Emerging Asian markets and export diversification

Widening comparative advantage in global export market has not only triggered economic growth but also ensured expected structural transformation as has been revealed in many Asian developing economies such as South Korea, Taiwan and China. Bangladesh, like other developing economies, has made considerable progress as an exporter of manufacturing goods, but it has yet to diversify its export base due to limited level of comparative advantage. While Bangladesh's export has maintained a 12.2 percent growth over the last decade, its total export is originated from a limited number of products and more importantly export is further concentrated over time. Consequently, Bangladesh's export basket looks like a 'tadpole' – an early phase of a frog's life cycle with a big upper part of the body (i.e. large volume of export originated from limited number of products) which is linked with a shadow middle part (i.e. moderate volume of export of few products) and long tail in the lower part (i.e. small volume of export of large number of products). Likewise, Bangladesh's export markets have a similar structure of a 'tadpole' - highly concentrated to few markets in the developed countries with a long list of countries (171 in total) where products are exported in a small volume. Overall, Bangladesh stands far behind in terms of developing a diversified export base both in terms of products and markets.

Markets of emerging Asia

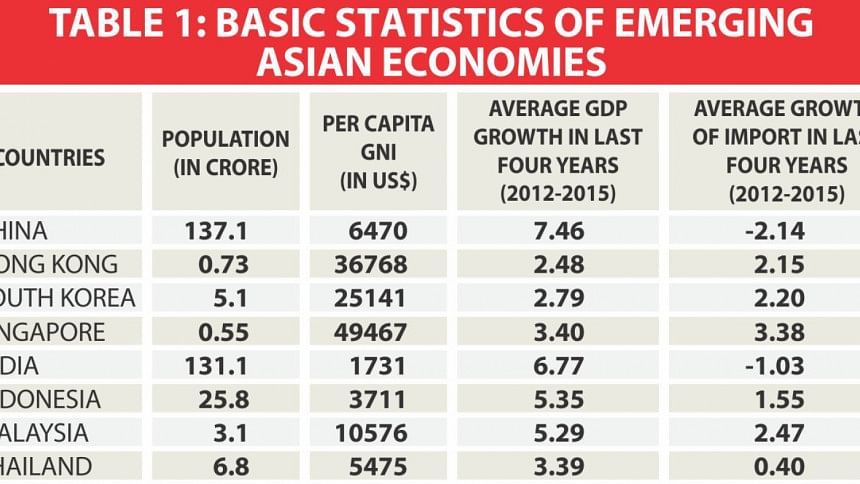

Emerging economies of Asia are comprised of economies like China, India, Singapore, Hong Kong, South Korea, Indonesia, Malaysia and Thailand. These are considered 'emerging' because of their high economic growth originated from high GDP growth mainly based on export of commodities, goods and services. In other words, these economies possess large consumers with high per capita. For example, China has a population of 1.37 billion with a per capita income of USD 6,470; South Korea has a population of 50 million with per capita income of USD 25,141; Indonesia has a population of 257 million with per capita income of USD 3,711 (Table 1). More importantly, most of these economies have been able to maintain moderate to high GDP growth. Between 2012-2015, average GDP growth of these selected emerging economies ranged from 2.5 percent in case of Hong Kong to as high as 7.5 percent in case of China when the average GDP growth in high income countries was only 1.07 percent.

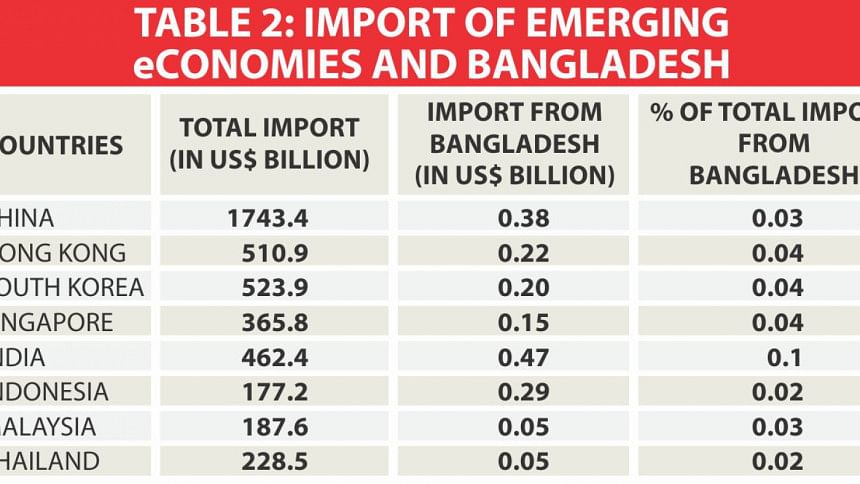

Moderate to high per capita income owing to better economic growth in emerging economies has over time increased demand for consumer goods in these economies which is met both through domestic products and imported finished products. In fact, imported products met an overwhelming share of domestic demand for a number of these economies. Another important aspect is that, all of these economies are closely linked with major global value chains under which these economies import a large volume of raw materials, intermediate products and capital machineries. Total import ranges from about USD 177 billion in case of Indonesia to as high as USD 1.7 trillion in case of China and the imported products include a diverse array of products such as electrical machinery and equipment, minerals, mechanical appliances, ores, mineral oils, organic chemicals, optical, photographic, medical products, iron and steels, plastic and related products and vehicles. Interestingly, most of these economies possess strong domestic manufacturing bases both for raw materials and intermediate products as well as for finished products. As a new entrant Bangladeshi exporters may likely confront challenges of huge competition both from domestic manufacturers and importers.

Bangladesh in emerging Asia

The emerging economies in Asia are one of the major importing countries in the world (Table 2). According to the Wikipedia, China, Hong Kong and South Korea are among the top 10 importing countries in the world while India, Singapore and Taiwan are among the top 20 importing countries. China's import crossed well over USD 1 trillion followed by South Korea (USD 524 billion), Hong Kong (USD 510 billion) and India (USD 462 billion). Unfortunately, none of these economies consider Bangladesh as a major source of their import. Bangladesh's export to these economies comprises only a miniscule share of their total import. Given the limited export capacity, Bangladesh finds it difficult to supply major imported products of these economies which are mostly raw materials, intermediate products and machineries. Hence, without widening the manufacturing base for the above-mentioned products and thereby developing the comparative advantage, Bangladesh would find it difficult to accelerate its export in these economies.

Unfortunately, Bangladesh's location is not favourable to tap the emerging markets easily - it has to use the entrepot facility of a third country which increases trade costs.

Bangladesh faces strong competition from other neighbouring competing countries of East Asia, South East Asia and South Asia case of export of its top 30 products to the emerging markets. For example, major exporters of woven apparels to China include Vietnam, Italy and North Korea; similarly, major exporters of footwear include Vietnam, Indonesia and USA. In case of South Korea, major exporters for woven wear apparels include China, Vietnam, Indonesia and Myanmar while in case of footwear major exporters are China, Vietnam, Indonesia and Italy. Due to proximity, operationalisation of regional trade intergradation, ethnic closeness and strong network, emerging Asian markets source large portion of products mainly from regional markets of East Asia and South East Asia. Besides, most of these economies have their own manufacturing base for most of our exportable products. Hence, without improving Bangladesh's comparative advantages in these markets vis-à-vis those of other competing countries as well as domestic suppliers of emerging countries, Bangladesh's major export products would have limited scope to enhance export in these markets.

Reasons for Bangladesh's lack of comparative advantage in the emerging markets

'Manufacturing Hub' based on the emerging markets: Emerging economies are located in a 'manufacturing hub' and part of well-integrated global value chains. These economies act both as 'source' of raw materials and 'destination' of finished products; intra-regional trade, particularly those located in South East Asia and East Asia, is quite high. Moreover, huge foreign investment, particularly by major multinational enterprises (MNEs), has made significant contribution in developing these manufacturing hubs. While Bangladesh's competing countries such as Vietnam, Indonesia, Cambodia, Myanmar and partly India are part of these manufacturing hubs, Bangladesh, unfortunately, is not a part of these production networks.

Integrated market in South East Asia and East Asia: Most of these economies are part of one or more highly effective and functional regional trade integration schemes. For example, Singapore, Malaysia, Indonesia and Thailand are members of ASEAN Free Trade Agreement and ASEAN Economic Community while China is a member of ASEAN plus 6 FTA and India has preferential trade agreement with ASEAN and bilateral trade agreement with Thailand. China and South Korea are members of East Asian economic partnership agreement along with Japan. Moreover, these economies have bilateral trade/economic partnership with other regions including Australia, South America and European Union. Unfortunately, Bangladesh has yet to establish bilateral or regional integration arrangements with any of these economies except India (under South Asian Free Trade Area [SAFTA]) and partly with Thailand (under the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation [BIMSTEC]). However, both SAFTA and BIMSTEC have yet to provide any visible outcome to regional economies. Hence Bangladesh lags behind its competing countries as those are enjoying preferential market access in the emerging markets.

Geographical proximity and better intra-regional connectivity in East Asian and South East Asian countries: Unfortunately, Bangladesh's location is not favourable to tap the emerging markets easily - it has to use the entrepot facility of a third country which increases trade costs. In fact, trade costs of Bangladesh with the emerging economies are significantly higher compared to those of the competing countries.

Strong domestic manufacturing base in the emerging markets: Most of the emerging markets have strong manufacturing base of similar types of products exported by Bangladesh. Domestic producers sell those products both in local and global markets. Moreover, domestic producers maintain special network with domestic retailers by providing various kinds of informal facilities which foreign suppliers often found difficult to offer (such as late payment contract, transaction with proper documents, etc.). Hence, Bangladeshi manufacturers and suppliers need to develop strong network with the buyers and retailers of these markets.

Bangladesh's limited manufacturing capacity of their major imported products: Bangladesh has limited manufacturing capacity of major imported products. These include electrical machinery and equipment, minerals, mechanical appliances, ores, mineral oils, organic chemicals, optical, photographic, medical products, iron and steels and related products and vehicles. Without developing the manufacturing base for the above-mentioned products, Bangladesh's potential to enhance manufacturing exports in these markets is limited.

Non-tariff barriers and high 'rules of origin' for preferential market access: Emerging economies apply different types of non-tariff barriers (NTBs) including sanitary and phytosanitary (SPS) and Technical Barriers to Trade (TBT) requirement. Such NTBs have adverse impact on Bangladesh's export. However, Bangladesh needs to improve its product standards by strengthening certification and standards system as well as improving technical standards. Developing institutional capacity at the domestic level, particularly strengthening the operation of BSTI, is highly important. On the other hand, Bangladesh has yet to use the preferential market access facility to a large extent due to high requirement of 'rules of origin'. Bangladesh like other preference receiving countries needs to fulfill the requirement of 40 percent of domestic value addition which itself discourages export of even Bangladesh's major products.

Suggestions

First, initiate discussion for bilateral FTA with economies where Bangladesh's export products have potentials under preferential market access (for example, FTAs with Malaysia and Thailand).

Second, Bangladesh could explore comprehensive partnership arrangement with major emerging economies such as South Korea and China which will focus beyond trade and explore opportunities in investment and services.

Third, Bangladesh along with other regional member countries should take steps to make effective and functional different sub-regional and regional trade and connectivity initiatives such as Bangladesh-Bhutan-India-Nepal Motor Vehicles Agreement (BBIN MVA), Bangladesh-China-India-Myanmar (BCIM) Forum for Regional Cooperation, SAFTA, BIMSTEC and SAARC Motor Vehicles Agreement (SAARC MVA).

Fourth, Bangladesh should negotiate with emerging economies to make the rules of origin more flexible – from 40 percent to say 25 percent of local value addition.

Fifth, Bangladesh should strongly raise the issue of NTBs at bilateral discussion with emerging countries as well as improve its domestic institutional base of monitoring the technical standards.

Sixth, Bangladesh should closely monitor the strategic shift of the emerging economies, particularly that of China and South Korea as regards their structural transformation in case of industrial sector (from low-tech to medium- and high-tech manufacturing industries) and possible implications such as relocation of various labour-intensive industries in neighbouring economies. Bangladesh should invite foreign investors of these industries from these economies to Bangladesh.

Seventh, given that Bangladesh will graduate from LDC within the next few years (possibly in 2024) and will face further competition in major markets including those of emerging markets because of scaling down the preferential market access facility with new conditionality, it is important to be prepared for the post-graduation period. In order to ensure smooth graduation, Bangladesh should set negotiation strategies to retain similar level of preferential market access in the emerging markets after graduation. Both the Ministry of Commerce and Ministry of Foreign Affairs need to enhance their technical capacity for better negotiation with these economies.

The writer is Additional Research Director, Centre for Policy Dialogue (CPD).

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments