WB forecasts 6.4pc growth

The World Bank has kept unchanged its growth forecast for Bangladesh at 6.4 percent for the current fiscal year, much lower than the country's achievement in the last fiscal year and the government target for FY 2017-18.

The government has set a growth target of 7.4 percent for the current fiscal year, up from 7.24 percent achieved a year ago.

The WB made the forecast in its Bangladesh Development Update report released at its Dhaka office yesterday.

The Washington-based lender's forecast is lower than that (6.8 percent) of the last fiscal year. This is because the growth in FY16-17 was overestimated as it undercounted the flood-induced losses in agriculture, among others, according to the report.

Besides, some of the windfalls, such as the large pay increases in the public and related sectors, which boosted services growth in FY 16-17, have tapered off.

However, Zahid Hussain, lead economist at the WB Dhaka office, said, "This 6.4 percent growth will be a very good one, considering the international and regional context."

The growth projection for China is 6.3 percent, Pakistan 5.5 percent, Indonesia 5.3 percent and Thailand 3.3 percent.

On Tuesday, the Asian Development Bank projected 6.9 percent GDP growth for Bangladesh for the current fiscal year.

WB Country Director Qimiao Fan said that with an improving global outlook, growth in Bangladesh is projected at 6.4 percent in FY 17-18, while macroeconomic stability is expected to be sustained broadly.

“This of course is subject to some downside risks, particularly the slowing down of reforms in the run-up to elections planned for late 2018 and early 2019, and a hardening of credit constraints with increased insolvency of banks due to rising non-performing loans. Excess liquidity in the banking sector and reduced fiscal space associated with costly domestic financing of the budget deficit present latent risks to macroeconomic stability.”

Bangladesh's economy is growing at a strong pace despite internal and external headwinds, he said.

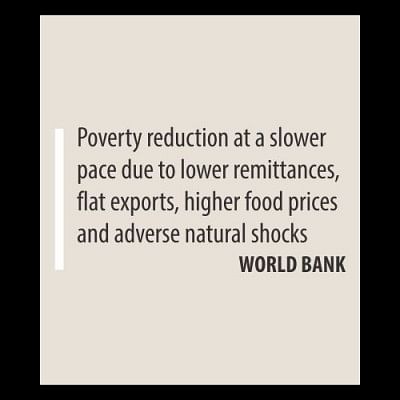

Poverty reduction underpinned by job creation has continued, albeit at a slower pace due to lower remittances, flat exports, higher food prices and adverse natural shocks.

Macroeconomic management has remained prudent, as reflected in decelerating inflation and rising foreign exchange reserves, he pointed out.

However, the banking system remains stressed with high levels of non-performing loans (NPLs), while financial development is hampered by the dominance of national saving certificates as a key source of deficit financing.

“Going forward, leveraging the most important asset of the poor -- their labour -- to generate an earnings stream from jobs is the most sustainable way out of poverty and to accelerate growth,” said Qimiao Fan.

In the report, the WB said it recently assessed labour market trends on job creation, quality and inclusiveness in Bangladesh. The analysis identifies several challenges that require concerted implementation of policy and institutional reforms to deliver the large-scale job creation necessary to absorb a growing labour force.

It pointed out that the rate of job creation has slowed down.

Between 2003 and 2016, Bangladesh economy generated more than 1.15 million jobs per year, on average. However, the pace of job creation has fallen in recent years: between 2003 and 2010, the total employment grew by 3.1 percent per annum, whereas between 2011 and 2016 the total employment grew by only 1.8 percent per annum. This has especially impacted women and youth.

Low levels of technology, outdated management practices, and lagging skills of the workforce contribute to the creation of low quality jobs. The vulnerable groups are facing higher challenges to find jobs.

The export oriented ready-made garments (RMG) sector has been a critical catalyst for creating more and inclusive jobs. While other manufacturing sectors are growing rapidly to meet increasing domestic demand, export-oriented sectors beyond RMG need to emerge to create quality jobs on a large scale, said the report.

Stagnant private investment, weak export growth and declining remittances have impacted the job market.

“Slow structural reform hinders faster job creation,” said the WB country director.

“Bangladesh must unlock the investment potential of both large, export-oriented firms outside the traditional readymade garment sector, as well as of micro, small and medium-sized enterprises which form the backbone of the private sector.”

Raising the quality of jobs in both formal and informal sectors would require policies that address barriers to expanding access to worker protection, translating productivity gains into higher wages and improving job security and working conditions, he said.

“Actions to connect vulnerable workers to jobs must address the specific needs of certain segments of the population, for instance reducing barriers to labour force participation by women and youth.”

To create more, better, and inclusive jobs, Bangladesh needs to bring about regulatory reforms and revisit distortionary industrial policies.

Moreover, planned urbanisation, infrastructure development and strong second-tier cities would create more jobs, said the WB country director.

Adopting new technologies and facilitating migration from rural to urban centres would help create better jobs.

The WB also talked about the challenges Bangladesh faces and structural reforms the country needs to undertake.

“Bangladesh still has a long road ahead.”

Large infrastructure projects have progressed in FY 16-17, but key reforms in taxation and the financial sector have stagnated. Excess liquidity and NPLs in banks pose risks to macroeconomic stability.

Both private and public investments are necessary for increasing productivity and employment. The country must take advantage of the global recovery to undertake institutional and market reforms, which can help sustain growth in the long term.

The WB also said floods would have adverse impact on production in the first half of FY 17-18 but could contribute to higher productivity in its aftermath.

The impact of floods on agriculture in Bangladesh is mixed: though severe inundation destroys crops in the monsoon flood months, monsoon floods act as an open-access resource in supplying irrigational input to agriculture, it mentioned.

While yield rates decline when floods assume “extreme” proportions, productivity increases during “normal” floods and in the post-flood months.

“A loss of crops in the flood months is more than compensated by a bumper production of post-flood crops,” said the WB.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments