Bad loans weigh down banks

A first generation private commercial bank has been fighting a loan default case worth about Tk 100 crore in court for the last 15 years, meaning it had to keep provisioning for the amount every year.

But it came as a great relief to the bank a couple of months ago, when the court gave the verdict in its favour.

In another case, a borrower of an Islamic bank defaulted on loans amounting to about Tk 600 crore.

It is difficult for any local bank to keep such a big amount aside from its annual profits as provision. So, the bank took approval from the central bank to make the provision spread across three years -- Tk 200 crore each.

In both cases, the lenders were required to make 100 percent provisioning for the bad loans from the profits they made.

So, the higher the nonperforming loans the lower the banks' profits.

The impact of bad loans goes far beyond the lenders' declining profits.

It also tightens a lender's hands when it comes to giving out fresh money and pushes them to charge higher rates for loans as the interest income on a bad loan will not be there. Depositors will also get lower interest rates.

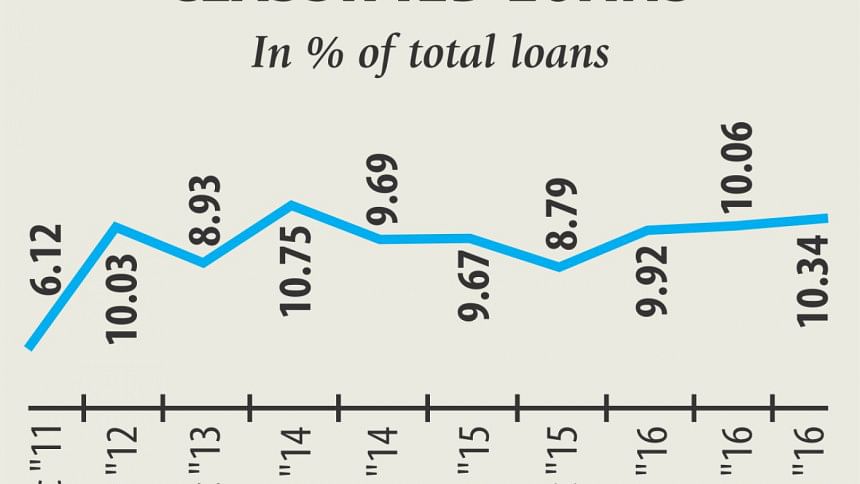

This is what is happening to the banking sector, which is progressively reeling from the rising NPLs in recent years.

As of September 2016, the cumulative NPLs of the banks reached Tk 65,731 crore or 10.34 percent of the total outstanding loans. In terms of percentage, it is the highest since June 2014, according to Bangladesh Bank.

If the written-off loans are added to the NPLs, the amount will come to Tk 110,000 crore.

Analysts blamed it on the political turmoil from 2012 to 2015, loan scams, incoherent rules taken by the central bank and poor governance.

The diversion of loans into purchase of lands is another reason for the increase in NPLs.

“Political turmoil, loan scams, especially in state banks, excessive finance to some large business groups, adverse selection of borrowers, poor appraisal, inadequate follow-up and supervision were responsible for uptick in NPL,” said Toufic Ahmed Choudhury, director general of Bangladesh Institute of Bank Management.

He said all bank groups experienced an upward movement in NPL ratio during 2010-15.

“If we add write-offs and rescheduled and restructured loans to NPLs, it would become a very shocking scenario,” Choudhury said.

Quoting a BIBM study, he said large loans occupy more than 30 percent of the total outstanding loans at present.

Over the last five years, around 38 percent of the classified large loans have been written off on average; and around 25 percent of the top 1,000 borrowers are defaulters.

Frequent changes in the central bank's loan rules also pushed the defaults up.

According to new rules, non-repayment period against a term-loan for more than two months will be treated as a "specially mentioned account" and the non-repayment period between 3-6 months will be classified as substandard.

If the non-repayment period is more than six months, it will be treated as defaults. In the past, a loan overdue for one year was marked as bad loan or default.

Again in 2013, the BB allowed defaulters to reschedule loans by paying only 1-2 percent down payment.

But half of the defaults that were rescheduled under this facility have slipped back into bad loans, according to bankers.

Also, BB's reluctance to extend the time for repayments of loans is piling up bad loans.

“We decide to extend the time based on a borrower's cash flow, but Bangladesh Bank doesn't want to understand that,” said a deputy managing director of a private bank requesting not to be named.

If a bank seeks four years of time extension for a borrower, the BB will allow one year. “But we know his cash flow won't support the borrower to repay the loan in a year,” he added.

Political turmoil during 2013-15 hurt businesses and borrowers badly and they are yet to recover from their losses, said Helal Ahmed Chowdhury, former managing director of Pubali Bank.

The central bank reduced the loan classification time by three months, which, he said, was not a good decision, at a time when borrowers failed to use their money due to chaotic politics.

“Not everything was in place to swallow the new classification rules,” said Chowdhury, also a supernumerary professor at the BIBM.

He cited the Reserve Bank of India's decision that forced banks to clean up their balance sheets by March 2017.

Accordingly, a heavily indebted Indian banking industry has been forced to go on a fire sale of its assets. Since January, assets worth over Rs 150,000 crore have been sold or are being put on the block.

“India's decision has been supported by legal enactment, but in Bangladesh it is not possible. Even Bangladesh Bank doesn't allow loan purchasing agencies like other parts in the world,” Chowdhury added.

The high NPL rate is the combination of a few contributing factors such as political turmoil, diversion of funds, willful default, weakness in the credit approval process and management, and business failure for reasons beyond the control of the borrowers, said Anis A Khan, managing director of Mutual Trust Bank.

“Some borrowers take restructuring and rescheduling facility as a recourse to delay repayments,” said Khan, also the chairman of Association of Bankers Bangladesh.

Though the sale of mortgaged property is possible under the Money Loan Court Act, it has some legal limitations. Also, legal recourse is available to the borrowers, which challenge easy realisation of loans.

Azam J Chowdhury, chairman of East Coast Group and Prime Bank, blamed the alarming rise in NPL on the poor governance of the regulator and banks.

“NPLs will keep increasing unless there is a strong regulatory environment.”

Chowdhury said India was able to decide on the fire sale of banks' assets because loans there were asset-based.

“Recovery of loans is difficult here as these are not asset-based and it takes 10 to 15 years to resolve a case in court,” he added.

SK Sur Chowdhury, deputy governor of BB, said they were forced to ease loan rescheduling and restructuring policies.

“We have to relax loan rules frequently despite our unwillingness.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments