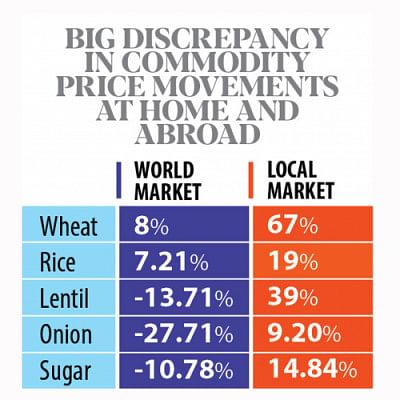

Essential commodities: Price rise for global hike not justified

Whenever the price of a commodity increases in the local market, the traders and wholesalers have the readymade excuse of a price hike in the international market. But a recent study by an intelligence agency found their justification to be unsubstantiated.

The investigation, which studied the price movement of commodities in local and international markets over a 12-month period from August last year, found that the price increases in the local market were disproportionate to their rise abroad.

And in many cases, when the prices dropped, the converse happened, found the study.

The Daily Star has a copy of the report, which was commissioned to get to the bottom of the random price hikes of commodities over the past year or so. This has fuelled inflation and prompted the poor and the low-income group to cut back on their food intake.

Last fiscal year, average inflation accelerated to 6.2 percent from 5.6 percent in fiscal 2020-21 -- well above the revised target of 5.7 percent.

And according to the Asian Development Bank's projections, inflation will average 6.5 percent this fiscal year, overshooting the target of 5.6 percent.

The intelligence agency's report indicates that the elevated inflation was not entirely due to the supply disruptions caused by the pandemic and Russia's invasion of Ukraine; the traders and wholesalers exploited the situation.

Take the cases of lentils, onions, and sugar, whose prices have plummeted in the international market but increased in Bangladesh.

The prices of pulses increased by 29 to 39 percent in the local market but they dropped 14 percent in the world market on average, the study found.

Similarly, the key cooking ingredient onion's price edged up 9 percent when it became about 28 percent cheaper in the global market in that period.

When sugar price declined about 11 percent, it increased by about 15 percent at home.

There are cases in which the price increase at home was always by a much larger percentage than that of abroad.

Take the case of wheat, whose price increased 67 percent year-on-year in August at home. In that period, its price increased by just 8 percent abroad.

The price of the staple rice increased by about 7 percent in the global market but at home, it increased by 10 to 19 percent depending on the quality.

Though the report did not mention any foul play or irregularities, the Bangladesh Competition Commission on September 22 filed 44 cases against a host of individuals and organisations accusing them of creating an artificial crisis that led to abnormal hikes in the prices of essential commodities.

Abul Bashar Chowdhury, chairman of BSM Group, a major commodity importer based in Chattogram, acknowledged the discrepancy in the wheat price at home and abroad.

"But the depreciation of the taka against the dollar means the lower prices in the global market could not be passed on to our consumers," he said.

Biswajit Saha, director for corporate and regulatory affairs at City Group, another major commodity importer, echoed Chowdhury.

"I don't see any sign of the price going down in the coming days," said Amin Mahmood, the owner of Nihad Traders, a major importer of lentils.

Mamun Saudagar, the proprietor of Muhammadia Traders in Chittagong, said the onion price increase was due to the record fuel price hike last month.

The prices of commodities would be brought in line with those abroad, said AKM Ali Ahad Khan, additional secretary (IIT) of the commerce ministry.

"Work for that is going on. We have already adjusted the prices of sugar and palm oil," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments