Clean energy goal far away

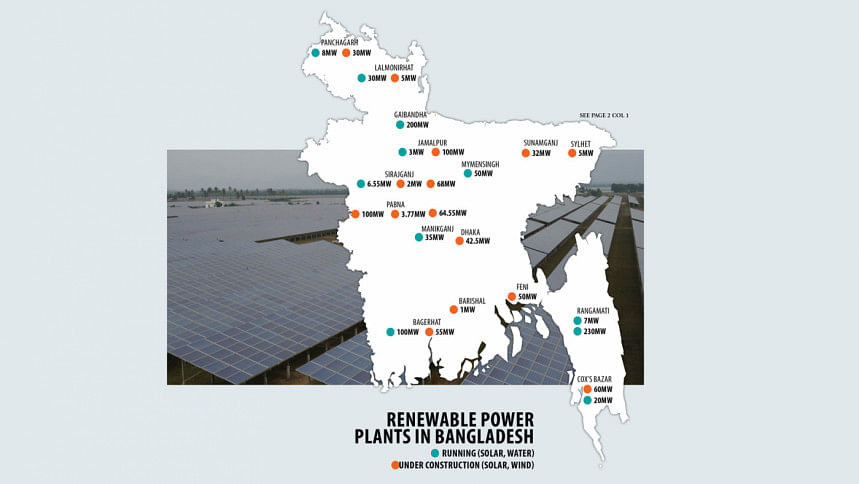

In a fresh push, Bangladesh entered its renewable energy era in 2017 with the launch of a 3MW solar power plant in Jamalpur's Sharishabari. Ever since, the country has added only 459MW of renewable energy to the national grid.

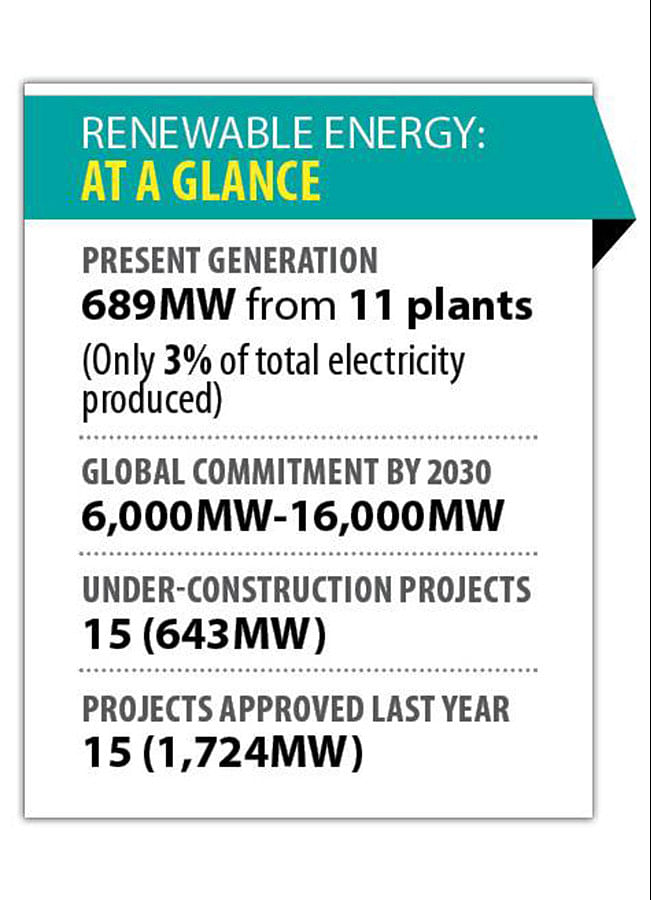

Despite a big jump last year, when the country added 200MW of renewable energy to the national grid, the highest so far in a single year, only 3 percent (689MW) come from renewable sources. Of this, 459 megawatts are from 10 solar power plants. The rest comes from the 230MW hydro power plant in Rangamati's Kaptai, which was built by the erstwhile Pakistan government.

Between 2016 and 2023, the government has taken up multiple renewable energy plans, revising upward and downward its 2030 target for clean energy consumption.

In the Mujib Climate Prosperity Plan 2022-2041, submitted in the Conference of Parties (COP26), the renewable energy capacity target for 2030 has been set at 6,000MW-16,000MW. This means, the country will have to generate about 5,500MW more in the next six years to reach even the lowest global commitment.

Currently, the country has a capacity to produce 25,481MW of electricity mostly from fossil fuel-based plants, a key contributor of global warming.

With the launch of Teesta 200MW Solar Park in Gaibandha last year, 10 solar plants are presently in operation. Two wind power plants in Cox's Bazar and Sirajganj -- having a capacity of 60MW and 2MW respectively -- also started trial run.

Additionally, at least 15 other renewable energy projects, with a capacity of 1,724MW, were approved last year.

One of these 15 and 14 others approved earlier are currently under construction, and are expected to go into production by this year or the next.

Their combined capacity of 643MW will take the share of the renewable energy to 4 percent against the total capacity of 31,700MW in 2025, according to the progress report of Bangladesh Power Development Board.

WHY SO SLUGGISH?

Experts say multiple policy issues are blocking the progress of the renewable energy sector. They include heavy tax and duty on imports of solar panels and batteries, non-transparent tariff fixing, and a lack of planning and investment roadmap.

The government backtracking and foot-dragging is another reason, they add.

For instance, in the Power System Master Plan 2016, the government aimed to meet 10 percent of the total electricity demand from renewable sources by 2021, but the plan failed.

Then in 2020, the Perspective Plan of Bangladesh (Vision 2041) made a fresh commitment to generate 10,888MW of renewable energy by 2030. The very next year, the government submitted the Nationally Determined Contributions to the UN, where it slashed the target for 2030 to 4,114MW.

The following year, in 2022, the government unveiled the Mujib Climate Prosperity Plan, again raising the minimum target at 6,000MW and maximum target at 16,000MW.

Although officials often cite land scarcity as a major problem, multiple studies show the unused Khas land across the country are more than enough to meet the target; it only requires the political will.

Bangladesh Environmental Lawyers Association and Coastal Livelihood and Environmental Action Network are currently doing a study on the division-wise available land for solar plants.

Data from six divisions of the still-ongoing research show these six divisions have ample potentials to generate 2,15,011MW of solar energy.

According to a government projection in its Integrated Energy and Power Master Plan, the country will need about half that amount, or 1,10,800MW, in 2050.

"It is a myth that there is land scarcity in Bangladesh to install solar power plants. Only a small portion of the available Khas land is enough to achieve the target by 2050," the draft report said.

HIGH TAX, HIGH TARIFF

Because it requires one-time investment and no fuel, renewable energy is cheaper around the world compared to fossil fuel-based power.

But in Bangladesh, it is the opposite, although the tariff is being reduced over time.

Experts say most renewable power plants in Bangladesh were awarded unsolicited, which created opportunities for businesses to charge high tariff compared to that in neighbouring countries.

"Had the government floated tenders, the prices would have been lower," said M Zakir Hossain Khan, a climate finance analyst and chief executive of Change Initiative, an energy research institution.

"We still have to pay around Tk 16-17 per kilowatts of solar electricity whereas the global average is Tk 5," he said.

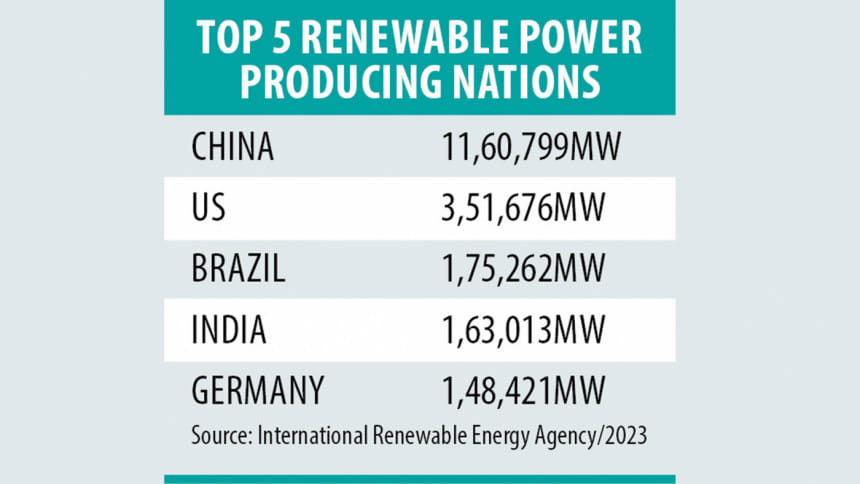

China is currently the global leader in renewable energy, followed by the US, Brazil, India and Germany.

In a recent study, the Centre for Policy Dialogue found that the Chinese government provides subsidies in the form of cash grants and tax credits, which led to the fast growth of the sector there.

"The Corporate Income Tax Law and its implementing regulations provide tax incentives to renewable energy projects. They provide an immediate VAT rebate of 50 percent applied to the sale of self-produced solar and wind power equipment. Moreover, enterprises that purchase and use equipment specified by the state for environmental protection, energy and water conservation, or production safety purposes are eligible for a tax credit of 10 percent of the investment in such equipment," reads the study report.

In contrast, investors in Bangladesh have to pay 37-56 percent tax to set up renewable power plants, said Zakir Hossain of the Change Initiative.

However, as newer technologies arrive, renewable energy prices are expected to fall further, making an even stronger case for a more vigorous push for clean energy.

For example, in the contracts that were awarded last year, tariff was set from $0.09 to $0.11 per unit, down from the $0.15/unit set in 2017 for the Teesta Solar Park, owned by Beximco. This is the highest yet renewable energy tariff set in Bangladesh, experts say.

Tariff for other plants awarded in 2020 and 2021 were fixed at $0.14 and $0.13/unit on average.

Global energy think-tank BloombergNEF in a study showed that the cost of solar plants will reduce further by 2030 compared to gas and coal-based power plants, which emit massive volumes of carbon into the air.

In the study report on Levelised Cost of Electricity (LCOE) published in October last year, it said the LCOE for a new utility-scale solar project in Bangladesh ranges from $97-135 per megawatt hour (MWh) today compared to $88-116 per MWh for a combined cycle gas turbine plant, and $110-150 per MWh for a coal power plant.

But by 2030, solar will be the cheapest -- $42 per MWh, against the LCOE for gas at $94 and coal at $118 per MWh.

"We should focus on renewable energy as the import-dependent fossil fuel-based power plants are eating away the foreign reserve. In contrast, renewable energy needs no fuel cost; it's a blessing for all," said Zakir Hossain, the climate finance analyst.

NO SINGLE UMBRELLA

While looking for data for this story, The Daily Star found that five entities -- Independent Power Producer (IPP) cell 1, 2 and 3, the directorate of renewable energy research and development, and Sustainable and Renewable Energy Development Authority (SREDA) -- are responsible for implementation of the government's renewable energy plan.

Although SREDA was formed in 2012 as the single authority for this sector, it has no jurisdiction over implementing renewable energy plants that have more than 10MW capacity, said Khondaker Golam Moazzem, research director at CPD.

Moreover, the decision on who will get the contract and at what prices is made by the ministry, creating another layer in the process, he noted.

Contacted, Power Cell Director General Mohammad Hossain said SREDA was indeed established as a single authority, but the government needs to strengthen the organisation and appoint the right people there.

Nevertheless, the country will achieve the clean energy target as planned since the government is enhancing initiatives for rooftop solar, irrigation with solar pumps, and clean energy import from neighbouring countries, he added.

Asked about the high tariff, he said the high price of land in a densely populated country like Bangladesh as well as the transmission cost, which must be borne by the investors in this sector, ultimately push up the cost.

THE RUNNING PLANTS

Nine of the 10 solar plants now in operation are producing electricity at 19 to 21 percent Plant Load Factor (PLF), meaning they are running 4.8 hours a day, mostly in daytime peak hours when the sun shines the most.

Only the country's first solar plant in Jamalpur has been producing less than that -- at 16 percent PLF.

PLF -- a measure of a power plant's capacity utilisation -- is calculated by dividing the total electricity generation in a year by its annual net generation capacity, multiplied by 100.

The current tariff for these plants ranges from Tk 13.92 to Tk 22.64.

Furnace oil-based electricity now costs Tk 17 per unit on average, which is Tk 26 for diesel-based power.

"We should think of solar as a daytime peak-hour power producer. The sun shines the most from 9:00am to 3:00pm, when the demand at offices and industries is the highest. During the time, we now use diesel-based or gas-based plants to meet the demand. But if we have solar, there will be no need to import fuel," said Prof Mohammad Tamim, Dean of Chemical and Materials Engineering at the Bangladesh University of Engineering and Technology (Buet).

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments