A weak taka brings cheers to exporters and remitters

After nearly a year of stable exchange rate, the taka has started to weaken against the dollar -- a development that is cheering up remitters and exporters.

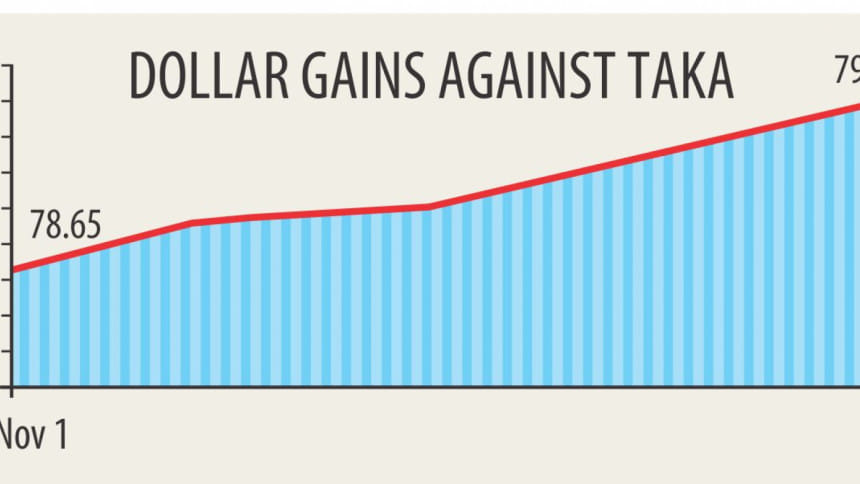

The average BC (bills for collection) selling rate has crept up 1.25 percent to Tk 79.62 against the dollar since November 1, according to data from Bangladesh Foreign Exchange Dealers' Association. Banks use this rate to sell dollars to importers.

Citi Bank's BC selling rate was the highest at Tk 79.98 a dollar yesterday. The lowest price was quoted by some state banks: Tk 79.3.

The inter-bank exchange rate, which was stable at Tk 78.4 for about one year, has also increased to Tk 78.75 a dollar yesterday.

Buying dollars has become even costlier as some banks are charging Tk 84 for one dollar. The rate is higher by Tk 1-2 in the open market, driven by the demand from Bangladeshis visiting India.

"A stronger dollar will help remitters and exporters," said Abdus Sadeque Bhuiyan, deputy managing director and head of international banking of Islami Bank Bangladesh.

The depreciation of local currency was necessary, particularly for exporters whose competitive advantage has been eroding for over year due to the fall of other currencies against the greenback, he said.

Market players also attributed the rise of dollar to the gap between demand and supply.

Inward remittance, which helps Bangladesh maintain a positive balance of payments, has declined 15.42 percent to $4.26 billion during the July-October period this year from a year earlier, according to data from the central bank.

The drop has made the finance ministry and the Bangladesh Bank concerned. The BB has also sat with the top executives of scheduled banks to identify the causes and discuss how the trend can be checked.

Devaluation of different currencies across the world has been identified as the major reason for the decline in remittance, according to a senior BB official.

The other reasons for the fall are the use of informal channels to send remittance home and job or wage cuts in the Middle East following the oil price drop, he said.

"A stronger dollar will help exporters and remitters offset the losses they are incurring due to depreciation of currencies in different countries," said a senior treasury official of Jamuna Bank.

As a result, remitters will now be encouraged to send their money home through the proper banking channel instead of hundi.

Payment pressure has also been blamed for the appreciation of dollar by some treasury officials.

"Payment pressure goes high in November-December. On the other hand, supply side has been affected in recent months," said a treasury official of Prime Bank.

He hopes the recent BB moves, such as the launch of agent banking in Bangladesh's remittance hubs and fairs to promote inward remittance, would bring the country back on the right track.

In a report on Tuesday, London-based BMI Research said the BB could be pressured to allow the currency to weaken as an overvalued currency would damage Bangladesh's export competitiveness, which is highly dependent on the country's cost advantage.

"The overvalued currency could also narrow Bangladesh's current account surplus by encouraging increased consumer goods imports. As a result, the national savings rate could dip, which would weigh on the country's long term growth potential," it said.

BMI Research also showed that following the sharp depreciation in November, Bangladesh's currency will likely stabilise over the coming months despite downward pressure from slowing remittance inflows. It said the central bank continues to accumulate reserves, and near-term growth will likely remain robust on the back of strong foreign direct investment and large investments in energy and transport infrastructure.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments