Inflation hits 4-month high despite govt steps

Inflation hit a four-month-high of 11.38 percent in November, despite the tightening monetary policy and easing of import tax on essential items.

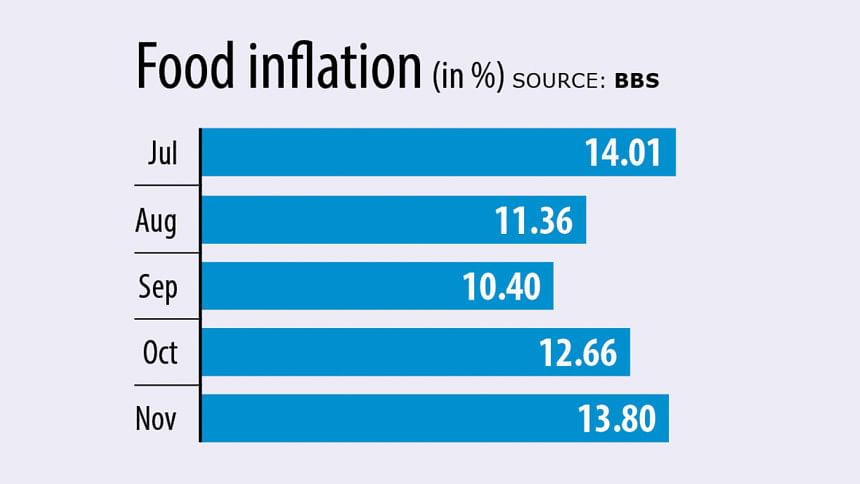

Food inflation soared to 13.80 percent from 12.66 percent in October, according to data from the Bangladesh Bureau of Statistics. It stood at 14.63 percent in urban areas and 13.41 percent in rural areas.

Non-food prices edged up to 9.39 percent in November from 9.34 percent a month earlier.

The stubbornly high inflation comes despite hawkish monetary policy under the new central bank governor Ahsan H Mansur, who took charge in August, and the National Board of Revenue reducing or exempting the tariffs in recent months on many essential commodities including sugar, potato, onion, dates, eggs etc.

The Bangladesh Bank raised the key policy rate thrice to 10 percent since Mansur took charge. As a result, the interest rate of loans has also soared.

During a meeting with the BB on Tuesday, the visiting mission of the International Monetary Fund said the policy rate could be increased further if inflation does not come under control.

Economists, however, said inflation would not ease through only tightening the policy rate if the central bank printed the high-powered money.

"Only monetary policy cannot tame the elevated inflation -- it has become a structural problem," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

Providing liquidity support to distressed banks to protect their depositors is causing money creation. If it cannot be sterilised, the contractionary stance will be diluted.

The BB has recently given Tk 22,500 crore in new money as liquidity support to six crisis-hit banks.

However, abandoning the contractionary monetary policy would not be wise either, Hussain said.

"If the fire brigade is unable to extinguish the fire, you don't let it burn, remove the brigade and pour more oil into the fire. The sensible thing to do is to complement the firefighters with all other fire extinguishing tools."

In the context of food inflation, those other tools are different approaches to market management: policing extortion in supply chains, ensuring competition and preventing collusion in wholesale markets, Hussain added.

Selim Raihan, executive director of the South Asian Network on Economic Modeling, echoed the same.

The injection of the huge volume of high-powered money into the economy may fuel inflation.

"The BB is taking a one-sided approach to handling inflation -- we need a multi-pronged approach."

He suggested taking fiscal measures and managing the domestic market alongside tightening the monetary policy.

Raihan suggested forming a common platform including policymakers like the BB, NBR, commerce ministry and the Bangladesh Competition Commission to handle the issue.

"All of them should work in a coordinated way where they can easily share their information," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments