Revenue target very ambitious

While economists have praised the proposed budget's emphasis on mega projects, skill development and job creation, they have termed the revenue generation target very ambitious.

"The emphasis on mega projects is appropriate and timely. But the success will hinge on their implementation," notes Ahsan H Mansur, executive director of the Policy Research Institute (PRI) of Bangladesh, a think-tank.

"In the past, we have seen good initiatives, but they were not successful," he said, referring to the public-private partnership which he thinks has not produced any positive result yet.

AB Mirza Azizul Islam, a former finance adviser to caretaker government, said the targets set in terms of some critical indicators were unlikely to be achieved.

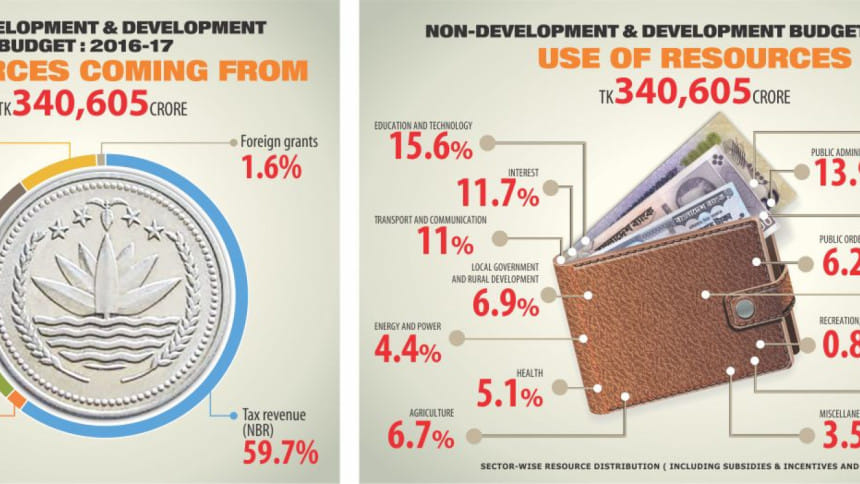

The proposed budget projects that the tax revenue collection by the National Board of Revenue (NBR) would grow by 35 percent. "This is something which, I think, will be impossible to accomplish," observes Mirza Azizul.

The year-on-year revenue growth, he elaborates, was maximum 22 percent in the history, and it ranged between 8 and 12 percent in the recent years.

The same is also true in case of non-tax revenue, the growth target of which has been set at over 35 percent from that in the revised budget of the outgoing fiscal year, said the former adviser.

Mirza Azizul says the target on the annual development programme (ADP) would not be reached. He called on the government to boost its implementation capacity.

Ahsan H Mansur of the PRI said the budget was prepared in line with the 7th Five-Year Plan and was consistent with the government's medium-term objectives.

However, the government is already trailing in a number of areas of the five-year plan, he says.

The first budget of the five-year plan, which is the outgoing year, was not able to reach its target at least in two areas: the revenue generation and the public sector service delivery, the PRI executive director elaborates.

"The same challenge is going to appear, and this time in a bigger way."

He thinks "it would be extremely challenging to reach the (revenue collection) target."

Historically, the revenue generated by the NBR did not grow by more than Tk 20,000 crore a year. But the proposed budget sets the goal at more than Tk 53,000 crore from the existing revised budget.

"Then you can imagine how big the extent of ambitiousness is," Ahsan H Mansur commented.

He praised some measures like increasing tax on tobacco products and reducing supplementary duties on some goods.

However, the former economist at the International Monetary Fund said levying further taxes on telecommunication may not be productive, as the government is already realising value added tax, and the tax incidence is one of the highest in the region.

Mansur, whose organisation PRI supports the new VAT Act, said it was okay to delay the law's implementation, but it should not have been for more than six months.

The VAT Act was supposed to take effect from July 1 this year but it has been deferred to the first day of FY 2017-18.

The proposed budget plans to raise the tax-to-GDP ratio to over 12 percent from the 10.3 percent now.

Mansur thinks it is unfortunate to allocate funds for the state banks, saying the country is spending "good money for a bad purpose". The relevance of the state banks did not exist in today's Bangladesh, as it did in 1980s, he says.

The economist stressed the need for bringing forth a major structural change in the taxation system, "but the budget has not been able to deliver that".

"Without that, the government will not be able to realise its dream of turning Bangladesh into a middle income and high-middle income nation."

Reforms efforts in the revenue collection system could have been strengthened further, Mansur commented.

Debapriya Bhattacharya, distinguished fellow at the Centre for Policy Dialogue (CPD), said the CPD "more or less agreed" with the challenges and the ways-out delineated by the finance minister.

The strategy to overcome the challenges remains to be seen as the minister did not give a full and clear outline on his thoughts about capacity building, particularly institutional capacity building that will be needed, said the economist in his initial reaction.

He said private investment in terms of the GDP fell over the last two years. So, there has to be a comprehensive plan regarding how the investment could be boosted.

Debapriya backed reorganisation of the surcharge on the rich, saying now the wealthy would pay more taxes to the state coffers.

The economist thanked the government for increasing budgetary allocation for three sectors -- education, railway and social safety net.

He, however, said it's unfortunate that a major portion of the non-development expenditure will be used in debt servicing "which is a bad signal". In the past, Bangladesh used to pay more interest for foreign borrowing whereas now it pays more for domestic borrowing.

Debapriya expressed disappointment at no increase in the allocation for the agriculture sector.

Mustafizur Rahman, executive director at the CPD, said there should be no question about the budget size. "Given the growth momentum the country is going through, Bangladesh will have to increase the public expenditure."

The government would have to pay heed to the implementation of the budget, he noted. "Without strengthening the implementation capacity, it would be tough for the government to reach its big revenue generation target."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments