Grameen Bank ownership, board to see major changes

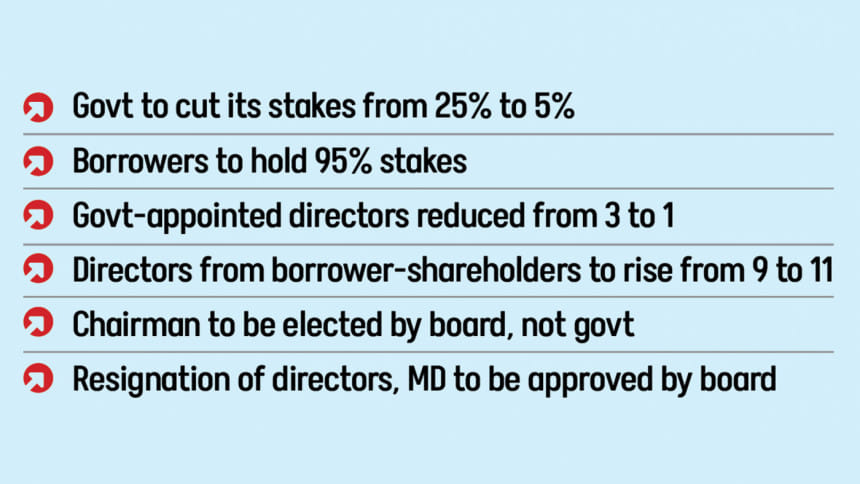

Grameen Bank is set to get a fresh lease of life as the government plans to reduce its stake to 5 percent from the existing 25 percent.

Earlier in 2013, the parliament passed the Grameen Bank Act, 2013 to tighten the government's grip on the Nobel Peace Prize-winning organisation without increasing its ownership stakes.

Now, the government has taken a step to roll back many of the changes made in the Grameen Bank Act, 2013 by way of an ordinance, whose draft has been uploaded on the website of the Financial Institutions Division.

The proposed amendment also seeks to bring down the number of government-appointed directors to one from three and remove the government's role in appointing the bank's chairman.

Consequently, the number of borrower-shareholders on the board will rise to 11.

Once the proposed changes are enacted through the ordinance, the chairman will be elected by the 12-member board instead of the government. This will reinforce the autonomy of the institution.

Grameen Bank, which was established in 1983 based on the Grameen Bank Ordinance 1983, came under significant scrutiny during the 15-year rule of the Awami League government.

Its founder Muhammad Yunus, now the chief adviser of the interim government, was forced to resign from Grameen Bank as managing director in 2011 after the government stated that his age exceeded the retirement age for public servants.

In the proposed amendment, the government is seeking to empower the board of the microcredit lender to approve the resignation of its directors and managing director. At present, the approval has to come from the government.

The new arrangement will significantly increase control for the bank's microcredit borrowers and reduce the involvement of the state in the affairs of the institution.

The Sheikh Hasina-led government became highly involved in the workings of Grameen Bank in 2011.

Initially, Grameen Bank members had a 60 percent stake and the government the rest. Later, the government's stake was reduced to 25 percent while the shares of the members went up to 75 percent.

In reality, the ratio of paid-up capital given by the government and the members of the bank came down to 3.29 percent and 96.71 percent respectively by the end of 2010.

The government later injected funds to raise its stakes to 25 percent.

After the proposed changes are passed, the ratio of shares of Grameen Bank members will rise to 95 percent.

In early October, the interim government reinstated a tax exemption for Grameen Bank until December 2029.

Grameen Bank enjoyed the tax exemption from its inception in 1983 as its activities are primarily focused on poverty alleviation. The benefit is typically renewed every five years and was last extended until December 2020.

The previous government did not extend the exemption after that period.

Officials at the FID said they have given some observations to the Grameen Bank authority.

"We will hold another meeting after we get the response from the bank," said a senior official of FID.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments