Let MFIs accept deposits from people: Dr Yunus to Indian authority

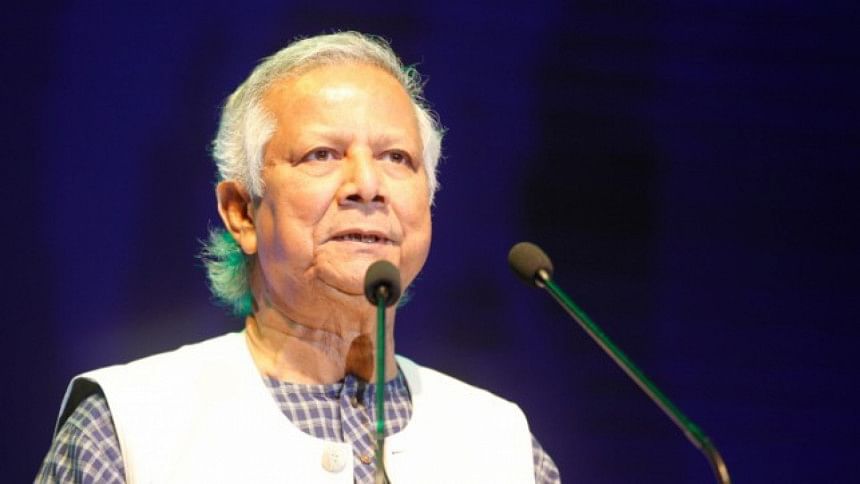

Nobel laureate Dr Muhammad Yunus has recommended allowing micro-finance institutions (MFIs) in India to accept deposits from the public.

Speaking at the 'PanIIT Global eConclave', he said that at present MFIs have to go to the banks for money, reports our New Delhi correspondent.

"My plea to the Indian government is that MFIs should be allowed to accept deposits from the public. Now, they go to the banks for money," Yunus, founder of Bangladesh-based Grameen Bank, said last night.

He said the Reserve Bank of India (RBI) has allowed the opening of small finance banks who are able to accept deposits.

"Finance is the economic oxygen of people. The banking system is not keen to lend money to the poor for which an alternative banking channel has to be developed for them," he noted.

As MFIs are not allowed to accept deposits, the cost of funds at the hands of the beneficiaries become high because they borrow money from banks -- Small Industries Development Bank of India (SIDBI) and National Bank for Agriculture and Rural Development (NABARD).

Several Indian MFIs such as Ujjivan and Jana have converted into small finance banks after getting licenses from the RBI.

Responding to concerns that MFIs may become "loan sharks", Yunus said the sector should be defined as "social business" and also pitched for zero dividend-paying entities.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments