Financial anxiety: Causes and ways to tackle

If you find yourself worrying about money more often than you are comfortable with, you're not the only one. Money or financial anxiety has become more common than ever and it's a tad bit more than your regular financial conscious or savings-oriented attitude. A crippling fear of anything to do with finances, the feeling can drain you mentally and leave you feeling exhausted and insecure.

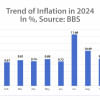

If one has had a bad job experience, a job loss, is looking at a potential job loss, has debt or a bad family history of it, had financial deprivation in their childhoods or works at an unstable industry, such as the gig economy, one is sure to face financial anxiety in their lives at some point. With rising inflation to add to the woes of the global population, feelings of financial insecurity are inevitable.

Symptoms of financial anxiety can include overspending (or retail therapy, surprisingly), a fear of spending — which is a little more obvious, hoarding items to relieve oneself of anxiety, discomfort in accumulating wealth, depression and obsessive behaviour.

Staving off financial anxiety is more difficult than one might think it will be. However, there are a number of ways that can successfully work to eliminate this debilitating situation. Firstly, set a savings goal for yourself. Give yourself a deadline that you must save a certain amount by. Then start putting money aside.

Second, take control of your spending. You can sit down with a pen and paper, and figure out what portion of your income goes into daily needs, bills and on yourself. This will clearly show you how much you've spent in a month and on what, and you can then cut down or increase spending in certain areas accordingly.

Third, manage your debt situation. Avoid taking them on in the first place. Things can look tight, especially as pay checks barely catch up to the rising costs of living but living prudently and avoiding debt can be one of the most liberating decisions one can take. If you already have some debt, make a plan to pay it off and follow it strictly.

Fourth, create a contingency fund for yourself. This keeps you secure, especially if you have to dole out cash for an unforeseen illness, or a sudden job loss. This fund can serve as a buffer while you re-join the workforce and start getting salaries again — it can also help stave off whatever anxiety you feel about having to live off your savings for some amount of time.

Next, get out of the rat race — even if you come out on top of the competition of wealth accumulation, it doesn't make you any less of a rat. Wealth grows consciously, through hard work and a lot of planning, not through constant anxiety and obsession. Give yourself grace and allow yourself to rise above the constant competition.

Finally, be mindful of your actions and reactions. If you find yourself reaching to check your bank balance for the fourth time in a month, it's time to tell yourself to stop. Be systematic about paying off your bills, the more paper you see on your desk, the more your anxiety grows. If you find yourself getting anxious looking at the piles bills to pay off, take a deep breath, have a glass of water and remind yourself that you've got enough saved and it's all under control.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments