Yunus urges global unity

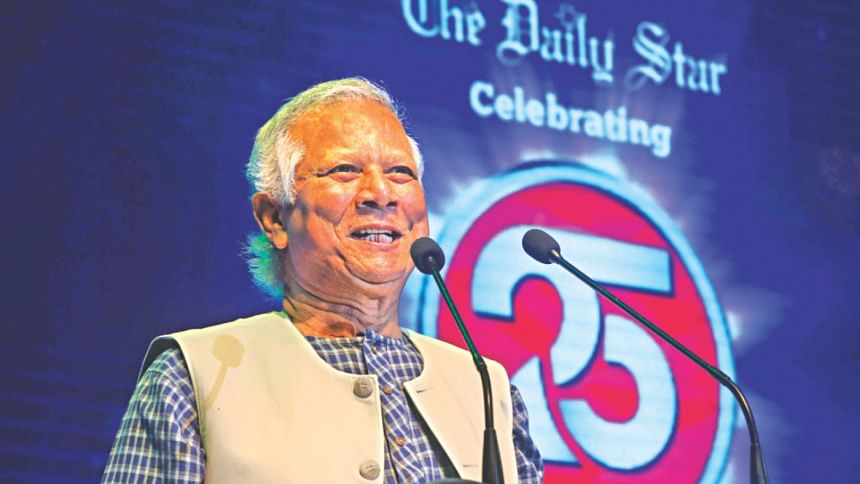

Nobel laureate Prof Muhammad Yunus yesterday called for a global unity to launch a fight against wealth concentration in the hands of a few as it is a threat to peace.

“Wealth concentration is a global threat. It has already entered the danger zone this year with 99 percent of wealth going to 1 percent of people,” he told an event celebrating the 25th founding anniversary of The Daily Star at the International Convention City Bashundhara in Dhaka.

“Not only it is getting worse globally, it is getting worse within nations, and between nations. Wealth gap between nations is always a threat to peace.”

The anti-poverty crusader said historically some nations had accumulated more wealth than others, sometimes taking unfair advantages.

“If the wealth concentration within and among nations becomes acute, then social, political and economic compulsions for armed conflicts will become imminent,” he said while giving a lecture on “Can Wealth Concentration Be Stopped?”

Prof Yunus founded Grameen Bank three decades ago in order to provide collateral-free loans to people who had been shunned by traditional financial institutions.

He said the problem of wealth concentration was ever-expanding gap in private wealth.

Quoting figures from the UK-based international charity, Oxfam, Prof Yunus said 62 richest people owned more wealth than that by the bottom half of the world population.

Between 2009 and 2014, the wealth of 80 richest people doubled, he said, adding that during the current year, Oxfam forecast the richest 1 percent of the world would own 99 percent of the world's wealth.

“That means 99 percent of the people will be left with only 1 percent of the wealth. This information is so unbelievable that it takes time to absorb.”

The Peace Prize laureate said concentration of wealth also meant concentration of power -- political and social -- and privileges and opportunities.

“The reverse is also true. If you don't have any wealth, you have no power, no privileges, and no opportunities.”

Prof Yunus blamed the present economic system for the concentration of wealth, saying the current economic system was biased to the richest.

He mentioned he was not saying that the richest people are necessarily bad people, but it was the system which worked for the rich.

Prof Yunus said the outcome of the 2015 Paris Climate Conference in December, which saw nearly 200 countries striking a landmark deal to agree for the first time to take action to curb greenhouse gas emissions, inspired him to think of an idea to launch a global fight against wealth concentration.

“If the collective efforts of citizens led by committed group of scientists and activists from all sections of society could make us aware of climate danger, I believe by following the same roadmap we can galvanise forces to protect humanity from the danger of its destruction through ever-intensifying wealth-concentration.

“Now I feel confident that wealth explosion can be arrested.”

He said people at the top from whom governments are supposed to collect heavy taxes are politically very powerful. “They use their disproportionate influence on the governments to restrain them from taking any meaningful step against their interest.”

In recent years, the World Bank, the International Monetary Fund, the United Nations and other bilateral donors were promoting inclusive finance, he added.

“If anybody aims at inclusiveness in banking with any seriousness, definitely it can not be achieved through conventional financial institutions. These financial institutions are built on principles and mode of operation which promote financial exclusion.”

“If we wish to reach the poor, we need to build separate institutions with completely different architecture.”

He said Grameen Bank's microcredit idea flourished globally because NGOs took it up. But NGOs are not the answer to fill the vacuum left by existing financial institutions.

“I have been arguing that one easy way would be to give banking licences, with some restrictions, to the microcredit NGOs, to operate as banks and take deposits, so that they can become self-reliant institutions.”

Prof Yunus said he was very happy to see the Reserve Bank of India issuing licenses to microcredit NGOs to become microcredit banks.

He said existing financial institutions had to be redesigned to make sure they could not remain to be the facilitating vehicle for wealth concentration.

“We need to build an entirely new set of financial institutions to deliver all financial services to the poor.”

These exclusive institutions should be designed as social business rather than allowing them to become instruments of personal profit making for the rich, he said.

“Whenever people look for ways to bring down the wealth-gap, they will find social business as a very powerful tool to make it happen. Social business will slow down the process of accumulation at the top while people at the bottom will build up their asset base and retain whatever they earn.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments