Foreign funds double in DSE

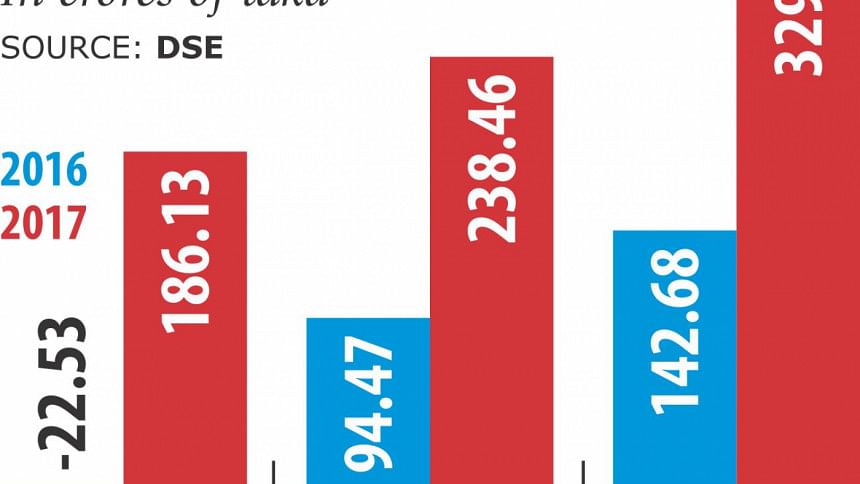

Net foreign investment in Dhaka Stock Exchange more than doubled to Tk 754.58 crore year-on-year in the first quarter this year, as the Bangladeshi stocks are gradually becoming lucrative for investment.

Overseas investors bought shares worth Tk 1,758.01 crore and sold shares worth Tk 1,003.43 crore during the January-March period, according to DSE data.

Fresh funds are being injected into the secondary market as many international fund managers see the Bangladesh stockmarket as an emerging one in the region.

“Sustained revival of the foreign investors' interest was backed by the rising corporate profitability and increasing consumption level of Bangladesh,” said Md Ashaduzaman Riadh, strategic portfolio manager of LankaBangla Securities, a stockbroker that deals with foreign investment.

“If we analyse the economic factors -- first, in the way that they affect interest rate and overall market liquidity, and, second, in the way that they affect company earnings -- conditions were very friendly for the equity market,” he said.

Among the frontier markets, he said, Bangladesh did better in terms of declining interest rate, strong currency and GDP growth.

Riadh said large-cap companies with attractive valuation in which foreigners have high interest will strongly come back with top and bottom line growth in 2017 and Bangladesh market is expected to get higher weight from foreign investors.

Banks are the foreign investors' preferred sector, followed by non-bank financial institutions, power and energy, pharmaceuticals, multinationals, telecom and IT.

Global investment banks such as Morgan Stanley, JPMorgan and Goldman Sachs, and asset management firms such as BlackRock have a presence in Bangladesh.

Foreign investment accounts for only 1 percent of the premier bourse's total market capitalisation, which stood at Tk 382,279 crore yesterday. Net foreign investment was Tk 1,340.7 crore in 2016, a seven-fold rise from the previous year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments