Cardiac Treatment: Patients hit hard by costly stents

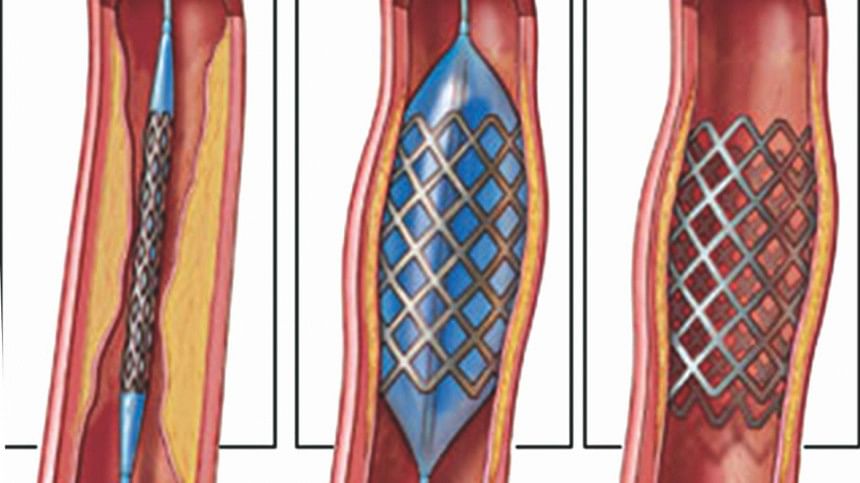

Mohiuddin Ahmed was extremely anxious. And it was just not because his 68-year-old father was undergoing a cardiac stent implantation surgery. He had no idea how he would pay back the creditors for the funds he borrowed for the operation in March.

His worries would not have been this overwhelming had the government not hiked the price of cardiac stents by 20-35 percent from February 1 to factor in the steep depreciation of taka against the dollar, making the already expensive cardiac treatment in Bangladesh more costly at a time when the ordinary people are grappling with the rising cost of living.

"It is too much for my family," Ahmed, a lawyer, recently said. He needed three weeks to arrange the Tk 3.64 lakh needed for the surgery at the Bangabandhu Sheikh Mujib Medical University (BSMMU) after the heart blocks were detected.

Each stent was billed at around Tk 1 lakh, more than double the price in India.

Take the case of the Xience Xpedition stent made by Abbott, an American medical devices manufacturer. It costs about Tk 47,000 in India and Tk 70,000 in Nepal.

But in Bangladesh, its maximum retail price is Tk 125,500 after the hike by the Directorate General of Drug Administration, up from Tk 108,628.

Such big differences were found in the case of stents of other companies like Boston Scientific's Promus Premier and Promus Elite, German company Biotronik's Orsiro and Medtronic's Resolute Onyx.

In India, the price of stents starts from Rs 9,842 and goes up to Rs 35,835.

The price of stents in Bangladesh is determined as per the markup set by the DGDA's price-fixing committee. The markup was set at 1.42 percent, which includes the taxes and profit margin of the suppliers as well as the dealers. It also includes an 11.5 percent "retail commission" for middlemen.

And the recent hike was made to factor in the depreciation of taka as per the markup set, said Mohammad Yousuf, the director-general of DGDA.

In the past year, the taka depreciated 23.7 percent against the dollar, according to data from the Bangladesh Bank.

"If the suppliers did not need to pay a commission to the physicians, health staffers and different middlemen, the price would have been much lower like in India."

"The stent market was in an unruly state. We tried our best to draw an accepted and transparent solution for the sake of patients," said Afzalur Rahman, a former director of the National Institute of Cardiovascular Disease (NICVD) who led the 2017 expert committee for fixing stent prices.

The time has come to revisit the markup formula to ensure transparency in the stent supply chain, he said.

The drug administration must explore ways to bring down the price, said Abdullah Wadud Chowdhury, head of the cardiology department at Dhaka Medical College Hospital.

"Otherwise, patients would prefer going to India for cardiac care," he said.

The National Pharmaceutical Pricing Authority in India fixes the price of stents for foreign manufacturers, while the global companies supply at a discount to Nepal, considering the country's economic status, according to Chowdhury.

"In the case of Bangladesh, however, they follow the European standard. If we can bargain with the companies, the price can be lowered," he added.

On May 2, the DGDA along with the experts sat with the representatives of Boston Scientific Corporation and Abbott Laboratories at its office in Dhaka.

The representatives agreed to submit a proposal regarding a feasible price cap for their stents, The Daily Star has learnt from officials informed on the proceedings.

DGDA officials said they will also sit with the rest of the principal companies as early as possible.

Chowdhury Meshkat Ahmed, professor of the Department of Cardiology at the BSMMU, however, highlighted another reason for the higher price.

"If the suppliers did not need to pay a commission to the physicians, health staffers and different middlemen, the price would have been much lower," he said.

The Daily Star found credence to Ahmed's claim after speaking with four local suppliers of cardiac medical devices.

"Mainly the physicians get the commission and it is 20-50 percent of the stent price. Every supplier has their own strategy in this regard. Some may also pay the other health staffers involved in the process," said an official of a local supplier on the condition of anonymity.

Ahmed went on to call for transparency in the supply chain. "The physicians need to stop taking financial benefits from the companies. Otherwise, patients will continue to suffer," he said.

Each year, about 45,000 stents are implanted in around 25,000 patients, according to Chowdhury.

For now, the price hike of stents will leave more cardiac patients out of treatment, according to Mir Jamal Uddin, director of the NICVD.

"Were the price of stent less than Tk 50,000, it would have been bearable for our family amid the high inflation," said Mohammad Unus, whose father-in-law was undergoing the same procedure as Ahmed's father at the same time on March 20.

Inflation averaged 8.85 percent in the first 10 months of the fiscal year, way higher than the 5.6 percent target set for fiscal 2022-23 in the budget.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments