years

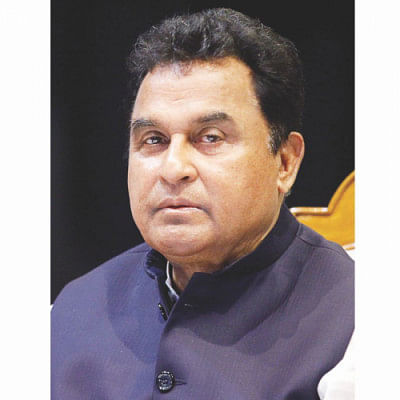

Finance Minister AHM Mustafa Kamal yesterday reassured taxpayers that there would be no hike in tax rates in the coming budget, rather more people would be brought under the tax net so that it widens.

“It’s unfortunate that regular taxpayers continue to pay taxes while a section of people, despite being eligible, does not … those who don’t pay taxes will have to pay now,” he said.

Besides, the tax rates would not be increased in the next five years, he said.

Kamal was speaking as the chief guest at a consultative committee meeting between the National Board of Revenue (NBR) and businessmen, including members of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), at the capital’s Bangabandhu International Conference Centre.

“Taxes will not go up by a single Taka. The existing rates would either con-tinue or reduced. New taxpayers would be given attention so that no one has to face any hassle,” he said.

The minister had made similar comments while speaking at a press briefing at the planning ministry on April 2.

On that day, he said although the government has no plan to increase taxes, it intends to bring more people under the tax net. “We have a lot of scope for widening the tax net. We will use this opportunity,” he had mentioned.

Currently, the ceiling of individual tax-free income in the country is Tk 2.50 lakh for a year. The national budget is placed in parliament in the first week of June every year.

Yesterday, Kamal also hinted that exporters would be given incentives and steps would be taken to initiate reforms to areas like customs, Value Added Tax (Vat) and banking. “You will see a lot of reforms in different areas.”

At the meeting, the FBCCI urged for increasing tax free income limit for indi-vidual taxpayers; 2.5 percentage points cut in corporate tax; removal of ad-vance income tax on imports; increased incentives for exports; hike in sur-charge-free net wealth threshold; multiple rates of Vat; and reducing import tariff on basic raw materials and chemicals to three percent for the fiscal 2019-20 from five percent in the outgoing fiscal year.

The apex trade body also demanded the government take steps to bring down the amount of non-performing loans and bring an end to lending on po-litical consideration. Besides, it called for taking actions against the willful loan defaulters.

This budget is going to be the first budget for Kamal as the finance minister. Previously, he headed the planning ministry for five years.

The size of the national budget for 2019-20 would be more than Tk 5 lakh crore, and taxmen would be given the target of Tk 3.25 lakh crore.

Kamal said he would try to bring “something new” in his budget proposals.

The next budget would not be a budget for one single year. Rather, it would lay the foundation for budgets for successive fiscal years till 2041, he said.

The budget would be prepared in such a way that everybody would be able to understand it clearly, he added.

He further said like the previous years, no statutory regulatory orders (SRO) would be issued after the passage of the budget.

“We will give incentives to all export items,” he said, adding that real estate sector would also be given priority in the next fiscal year’s budget.

On the hassles to get cash incentives against exports, he said the incentives would be handed over in two weeks after filing of applications. But exporters would require providing bank guarantee for it, he said.

“My first task will be to save people from harassments,” the minister said, adding that he would act to stop various irregularities, including all types of bribery, to ensure better services to the people.

Kamal further said his office would have a special number dedicated to re-ceiving complaints of harassments and wrongdoing by officials. Action will be taken in seven days if anyone is found guilty, he added.

Kamal said he wanted the FBCCI to take action against dishonest and non-compliant businessmen.

Citing records of goods imports through false declaration, he suggested the trade body cancels membership of the businessmen at fault.

Salman F Rahman, prime minister’s adviser on private sector, and FBCCI President Shafiul Islam Mohiuddin also spoke at the meeting chaired by NBR Chairman Mosharraf Hossain Bhuiyan.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments