Responses from NY banks were sluggish

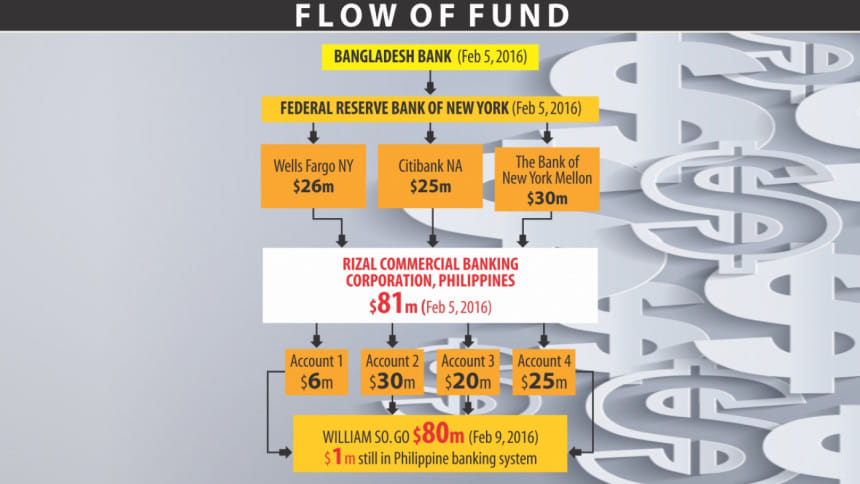

The Bangladesh Bank was denied prompt responses from the intermediary banks and due diligence from the Federal Reserve Bank of New York, which would have raised the stakes of recovering a major chunk of the $81 million stolen by hackers.

Although the New York Fed blocked 30 transactions amounting $850 million from the BB's account because of a lack of beneficiary details, it let another five transactions, totalling $101 million, to go through.

“We view this as a major lapse on the part of the FRB NY,” said a BB document dated March 13.

And the three New York-based intermediary banks -- Citibank, Bank of New York Mellon, Wells Fargo -- were sluggish with their responses to the central bank's desperate pleas to stop the fund transfers on February 8.

Other than the SWIFT message on February 8, the BB also sent four more requests to Citibank NA until February 14 but to no response.

Then after a month, the Citi Anti-Fraud Department replied and even then, the response was ambiguous.

The Bank of New York Mellon wrote back a day after it received the SWIFT message from the BB, but said it was unable to locate the transaction in question.

The bank asked for further information on the beneficiary, which the central bank provided. Four more requests were sent until February 14 but no response.

The central bank is still pursuing the matter through the bank's anti-fraud department, said the document.

Wells Fargo & Co. responded on the same day it received the SWIFT message from the BB, informing that the beneficiary bank of the two payments instructions that went through was Rizal Commercial Banking Corporation (RCBC) of Manila.

A total of $81 million was channelled through the three banks -- $26 million through Wells Fargo, $25 million through Citibank and $30 million through the Bank of New York Mellon. The funds finally ended up at an individual account through RCBC.

“The fact of the matter is that these three banks' anti-money laundering system failed grossly in this instance,” said a senior BB official seeking anonymity.

The BB official said the global anti-money laundering body, the Financial Action Task Force, stipulates every bank has a responsibility towards every transaction that goes through it.

“As per the rules, the banks involved in the heist should have been more careful. They should have asked why millions of dollars are being sent to a personal account,” he added.

In contrast, the BB received prompt cooperation from the Pan Asia Banking Corporation of Sri Lanka, as a result of which the full $20 million that was remitted could be remitted.

Earlier on March 8, Finance Minister AMA Muhith said the BB would file case against the New York Fed as it was responsible for the stolen funds.

The BB document said the central bank was reviewing multiple processes to “prepare grounds to lay legitimate claim for loss of funds with the FRB New York”.

Mirza Abdullahel Baqui, special superintendent of police, yesterday said the Criminal Investigation Department will investigate whether the New York Fed followed the correct due diligence procedure.

“We will take cooperation from the FBI,” he told The Daily Star.

After receiving permission from the courts and the government, a team of the CID will travel to the US to speak with the New York Fed, he added.

In a report published on the Bloomberg yesterday, New York Fed spokeswoman Andrea Priest said they were not commenting beyond a statement earlier this month.

On March 8, Priest said the instructions to make the payments from the account of BB followed standard protocols and were authenticated by the SWIFT message system used by financial institutions.

Over at the Philippines, RCBC yesterday fired the manager and deputy manager of the branch through which the illicit transactions took place, citing violations of bank policies and procedures as well as falsification of commercial documents, reported the Inquirer.

RCBC claimed the two officials had breached rules and facilitated the alleged laundering of $81 million.

A money laundering complaint was also filed at the Philippines'' Department of Justice against two more people allegedly involved in the heist, according to Bloomberg.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments