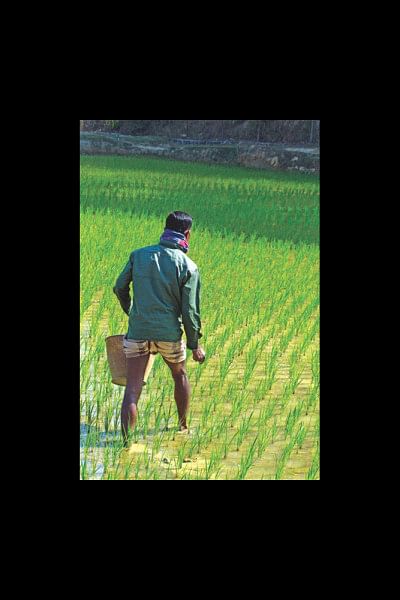

Financial inclusion of farmers

Though there is a provision in the constitution for agricultural revolution in the constitution, financial inclusion issues are largely ignored in undertaking large development work. “The State shall adopt effective measures to bring about a radical transformation in the rural areas through the promotion of agricultural revolution, the provision of rural electrification, the development of cottage and other industries, and the improvement of education, communications and public health, in those areas, so as progressively to remove the disparity in the standards of living between the urban and the rules areas”- said in Article 16 of the constitution of Bangladesh. As an enabler, greater financial inclusion contributes to development goals of poverty reduction, economic growth and jobs, greater food security and agricultural production.

There was an editorial (August 27, 2016) published in The Daily Star on launching of A-card, an initiative to help farmers access microfinance through banks. The USAID Agricultural Extension Support Activity (Ag Extension Project) has been facilitating farmers' access to microfinance through Bank Asia. However, payment would be facilitated through NFC-enabled smart biometric point of sale (PoS) devices and near field communication (MFC) enables two devices to establish communication between buyer and seller when both of them are within about 4cm of each other.

Bangladesh has been considered as a role model in achieving millennium development goals and there is high ambition regarding SDG in home and abroad. The very first SDG—ending extreme poverty—explicitly mentions the importance of access to financial services. When people are included in the financial system, they are better able to climb out of poverty by investing in business or education. Farmers who have access to financial services often produce more bountiful harvests, leading to progress on the second SDG: reducing hunger and promoting food security. According to the UN Food and Agricultural Organizations (FAO), about 795 million people globally are undernourished, with most living in rural areas neglected by the financial system. A lack of access to credit and insurance prevents farmers from making investments that could increase crop yields and strengthen food security (FAO 2015).

'It shall be a fundamental responsibility of the State to emancipate the toiling masses the peasants and workers and backward sections of the people from all forms of exploitation' said in Article 14 of the constitution. However, peasants often get exploited while taking credits and there is hardly any protection mechanism available for farmers even when buying agricultural inputs. Launching credit card for farmers is certainly a milestone on the way towards achieving financial inclusion.

The writer is a human rights worker.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments