Can Bangladesh fend off Vietnam in RMG race?

Bangladesh's status as the world's second-largest garment exporter has become increasingly precarious, driven by a confluence of global trade shifts, regional competition and structural inefficiencies at home.

The imposition of 37 percent tariffs by the Trump administration has only intensified the pressure on Bangladesh, prompting industry leaders and analysts to express concern over the country's ability to maintain its global standing.

The country now faces a decisive test of its export resilience and trade negotiation capacity. For a sector built on cost competitiveness and heavily dependent on price-sensitive markets, the tariff escalation poses a direct threat to a business model long anchored in low-wage labour.

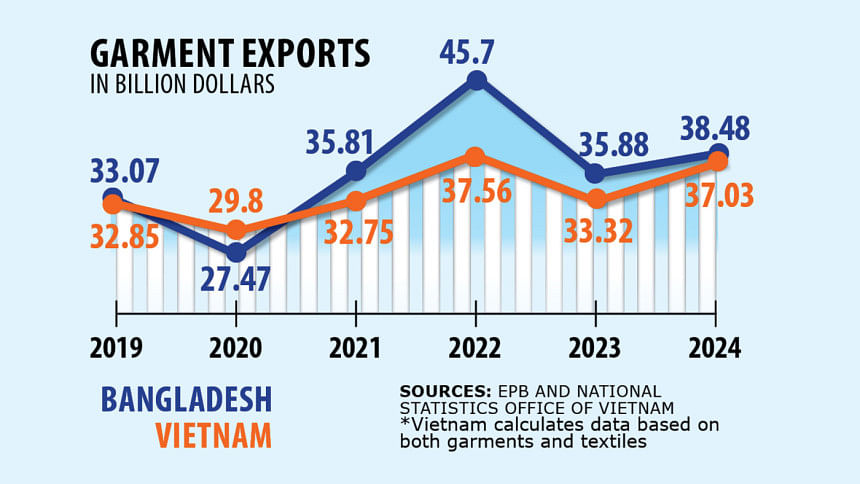

Many industry leaders are monitoring Vietnam's ascent warily. Although Vietnam faces a steeper tariff -- 46 percent compared to Bangladesh's 37 percent -- there is growing concern that Bangladesh's limited trade diplomacy, coupled with its slower shift towards value-added production, could allow Vietnam to surpass it in global rankings.

"If we don't move fast, we will not be able to save the day," said Rubana Huq, former president of Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

In 2023, Bangladesh accounted for 7.4 percent of global apparel exports, valued at $38 billion, according to the World Trade Organization (WTO). Only China ranked higher, with $165 billion in exports and a commanding 31.6 percent market share. Vietnam followed closely, exporting $31 billion of garments and holding a 6 percent share.

These rankings, however, reflect 2023 performance. The WTO's 2024 data -- yet to be released -- may offer a clearer picture of shifting dynamics. Compounding concerns, the WTO revised Bangladesh's previously reported export figures downward by $9 billion due to discrepancies in data submitted by the Export Promotion Bureau, raising questions about statistical reliability.

Despite the correction, Bangladesh retains several structural strengths: a large and affordable labour force, robust backward linkages through its $25 billion primary textile sector, a global lead in certified green factories, and rising compliance with international safety standards.

But these are increasingly offset by entrenched weaknesses -- underdeveloped infrastructure, extended lead times, high borrowing costs, bureaucratic frictions and overreliance on low-value, basic garments.

What separates Bangladesh from competitors like Vietnam is not just cost structure but strategic direction. Vietnam has steadily moved up the value chain, diversifying its product base and leveraging free trade agreements to secure preferential access. With both countries subject to elevated tariffs in the US market, the decisive variable may be the ability to offer differentiated, value-added products and to navigate trade diplomacy with agility.

Without targeted reforms and meaningful trade engagement, Bangladesh's position in global supply chains risks being overtaken -- not through a sudden collapse, but by gradual erosion in competitiveness and missed opportunities.

Tapan Chowdhury, a garment exporter and managing director of Square Pharmaceuticals, acknowledged that Vietnam could eventually overtake Bangladesh if key structural challenges remain unaddressed. However, he believes Bangladesh retains its competitive edge -- at least for now.

"Given that the Trump administration set the tariff at 37 percent, Bangladesh retains its competitiveness since the effective tariff rate for Vietnam is nearly 10 percentage points higher in the same market," he said.

Tapan urged exporters to shift towards high-value products to withstand price pressures. "International retailers and brands always offer lower prices for basic items. Exporters must adopt the right strategies and be selective in choosing buyers to offset challenges."

Echoing the need for deeper reforms, Rubana Huq, also managing director of Mohammadi Group, said Bangladesh's growth narrative often overlooks entrenched problems.

While the potential of the apparel sector is widely recognised, Rubana warned that optimism alone is not enough. "Relying solely on the continued growth of basic garments is no longer a viable strategy," she said. The sector must diversify its product base, invest in technology upgrades, and develop a skilled workforce capable of adapting to global demand. She stressed the urgency of expanding capacity in man-made fibre (MMF) garments, where Bangladesh continues to lag behind competitors.

"Bangladesh will lose its competitive edge if we can't engage in active economic diplomacy," she warned, calling for stronger international engagement to secure favourable trade terms.

Faruque Hassan, managing director of Giant Group, raised another important distinction in the comparison with Vietnam. He said Vietnam's export statistics often include both garments and textiles, unlike Bangladesh, which reports garments only.

"For example, Vietnam last year reported more than $37 billion in combined textile and garment exports, which included several billion dollars worth of textiles," he said. "If we exclude garments from that equation, it will take more time for Vietnam to overtake Bangladesh."

Nonetheless, Hassan stressed the need for swift action. "We need to explore new markets, diversify both products and destinations, invest in technology, and produce more value-added garments. That must go hand-in-hand with improving customs services, port operations, gas supply, and utility services, and removing non-tariff barriers."

Other exporters remain more confident. Md Fazlul Hoque, managing director of Plummy Fashions Ltd, dismissed speculation that Vietnam is about to overtake Bangladesh.

"For years, people have been saying that Vietnam will surpass us, but that hasn't happened. Bangladesh remains competitive and continues to grow."

He added that rankings are less important than performance. "Meeting the market demand is how we can climb even higher."

Indeed, Bangladesh has maintained a strong presence in key markets. It is currently the second-largest apparel exporter to the EU, with annual shipments exceeding $25 billion, and ranks third in the US with yearly exports of over $8 billion. In Canada and select emerging markets, Bangladesh has also expanded its footprint significantly, with market share rising to more than 20 percent, double the level from five years ago.

Still, concerns over looming threats persist. Anwar-Ul-Alam Chowdhury, chairman of Evince Group, pointed to two immediate risks: Trump's tariffs and Bangladesh's upcoming graduation from least developed country (LDC) status, scheduled in November 2026.

He stressed the need for proactive diplomacy in addressing the US tariffs. "Bangladesh must address Trump's tariffs politically. And the government must take timely policy steps to offset the immediate impacts of LDC graduation."

Although countries like the EU, the UK, Canada, and Australia have pledged to extend duty-free access beyond 2026, Anwar-Ul-Alam argued that Bangladesh must not be complacent. He called for negotiating free trade agreements (FTAs) with major trading partners and enhancing engagement with Asian markets such as China, India, and Japan.

If positioned strategically, he noted, Bangladesh could attract new orders as sourcing patterns shift away from China and Vietnam under US tariff pressure. "But this will depend entirely on our diplomatic and strategic responses."

Mostafa Abid Khan, a former member of Bangladesh Trade and Tariff Commission, warned that even a 10 percent tariff burden could be difficult for many local exporters to absorb. He also flagged Vietnam's advantage under its free trade agreement with the EU, saying the Southeast Asian country continues to strengthen its foothold in the European market.

Mohammad Abdur Razzaque, chairman of the Research and Policy Integration for Development, echoed this concern. "Under the EU-Vietnam FTA, Vietnam's exports to Europe are bound to rise. Its presence in the US and Canadian markets is also expanding."

Razzaque also pointed to a critical structural difference. Vietnam's rapid growth in the garment sector is driven largely by Chinese investment, reportedly $61 billion in textiles and garments. In contrast, Bangladesh's $55 billion textile and garment sector has less than 5 percent foreign investment.

"This is a relative advantage for Bangladesh," he said, suggesting that US buyers may be wary of Vietnam's deep production ties with China.

However, to seize any potential gains from declining Chinese exports, Bangladesh must address one key weakness: its limited capacity in MMF-based apparel, according to Razzaque. "Countries that wish to fill the gap left by China in the US market must be able to scale up MMF production."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments