Renata: a cure for many ills

The journey of Renata towards becoming one of the fastest-growing pharmaceutical companies in Bangladesh proves two things: a pro-poor and environment-friendly business can have strong growth and content employees can go beyond the call of duty.

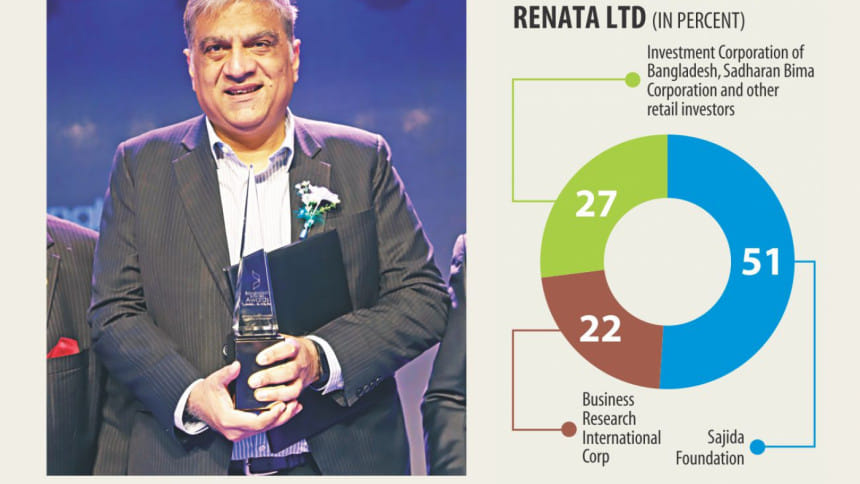

Renata's ownership structure makes the company slightly different from others.

“In theory, 51 percent of everything—from profits to wealth—which Renata generates belongs to the poor,” Syed S Kaiser Kabir, CEO of the company, said in an interview.

When Renata started its journey in 1993, it had a market capitalisation of $1 million at Dhaka Stock Exchange. Today, it has gone up to $1 billion.

“This happened without the injection of any additional capital. This shows that Renata is also very good at business. It is a combination of business enterprise and charity.”

Located in the heart of the capital, the company's corporate headquarters contains outdoor meeting spaces which are full of natural light and trees.

“We try to protect trees as much as possible. There are instances where we redesigned buildings to protect a single tree,” said Kabir.

Renata has fewer people compared to its competitors, but those people have great responsibilities and generate a lot of new businesses, he said.

“At Renata, we encourage you to behave like entrepreneurs even though we are all managers by designation,” he said.

The company's beginning started in 1972 when Pfizer (Bangladesh) Ltd was launched. Pfizer (Bangladesh) Ltd's business suffered and went into a decline in the 1990s.

In 1993, Pfizer transferred the ownership of its Bangladesh operations to local shareholders, who renamed the company as Renata Ltd.

Syed Humayun Kabir, the first managing director of the Bangladesh chapter of Pfizer, took charge of Renata as the founder chairman and successfully arrested the decline. Humayun Kabir had to go for very aggressive cost-cutting and had to lay off a lot of people through golden handshakes.

Renata used the savings and put it into marketing. The turnaround came in 1998. Since then, the company has not looked back.

Today, it is the fourth largest pharmaceutical company in Bangladesh and the market leader for over 20 years in animal health products.

In 2016-17, the company's turnover grew 13 percent year-on-year to Tk 1,604 crore while its profit after tax also increased 18.5 percent year-on-year to Tk 262 crore.

In the same year, Renata paid Tk 381 crore to the national exchequer as corporate income tax, import duties and value-added tax.

The company is the largest manufacturer of oral contraceptives in the country, providing two-thirds of the oral contraceptives used in government programmes. It is also the largest manufacturer of oral saline in the country. Outside Bangladesh, Renata is among the largest suppliers of micronutrient powders.

Pharmaceuticals account for 70 percent of the group's revenue, 20 percent is animal health and the rest is contract manufacturing.

The revenue of the company with around 6,000 employees grows about 15 percent to 20 percent a year. Exports grow much faster, in excess of 50 percent a year, albeit foreign shipments are still very small in numbers, said Kabir.

Kabir said he spends most of his time trying to increase exports. Renata exports pharmaceuticals to different countries, including Afghanistan, Belize, Cambodia, Ethiopia, Guyana, Honduras, Hong Kong, Kenya, Malaysia, Myanmar, Nepal, the Philippines, Sri Lanka, Thailand, the United Kingdom and Vietnam.

Renata wants to turn up as a multinational company in the next few years.

Renata Agro Industries Ltd, which is an integrated poultry farm producing commercial day-old chicks and engaged in commercial broiler operations, is also doing well.

Kabir has great hopes for Purnava, a non-medicated healthcare subsidiary of Renata. “One day, Purnava will have global brands and we have put a fair amount of investment and research to come up with interesting formulations.”

One of Purnava's health products is expected to hit the market in three months. “We hope to brand the product globally.”

According to Kabir, his father—who died in July 2015—left a very good base for Renata, not just in terms of assets, but also in terms of values and people. “We still continue his values.”

Currently, it is building two new factories. On an average, Renata builds a factory every year, said Kabir.

“Renata's stock doesn't see huge rise or fall, as most of our shareholders hold the stocks for longer periods. Our track record is good,” he said.

Renata's dividend policy is very predictable and always gives a combination of stock and cash dividends and has been doing it for 17 years.

Kabir hopes that by the time he retires, probably in five years' time, the market capitalisation of Renata will reach nearly $2 billion.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments