Empowering Women Entrepreneurs in Bangladesh: The Role of SMEs and EBL Women Banking

In Bangladesh, women entrepreneurs are rewriting the rules of economic empowerment. Despite societal barriers, they now account for 7.8 per cent of the country's 7.8 million SMEs, creating jobs, driving innovation, and contributing to nearly 25 per cent of the nation's GDP. The SME sector, which employs 40 per cent of the workforce and represents over 80 per cent of industrial jobs, is a powerful engine of growth and women are emerging as its transformative force.

Yet, challenges like limited access to finance, insufficient training, and societal bias continue to hinder the progress of women-led enterprises. Recognising this potential and the barriers they face, Eastern Bank PLC. (EBL) has stepped up with its Women Banking unit, a comprehensive platform designed to empower women entrepreneurs with innovative financial solutions, business training, and support networks.

With EBL's targeted approach, the future of women-led SMEs in Bangladesh looks brighter than ever—transforming not just businesses, but communities and the nation as a whole.

Challenges Faced by Women Entrepreneurs in Bangladesh

Limited Access to Finance

Access to capital remains one of the biggest hurdles for women entrepreneurs. Societal biases, lack of collateral, and bureaucratic obstacles often prevent women from securing loans or opening accounts to manage their finances efficiently.

To address this gap, EBL Ovilashi, an interest-bearing current account, is specifically designed for women entrepreneurs. It facilitates seamless daily transactions while offering interest benefits, helping women manage their funds effectively without the financial burden of maintaining multiple accounts.

Capacity Building and Skill Development

Many women entrepreneurs lack formal training in business management, marketing, or financial literacy. These gaps often hinder the scalability of their ventures, making it harder to compete in an increasingly digital and globalized economy.

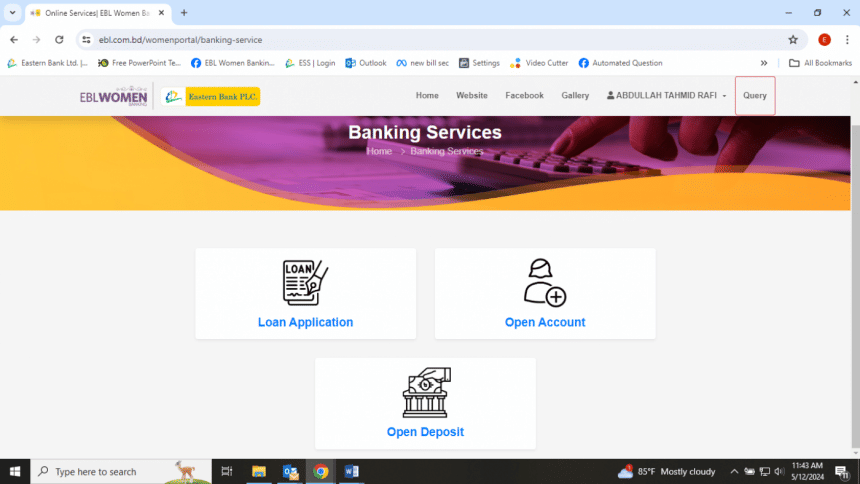

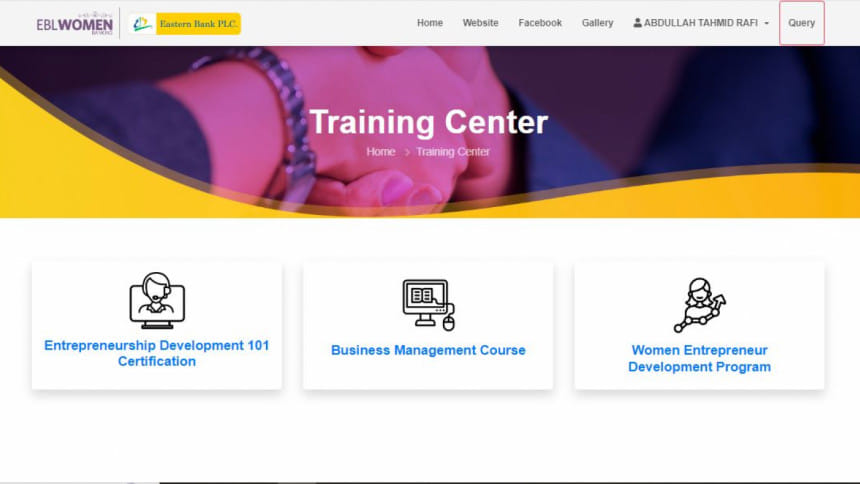

Through the EBL Women Banking Portal, women entrepreneurs can access free online courses in business management, entrepreneurship, and marketing. This digital platform equips them with essential skills while also allowing them to open accounts remotely, making banking accessible and hassle-free.

Challenges in Accessing Loans

Even with viable business ideas, many women struggle to secure loans due to stringent requirements or a lack of tailored financing solutions. This financial gap restricts their ability to invest in technology, expand operations, or penetrate new markets.

Recognising this critical need, EBL offers EBL Mukti, an SME loan exclusively designed for women entrepreneurs. With flexible terms and simplified processes, this loan enables women to scale their businesses without being bogged down by traditional loan complexities.

Bridging the Gap Beyond Finance

EBL Women Banking goes beyond financial services to address systemic challenges faced by women entrepreneurs.

Networking and Advocacy

Women entrepreneurs often lack access to networks that can help them find mentorship, share knowledge, or build partnerships. EBL hosts regular roundtable discussions, bringing together experts, policymakers, and women entrepreneurs to discuss pressing challenges and identify solutions. These platforms foster a sense of community and collaboration, empowering women to overcome barriers collectively.

Training and Mentorship

In addition to online courses, EBL sponsors access-to-finance training programs in partnership with women's associations. Regular branch-level training sessions ensure women entrepreneurs have practical tools to improve financial planning and decision-making, building their confidence to grow their ventures.

The Road Ahead for Women Entrepreneurs

Women entrepreneurs in Bangladesh are not just contributing to the economy—they are leading a social transformation. By creating jobs, generating income, and challenging gender stereotypes, these trailblazers are building a more inclusive future. However, their potential can only be fully realised with sustained support from institutions and communities.

EBL Women Banking exemplifies how targeted interventions can empower women entrepreneurs to overcome challenges, providing them with tools, training, and financial solutions tailored to their needs. By addressing the unique obstacles faced by women in business, EBL is fostering a culture of empowerment, ensuring that women-led enterprises continue to thrive and inspire.

As Bangladesh moves toward becoming a middle-income nation, empowering women entrepreneurs is not just an economic imperative—it is a societal one. Together, we can create a future where every woman entrepreneur has the resources, skills, and support needed to succeed.

Photo: Courtesy

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments