New VAT law put on hold

The government has shelved the uniform 15 percent VAT plan for two years in the wake of public outcry and reported pressure from businesses and lobby groups.

This means the multiple rates of the indirect tax under the 1991 VAT law will continue until fiscal year 2018-19.

The much-discussed VAT and Supplementary Duty Act 2012, which has the provision for 15 percent flat VAT rate, was set to be implemented from next month.

But now the onus of doing so will be on the next government, which will be formed through the general election due in late 2018 or early 2019.

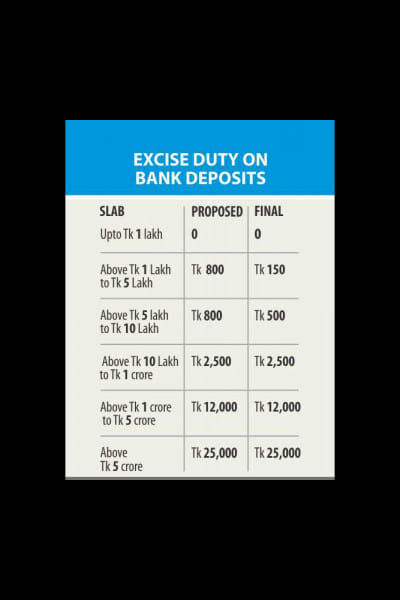

In another change, the government cut the excise duty on small bank deposits but retained the proposed rates for big ones.

It comes after Prime Minister Sheikh Hasina requested Finance Minister AMA Muhith to put on hold the new VAT plans in parliament yesterday.

“As the new VAT law received a lukewarm response from the business community, I will urge the finance minister to keep it like it was before and not to implement it for the next two years,” she said.

Hasina also suggested that Muhith bring changes to his plan to increase excise duty on bank deposits.

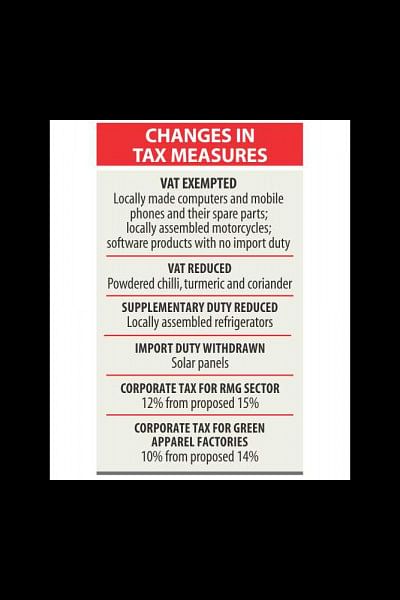

Following the PM's call, the finance minister proposed some changes in the tax measures, which the House passed unanimously in voice vote.

“The implementation of the new law, which was tabled in the House on June 1 for approval, has been postponed based on suggestions from Prime Minister Sheikh Hasina and other lawmakers,” Muhith told parliament in his closing speech on budget.

And the 2012 VAT law will be implemented in phases through amending the 1991 law, he added.

The proposed imposition of the single rate VAT sparked concern among consumers and businesses that it will push up living cost.

Following the changes in the Finance Bill, corporate tax in garment sector will come down to 12 percent from the proposed 15 percent. But the tax on earnings from apparel exports will be 1 percent, up from 0.7 percent in the outgoing fiscal.

The income tax for green garment factories has been fixed at 10 percent and that of other garment factories at 12 percent.

THE NEW VAT LAW

This is the third time that the government has backtracked on its decision to enforce the new law that seeks to impose a flat 15 percent VAT instead of multiple rates on goods and services under the existing law.

At the prescription of the International Monetary Fund and to fulfill its conditions of $1 billion loans, the government framed the new VAT law in 2012. The last deadline to enforce it was this July.

Finance ministry officials said policymakers had initially planned to bring down the flat VAT rate to 12 percent from the proposed 15 percent.

But in the face of strong opposition from businesses, lobby groups and the fear of rising living cost, policymakers have put the plan on hold for now.

Parts of the 2012 VAT law are already being enforced.

Revenue officials said most of the VAT measures applicable for the outgoing fiscal year are likely to continue in the upcoming fiscal year.

Along with the standard rate of 15 percent applicable to goods and services such as mobile phones, businesses will have to deposit indirect tax to the national coffer based on multiple rates determined based on tariff value and truncated value.

Currently, VAT is collected on 85 products such as biscuit, paper and exercise books, rods and bricks based on tariff value and for nearly 20 items, including flats, based on truncated rates.

Yesterday, Muhith also gave VAT waiver for meditation, particularly to Quantum Foundation, for the next two years. Exemption has also been offered to locally made computers, cellular phones and spare parts as well as locally assembled motorcycles.

He proposed to reduce the VAT rate on processed spices, including chilli, turmeric and coriander, based on tariff value or minimum value method.

The minister also withdrew the proposal to increase Supplementary Duty (SD) on completely knocked down units of motorcycle imported by entrepreneurs who are setting up factories here to gradually start manufacturing.

Reduced duty benefit for cars has been offered to promote domestic manufacturing.

The minister also shelved his plan to impose duty on solar panels import.

EXCISE DUTY

There will be no excise duty on bank deposits of up to Tk 1 lakh in the upcoming fiscal year as proposed. In the outgoing fiscal year, depositors had to pay Tk 150 in duty per year for savings of Tk 20,000 to 1 lakh.

In his budget proposal, Muhith had sought to impose Tk 800 in duty on deposits between Tk 1 lakh and 10 lakh.

This has now been divided into two slabs. In the first slab, the duty has been fixed at Tk 150 on deposits of Tk 1 lakh to 5 lakh, down from Tk 500 at present.

In the second slab -- of Tk 5 lakh to Tk 10 lakh -- it will be Tk 500 per year as in the outgoing fiscal year.

However, the excise duty on higher deposits will be increased as proposed.

The duty on deposits of Tk 10 lakh to Tk 1 crore will be Tk 2,500, a 67 percent rise from Tk 1,500 now.

It will be Tk 12,000 on deposits from Tk 1 crore to Tk 5 crore, which is Tk 7,500 at present.

Those having deposits above Tk 5 crore will have to pay an excise duty of Tk 25,000, up from Tk 15,000 now.

The proposal to increase excise duty drew huge criticism as it was hiked at a time when average interest rates on deposits came down to below 5 percent.

Savers as well as ministers, economists and business leaders criticised the move.

The government has been imposing excise duty on bank deposits since 2002.

THE VAT IMPACT

The shelving of the new VAT plans will widen the budget deficit further and make the revenue target unachievable, economists have said.

The decision means the government will not be able to achieve its revenue collection target -- of Tk 248,190 crore -- in the next fiscal year, which is 34 percent higher than the revised target for the outgoing fiscal, said AB Mirza Azizul Islam, former finance adviser to the last caretaker government.

It would have been tough to achieve this target even if the government had collected VAT at the flat 15 percent rate. Now it will be even tougher, he told The Daily Star.

Many firms still do not pay VAT and tax properly, he said, adding that these firms should be brought under the VAT and tax net.

The government had aimed to collect an additional Tk 63,190 crore in 2017-18. Of the sum, Tk 22,579 crore was supposed to come through implementation of the new VAT law.

The government will miss this target because of the changes in the tax measures, but normal economic growth and price hikes generate higher revenue income every year than that of the previous year, officials said.

“As the uniform 15 percent VAT is not being implemented, the government would have to revise the budget estimates -- both income and expenditure,” said Khondker Golam Moazzem, research director at Centre for Policy Dialogue (CPD).

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments